I think we can all agree on the importance of college for some students as a time of personal and intellectual growth that has the potential as a launching pad into a brilliant career or increased financial stability. And, we’ve all heard plenty about how unaffordable it has become for many families leading us to our present student debt crisis. What then, is college affordability?

What is College Affordability?

On the surface, it seems pretty simple. If you have the money to pay for college, it is affordable. But, since very few families have that kind of money sitting around, it makes sense to dig a little deeper.

College affordability involves:

- Having the financial bandwidth to save for college without ignoring your other financial goals (The Past)

- Having the tools to shop for colleges that match your personal and financial goals (The Present)

- Having no more student loan debt than you can comfortably manage after you graduate. (The Future)

You might have noticed that there are elements of the past, present and future in my definition of affordability.

Let me explain each of these elements and show you how College Aid Pro’s MyCAP software platform tailors each of these elements to YOUR personal situation.

The Past

I know not every family has had the ability to save for their child’s college education, and that’s ok. For those that have, hopefully you are able to do it while still paying all of your bills on time, keeping your home and cars in good repair, and saving for retirement. That last one is super important and often overlooked.

Being able to afford college shouldn’t come at the risk of not having enough money to retire until you’re 75 or 80. It’s not selfish to take care of your future needs before saving up for your child’s college education. If you’re on track for a reasonable retirement age and you still have extra cash flow to put in a 529, great – do it.

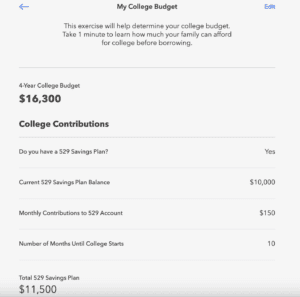

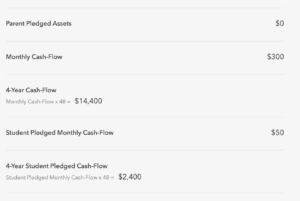

How MyCAP measures it – In your MyCAP account, you have the opportunity to create your college budget in your profile. There are specific fields for 529 savings and other parent and student assets that are earmarked for college. You can even include amounts pledged by grandparent or other family and friends. These amounts are added to other sources to calculate your budget.

Here’s an example of what your College Budget may look like in your MyCAP account.

The Present

By this, I mean the period of time from when you start seriously planning for college until your student graduates. This usually begins sometime during high school. There are actually two elements that contribute to college affordability during this time. One is knowledge and the other is simple budgeting.

We’ll tackle the budgeting aspect first. I’ll imagine about 50% of you have a son that will be going to college. How much do you think your grocery bill is going to drop when he moves to campus? I can vouch for mine going down about $300 a month when my son left. That’s substantial!

If you diligently roll that money into a savings account every month and keep it safe, you’ll have about $2,400 (for 8 months away at school) more to put toward the tuition bill the next year. Over 4 years, that’s over $9,000! What about sports and activity fees that you won’t be paying for anymore. Music lessons. Hobbies. Will your student be taking a car to school? If not, let your insurance company know and you might be paying less in car insurance. All of those savings can add up to more money for college expenses.

A word of caution here, though – if you don’t set aside those savings in a special account, they will likely disappear in random incidental spending, so be proactive about it.

How MyCAP measures it – Go back to your MyCAP College Budget and you will have the opportunity to enter in these savings.

Here’s an example of adding that monthly $300 you are no longer spending on your child at home and adding it to your monthly cash-flow as part of your MyCAP college budget.

The other aspect of college affordability in the present is knowledge. Families use online resources and tools to try to figure out how affordable college will be for them. Most tools only tell a piece of the story. You have the full price, the average cost, average percentage of students receiving aid, average merit aid awarded, etc.

None of that tells the whole story. After all, who is this average family of whom they speak? A list of averages meant to inform everyone is actually helpful to no one. What you need to know is how much YOUR family is going to have to pay, and the colleges don’t make it easy on you. MyCAP was created to attempt to bridge that knowledge gap as closely as possible.

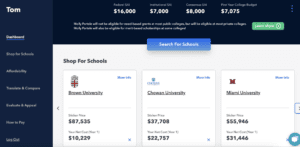

How MyCAP measures it – After completing the Personal Info section of your MyCAP profile, the software calculates your SAI or Student Aid Index. This is essentially the amount the colleges assume you can afford to pay. The difference between the total cost for one year and your SAI equals your need.

![]()

The schools you are looking at probably meet some percentage of need. When possible, the software will also factor in any merit aid that you are very likely to be offered.

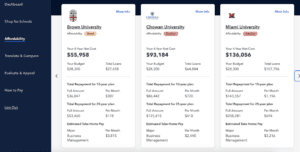

MyCAP will take all of that information to calculate your “Net Cost.” This amount will show up for each college tile you add to your dashboard.

Taking it one step further, MyCAP compares your net cost to your college budget to assign an affordability profile of:

- Ideal – No loans

- Great – Less than $27,000 (Federal Student Loan cap for 4 years)

- Good – Total loans less than expected first year salary

- Caution – Total loans greater than expected first year salary

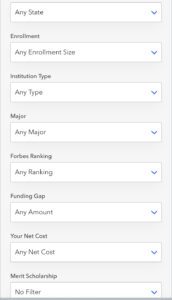

Using this knowledge and the Advanced College Search, you can filter for schools that match your financial as well as personal goals while shopping for college.

Here are some of the filters on our Advanced College Search.

The Future

Oftentimes, students and families make a college decision that involves loans. That’s where the future comes in. Paying off student debt should not keep you from reaching your other financial goals. It’s really important that you consider how much debt you’ll be taking for all four years of college rather than just the first year when deciding to attend a certain school.

Even more importantly, you need to know how much your payments will be and how that will affect your cash flow and ability to pay for other things and save money. In other words, you need to know your opportunity cost. For example, will going to a certain school make it harder for you to buy a car after college and require you to keep driving your parents old car for a lot longer? Will it make it a lot harder for you to take vacations, buy holiday and birthday gifts, upgrade to a nicer apartment or save for retirement?

How long will you have to make these sacrifices?

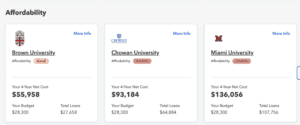

How MyCAP measures it – On your myCAP dashboard, go to the Affordability tab to get information like this:

You can easily see, from this view, how much you will likely need to borrow, what your loan payments are estimated to be if made over 10 years or 25 years, and what your take home pay might be starting out in your career.

I strongly encourage families to sit down together and use this information to help their student create a hypothetical budget for their first years out of college to make sure they are comfortable with the loan payments they will likely be making.

Affordability is different for every student

By working with MyCAP you get a personalized guide on college affordability. That’s important because affordability is different for every student. Even students from the same household may have completely different affordability profiles. One sibling may be planning to become a social worker while the other plans to be a surgeon.

Their potential income may make a huge difference in the amount of loans they can handle after school. One family may feel very comfortable with debt, while another avoids debt as much as possible. One family may have a totally different opinion of the value of an elite education than the next.

Even families with the same SAI may qualify for different amounts of aid depending on the schools they are considering because of the way different schools use certain data points in different ways. For example, some schools include more home equity in their SAI calculation than others. Thankfully, you, as the consumer, don’t need to know all of those fine details, myCAP figures it out for you.

Whether its differences in income, academic profiles, home equity, savings, or something else, you can see why those averages reported by lots of college sites are less than helpful. You are not average, why should your college search be?

So, is college affordable? That depends on you. Using MyCAP, can help you figure it out. If you haven’t set up your MyCAP account yet, you can give our Freemium version a try here. You can add 3 schools for free. If you’d like to add more, edit or delete your schools, or have access to the advanced search features, you can upgrade your account to our paid version!