The Importance of Transparency

College Aid Pro’s (CAP) Mission is to End the Student Debt Crisis by empowering families to shop smarter for college. This is an audacious and ambitious goal, yet one we believe is achievable.

CAP is a strong and growing community of college planning experts, school counselors, administrators, concerned parents, and college graduates who have the experience and passion to embark on this crusade. We acknowledge, however, that to ultimately achieve our goal we will need participation and support from the major institutions that have perpetuated the problem in the first place: the federal government and the industry of higher education.

While the federal government can and should make needed changes to public policy to better support college-bound students (hint: it is NOT debt forgiveness), this white paper is directed at the colleges and universities themselves who have avoided true accountability for their role in the Student Debt Crisis.

Our core belief at CAP is that students and families can make smart, fiscally sound college selection decisions if they are appropriately educated and armed with the relevant information they need. Regretfully, college consumers are far from being provided with simple and straightforward cost- benefit propositions. Instead, they are forced to fight through an unnecessary maze of confusing paperwork, urgent deadlines, and opaque fee structures, which too often leads to irresponsible borrowing and regrettable outcomes.

To better balance the scales for families of college-bound students, we created College Aid Pro to fill this critical knowledge gap. Our platform is built on the fundamental pillars of 1) comprehensive process education, 2) customized data-driven insights, and 3) tailored and timely guidance. While our platform and team provide a meaningful competitive advantage to our users, consumers of higher education will always be at a material disadvantage as long as colleges and universities play games with tuition amounts and hide financial aid methodologies in a black box. It is with this goal of increasing transparency and clarity that we are publishing this first edition of our Merit Scholarship Transparency Report Card.

The Merit Scholarship Transparency Report Card gives credit to the schools that do not “hide the ball” and are straightforward with their potential applicants, allowing them to make well-informed decisions. At the same time, we are shining a light on the many schools that are less forthcoming with the aid they award and the criteria they use to decide who they think is deserving.

More than anything else, we want this white paper (and the others like it) to provide much-needed clarity for families and to push the dialogue with all colleges and universities forward so that the value and ROI of a college degree will simply speak for itself, rather than be buried behind a jungle of misdirection and misinformation. We look forward to the discussion.

Click here to download the full list of Merit Scholarship Transparency Rankings.

Kevin Degnan

CEO, College Aid PRO

Introduction

Have you ever wondered if you can afford college and how much you are able to pay? You are not alone. According to a survey conducted by Discover Student Loans, 66% of parents with kids 16-18 years old who are planning to go to college are worried about paying for their child’s education. Simply put, most American families do not know what they can afford for their children’s college education. What should be a straightforward question is complicated by enormous amounts of information about how to pay for college and a lack of clarity and accuracy from colleges on how they distribute financial aid.

As a company whose Mission is to End the Student Debt Crisis, College Aid Pro helps families shop smarter for higher education by teaching them how college financial aid works, providing them customized planning tools, and enlightening them on all resources and opportunities available so they clearly understand their options and feel confident about what they can afford.

This is the first white paper in a series dedicated to demystifying college financial aid. It focuses on types of financial aid available, how transparent colleges are about institutional scholarships, and tools to estimate how much you will need to pay for college. We also explain College Aid Pro’s data collection process and introduce the grading system we created to rate merit scholarship transparency.

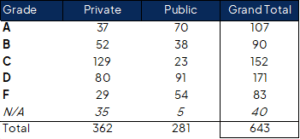

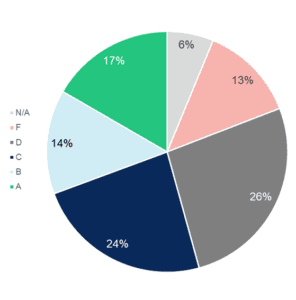

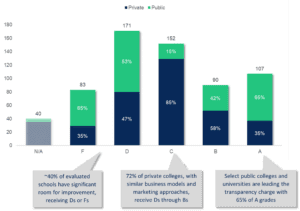

Summary Statistics

For this initial report, we graded 643 of the leading colleges and universities across the country. We chose these schools based on factors such as quality of education, popularity amongst applicants, and general reputation.

.

.

Types of Financial Aid

College financial aid falls into two categories: merit and need. While this paper focuses on merit aid, commonly known as scholarships, we will briefly touch on both categories so you may understand the difference.

Merit aid, or scholarships, come from private businesses, non-profit organizations, colleges, and universities in the form of “free” or “gift” money that does not have to be repaid. Colleges offer merit aid to students based on academic performance, extracurricular activities, and other achievements by the student. High school GPA, class rank, standardized test scores, extracurricular activities, recommendation letters, and essays are some of the factors used in determining merit scholarship eligibility and award amounts.

Need-based aid, on the other hand, is granted solely on the basis of the student’s or family’s financial profile. A candidate’s financial need eligibility is determined by a family’s Expected Family Contribution (EFC): a federally calculated number using information such as a family’s income, assets, and size.

Learn more about EFCS here – Understanding the Expected Family Contribution in FAFSA

Need-based aid comes in different forms from different sources:

- Grants: a form of free, need-based aid provided by the government (state or federal) or the institution themselves that does not need to be repaid

- Work Study: the Federal Work-Study program, another form of need-based aid, offers qualified students part-time employment while enrolled in school

- Loans: need-based aid you borrow and repay with interest

For admitted students, colleges create personalized financial aid packages that outline the “best” financial aid option for you, which they deliver in an “award letter.” An accepted student’s award letter may include different levels of both merit and need-based aid options. Although we recommend minimizing debt, most families finance college with both types of aid.

The focus of this white paper is on how transparent colleges and universities are with the merit- based aid they offer accepted students. Do all accepted students with the same credentials receive the same awards? Does the college clearly define what its criteria is for qualifying students? Or is the “criteria” loosely applied when the college sees fit and is part of a larger pricing strategy that is not strictly tied to a student’s academic qualifications? These are the questions we seek to answer in this report.

Need-based aid is a significant and critical piece to the college affordability puzzle and is deserving of its own transparency report. This is in the works so stay tuned.

Merit Scholarship Transparency

Merit transparency describes how readily colleges share merit aid (scholarship) availability and how the school awards it. Merit transparency allows interested students to see scholarship types, dollar amounts, and qualification eligibility before applying for admission.

As you can imagine, knowing how much “gift aid” to expect from a college helps families clearly understand out-of-pocket costs or required loan amounts more easily. These are essential details for determining affordability and avoiding needless debt. Knowing this information up front, or “full transparency,” is critical when affordability is the single biggest factor for attending college for most families.

Transparency is also important for families who do not qualify for need-based financial aid (because the school and the government think they earn too much money), but still rely on merit aid to afford college. Needless to say, merit scholarship transparency is critical for the average family trying to finance higher education.

As we explain below, however, there are NO merit transparency standards schools must follow. In fact, each college determines how much information they want to publish and where and when they do so, with varying degrees of accountability.

Click here to download the full list of Merit Scholarship Transparency Rankings.

General Process & Timeline

The financial aid calendar officially kicks off each year with the opening of the Free Application for Federal Student Aid (FAFSA) on October 1st. The FAFSA is the form that the federal government requires if a college-bound student wants to be considered for need-based aid. The FAFSA requests financial and family information to determine a family’s EFC, that is used as part of college’s financial aid review process. Additionally, some schools require supplemental applications, such as the CSS Profile, which go deeper into the applicant’s financial situation.

To be considered for merit-based scholarships, many schools do not require anything other than the general application for admission. Automatic consideration may also be given to applicants based on submitted GPA (weighted or unweighted) and test scores (unless the school is test optional). If any supplementary material, such as essays or interviews, are required, the school will specifically request this as part of the application.

Depending on whether the student is applying early decision (ED), early action (EA), or regular admissions, the application results could come in as early as December of senior year or as late as mid-April of the following year. If the results are positive and the student is accepted, typically within a week or two, the candidate will receive what is commonly called the “Award Letter.”

Award Letters are what colleges send accepted candidates where they finally provide the financial aid package they are willing to offer the student. There are several hundred variations of Award Letter formats used by different colleges and universities, but they all contain the same general details on merit-based scholarships, need-based grants, loan amounts (subsidized and unsubsidized), and sometimes things like work study or other fee reductions.

After receiving the acceptance and award letters, a candidate who applies regular admission will have another week or two before a decision is needed on or around May 1st.

If you are keeping score at home, the months (and sometimes years) of college searching, planning, and applying come down to a window of just a week or two where the family of a college-bound student finally knows the ultimate cost to attend the college, and they need to decide if they can and are willing to pay it. This is an action- and anxiety-packed time period for applicants and their families, to say the least.

One change the federal government made just over a decade ago to alleviate some of the pressure in this stressful, backloaded decision process was the implementation of what is called the Net Price Calculator.

Net Price Calculators (NPC)

To be eligible for federal student aid (also known as Title IV), every college is required to provide a public-facing Net Price Calculator (NPC) on their website. The NPC is designed to help prospective students determine what their actual, out-of-pocket cost will be if they are accepted to a particular institution. While the government requires schools to make them available for use on their website, few requirements exist about the criteria used to calculate the net price, and the government has no audit process to ensure these NPCs are accurate. While some colleges are more diligent in updating their prices and asking clear, in-depth questions to give families the most accurate estimate, many NPCs are out of date or do not align with how a school actually reviews financial aid packages internally.

Learn more about NPCs here – Net Price Calculators: Part of the Problem, Not the Solution

It is because of these limited guidelines and loose requirements that consumers understandably find themselves confused and overwhelmed about which institutions and sources of information to trust when shopping for colleges.

This is where we come in.

To help you find schools that are more transparent than others and save hours of time parsing through the noise, College Aid Pro developed this grading system we hope you find helpful.

Transparency Methodology

Our Transparency Grading System

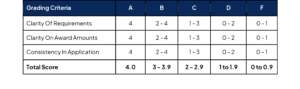

College Aid Pro’s scoring system uses three simple factors to determine a school’s “GPA” on the Scholarship Report Card:

- Clarity Of Requirements

- Clarity On Award Amounts

- Consistency In Application

We apply a traditional GPA score of zero through four in each of the above categories and the cumulative total dictates the final grade. We use a combination of quantitative and qualitative sources to score each particular category, including:

- Public data sources including the college’s website and government reports

- Direct communication with colleges about their merit award amounts and criteria

- Thorough verification process of each college’s published and intuited criteria based on our database of actual award letters

- Proprietary projection engine to incorporate real-time changes to available awards and shifting selection criteria

We strive to provide the most up-to-date and accurate numbers and transparency scores as possible, so we continuously evaluate our algorithms against actual awards to keep our results current and improve our processes. We have a fully dedicated team who verifies, updates, and analyzes our underlying data sets.

A = 4.0

- Clearly specified merit scholarship amounts, not wide dollar ranges

- Well-defined criteria required to earn each award on their school website

- Merit aid included in school’s Net Price Calculator (NPC)

B = 3.0 to 3.9

- Some merit qualification guidance provided

- Do not clearly disclose merit scholarship amounts and criteria on school’s website

- Typically include merit-based awards in the NPC results

C = 2.0 to 2.9

- Provide basic information on merit opportunities with a wide range of possible amounts

- Criteria for some automatic or semi-automatic scholarships may be specified

- Merit awards may be included in the school’s NPC, but often is not

D = 1.0 to 1.9

- Limited merit information on either award amounts or the criteria used, but not both

- Schools that only offer competitive scholarships

- Merit is not typically included in the school’s NPC

F = 0.0 to 0.9

- Make some mention of automatic, semi-automatic, or competitive scholarships on their website

- Unable to find any meaningful information on award amounts or selection criteria

- Merit is also not included in the school’s NPC

N/A : Merit scholarships are rare or non-existent at the school

- Highly competitive schools, such as the Ivy Leagues

- Military Academies that are free to attend for all accepted students

- Merit-based aid is only considered alongside the need-based criteria

In simple terms, our grading system rewards the colleges and universities that make it easy on potential applicants to determine if they will be eligible for merit-based awards and how much those awards will be. The schools that withhold this information until the award letter goes out, removing the family’s ability to plan accordingly, receive correspondingly poor marks.

Note: it is worth reiterating that this Scholarship Report Card deals with only merit-based aid. A college’s ranking based on this criteria will have no impact on how they are graded on the Need Report Card.

Click here to download the full list of Merit Scholarship Transparency Rankings.

![]()

So What, Now What?

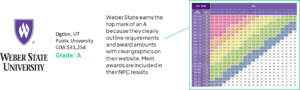

For college applicants combing through this report card evaluating schools, remember this: if you are counting on merit scholarships for college funding, the schools that earned As and Bs give a clear picture of what you can expect to receive. When you add these schools to your college list, do so with confidence that the price you see is the price you are likely to pay.

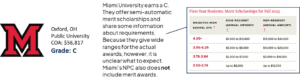

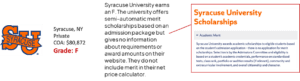

You may also see many “name brand” or “top ranked” schools earning lower grades. Some of these schools know they are not transparent and are not worried about it. These schools are so sought after that offering merit as an incentive is not necessary. They can use merit aid as an admissions tool and differentiator to recruit specific groups of students, and this is their prerogative. If you apply to these schools, however, understand that you cannot count on merit aid and it should not be factored into your college planning analysis.

We strongly recommend creating a balanced college list that gives you more options from a financial-fit perspective.

For the colleges and universities themselves, we know some of you may disagree with our current analysis and your school’s grade. Please reach out so we can start a conversation around how transparency helps consumers determine financial fit and improves their chances of success. This issue is more important than ever and working together to eliminate student loan debt is something we should all get behind.

In the meantime, here are some simple steps to receive a top grade:

- Clearly identify specific award amounts on your website

- Consistently apply a well-defined criterion, noting GPAs and/or test scores required to qualify for your merit-based awards

- Include merit awards in your Net Price Calculator results

College financial aid should not be a zero-sum game. While hiding the ball on projections may help schools hit short-term margin goals, it leads to long-term societal pain that higher education is supposed to relieve.

Getting basic information about scholarship aid from schools should not be difficult; it should be the standard. Clarity and consistency around the cost of college will allow families to make better, informed decisions, create a reliable college budget, and feel confident about their choices.

Click here to download the full list of Merit Scholarship Transparency Rankings.