Understanding Net Price Calculators & Finding A Better Option

Navigating the college application process can feel overwhelming, especially when it comes to understanding how much it will cost your family. With tuition prices rising and the cost of college being a significant investment, figuring out how much a particular school will cost you can be a daunting task. This is where Net Price Calculators (NPCs) come into play. But what exactly is a Net Price Calculator, and why do many parents, counselors, and financial aid offices recommend using them? More importantly, why might these calculators fall short, and how can you find a better alternative in tools like College Aid Pro’s MyCAP Software?

What is a Net Price Calculator?

A Net Price Calculator is an online tool provided by colleges and universities to help prospective students and their families estimate the “net price” of attending that particular institution. The net price is essentially the amount you would pay after grants, scholarships, and other financial aid are deducted from the total cost of attendance (including tuition, fees, room, board, and other expenses).

To use an NPC, you typically enter information about your family’s financial situation, including income, assets, and the number of family members in college. Some calculators also ask for academic information, such as GPA or test scores, which can impact merit-based scholarships.

Why Are Net Price Calculators Encouraged?

For parents of high school students, the Net Price Calculator is often one of the first tools recommended when trying to figure out college costs. Here’s why:

- Initial Cost Estimates: NPCs provide a starting point to estimate how much a specific college might cost your family. This is invaluable in the early stages of the college search when you’re trying to get a sense of affordability.

- Comparison Shopping: By using NPCs for several schools, you can compare the estimated costs and financial aid packages across different institutions, helping you to narrow down your choices.

- Financial Planning: NPCs allow families to start financial planning earlier in the process. Knowing potential costs ahead of time can help in budgeting, saving, and determining how much you might need in loans or other financial assistance.

- Transparency: Colleges are required by law to provide these calculators, ensuring a degree of transparency in the often opaque college pricing structure.

The Flaws in Net Price Calculators

While Net Price Calculators can be helpful, they are far from perfect. Here are some of the key limitations:

- Outdated or Inaccurate Data: Many NPCs use outdated financial aid formulas or data, leading to estimates that can be far from accurate. This can give families a false sense of security or, conversely, unnecessary worry.

- Oversimplification: NPCs often rely on a simplified version of the financial aid formulas, which may not consider all the nuances of your financial situation. For example, they might not accurately account for special circumstances like a recent job loss, divorced/separated families, high medical expenses, or other financial obligations.

- Inconsistent Methodologies: Not all NPCs are created equal. Different schools use different models for their calculators, which can lead to vastly different results even for similar schools.

- No Context for Loans: NPCs often include loans in their calculations without clearly distinguishing them from grants or scholarships. This can lead to confusion about what portion of the aid is actually “free money” and what will need to be paid back with interest.

- Merit Aid Variability: Some NPCs don’t account for the variability in merit-based aid, especially if the college uses a holistic approach to admissions. This can result in underestimating or overestimating the aid package.

Why College Aid Pro’s MyCAP is a Better Solution

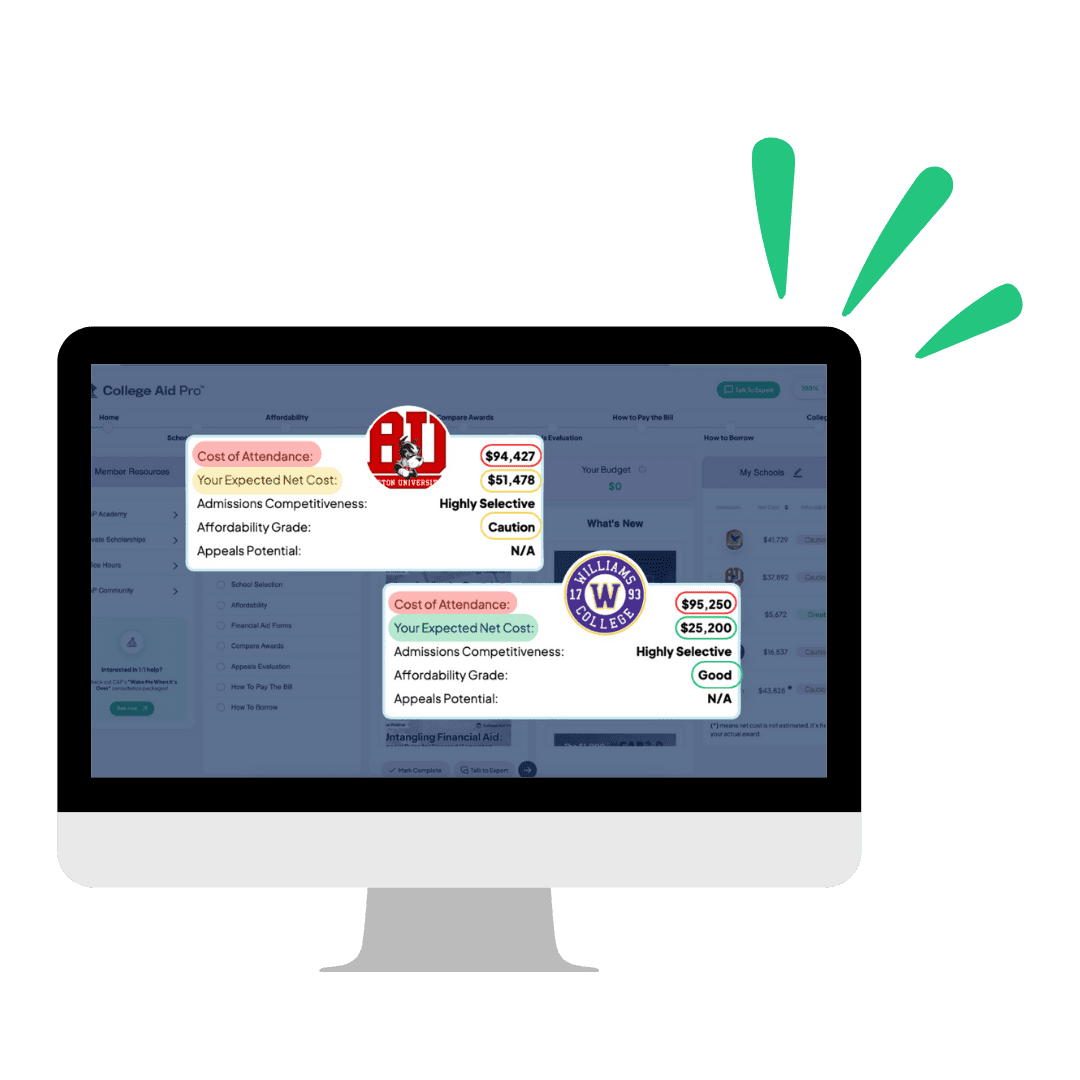

Given these limitations, families might find themselves feeling uncertain about their financial planning for college. This is where College Aid Pro’s MyCAP software can be a game-changer. MyCAP offers a more comprehensive, accurate, and personalized approach to understanding college costs.

- Customized Financial Analysis: MyCAP takes into account your family’s unique financial situation and provides a more personalized analysis. It digs deeper into the nuances that NPCs might miss, ensuring that all relevant factors are considered.

- Real-Time Updates: Unlike many NPCs, MyCAP updates its data regularly, ensuring that you’re working with the most current information. This means you get a more accurate estimate that reflects the latest financial aid policies and costs.

- Side-by-Side Comparisons: MyCAP allows you to compare multiple colleges side by side, not just on costs but also on the value and financial aid packages. This feature can help you weigh your options more effectively.

- Actionable Insights: MyCAP doesn’t just give you a number; it provides actionable insights and strategies to maximize your financial aid opportunities. This includes tips on where to apply for scholarships, how to appeal a financial aid package, and advice on minimizing loan debt.

- Transparent Loan Information: MyCAP clearly distinguishes between different types of financial aid, so you know exactly what portion is loans and what is free money. This transparency is crucial for making informed decisions about college affordability.

- Expert Support: MyCAP also offers access to financial aid experts who can help answer your questions and guide you through the process. This kind of support can be invaluable when navigating the complexities of college funding.

Conclusion: Making Informed Decisions with MyCAP

As you embark on the college search process, understanding the true cost of attendance is essential. While Net Price Calculators are a useful starting point, they have significant limitations that can lead to inaccurate estimates. College Aid Pro’s MyCAP offers a more reliable, comprehensive, and user-friendly alternative, helping you make informed decisions about college affordability.

For parents trying to navigate this complex process, investing in a tool like MyCAP can save time, reduce stress, and ultimately ensure that you’re making the best possible choices for your child’s future. You can get started with a free MyCAP account here.

If you’re interested in exploring more topics related to college financial planning, consider checking out our blog posts on how much financial aid you can get or strategies for maximizing merit scholarships.