Hi, I’m Matt Carpenter, co-founder of College Aid Pro. After working with thousands of families, I can tell you this—college planning feels like a full-time job, especially when it comes to figuring out scholarships. Most families don’t know where to start or what to focus on first. That’s why we built MyCAP: to simplify the process, take out the guesswork, and help families like yours make smarter financial decisions about college.

Navigating the college planning process can feel like drinking from a firehose. If you’re overwhelmed by costs, unsure what scholarships really mean, or frustrated by conflicting advice—you’re not alone. Merit scholarships are one of the most misunderstood but powerful tools families can use to reduce college costs. Here’s how they work—and how our MyCAP software can help you find and maximize them.

What Is a Merit Scholarship—and Why It Matters

A merit scholarship is money awarded to students based on achievements like GPA, test scores, athletic ability, or artistic talent. Unlike need-based aid, your family’s income isn’t part of the equation. That means whether or not you qualify for financial aid, merit scholarships can still drastically reduce your college bill.

Colleges use these scholarships to attract top students, and in many cases, they’re not small. We’re talking thousands—sometimes tens of thousands—off the sticker price.

Key Takeaway:

Merit scholarships aren’t based on financial need. They reward accomplishments—and can save your family thousands, no matter your income.

What Makes a Merit Scholarship “Good”?

Not all scholarships are created equal. A generous award from an expensive school might still leave you paying more than a modest award from a lower-cost college. The real number that matters is the net price—what your family pays after aid is applied.

Also, check if the scholarship is renewable. Many require students to maintain a certain GPA (usually 3.0 or higher) to keep getting the money each year. A manageable GPA in high school can be a lot tougher at a competitive college.

Key Takeaway:

A good merit scholarship lowers your net price and is renewable. Look beyond the award amount—know what you’ll pay, and what it takes to keep it.

Where to Find Merit Scholarships (Hint: Not Just on Google)

Digging through dozens of college websites or chasing outdated scholarship lists wastes time and often leads to confusion. That’s where MyCAP changes everything.

Our proprietary scholarship database brings together:

- College & Institutional Scholarships: Every college’s merit offerings, customized to your student’s academic profile.

- State Scholarships: Awards based on residency or academics, often overlooked.

- Private Scholarships: Thousands of vetted options, from $500 boosts to full rides.

All searchable. All in one place. Updated constantly.

Key Takeaway:

MyCAP puts all types of scholarships—college, state, and private—at your fingertips, saving hours of research and showing you what actually fits your student.

How to Increase Your Chances at Merit Money

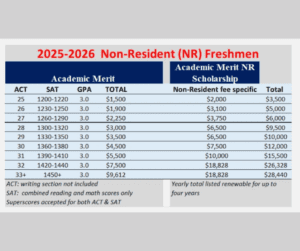

The stronger the student profile, the higher the odds (and amounts) of merit aid. Many colleges publish scholarship grids—charts that show how much aid you’ll receive based on GPA and test scores.

But not all colleges are that transparent. Some leave scholarship decisions to the admissions team, using a holistic review that looks at essays, extracurriculars, and more. In those cases, submitting a strong, complete application matters.

Also, don’t assume public schools are always cheaper. Private colleges often offer bigger merit awards, especially to top students they want to recruit.

Key Takeaway:

Higher GPA and test scores help, but understanding how each school awards merit aid—and applying strategically—can make or break your outcomes.

Private vs. Public Colleges: Who Gives More Merit Aid?

In general, private colleges offer more and larger merit scholarships than public ones. Why? They’re trying to close the price gap between themselves and lower-cost public schools.

Public universities may offer in-state merit aid, but it’s usually limited and more formula-based. Meanwhile, less selective private schools often give generous awards to strong applicants as a recruitment tool.

Key Takeaway:

Don’t rule out private colleges—many offer significant merit aid that makes them more affordable than you’d expect.

How Students in Each Grade Can Use MyCAP

MyCAP isn’t just for one moment in the process—it’s built to guide you through the entire journey. Whether you’re starting early or heading into senior year, here’s how families can use it at each stage:

🧑🎓 Freshmen & Sophomores

This is the time to focus on what matters most—grades and course rigor. GPA plays a huge role in merit scholarships. MyCAP helps you see the long-term impact of academic performance and which colleges reward it most.

Example: A freshman with a 3.8 GPA is already on track to qualify for $15,000+ per year in merit aid at dozens of colleges. MyCAP shows where that GPA pays off—and where it doesn’t.

Key Takeaway:

Start early. Building a strong GPA now opens the door to thousands in future scholarships.

🎯 Juniors

Junior year is crucial. Standardized tests, campus visits, and narrowing down your list all come into play. MyCAP helps you:

- See how SAT/ACT scores impact scholarship eligibility

- Set score targets for specific colleges

- Compare estimated merit awards across your top choices

Example: A student with a 3.9 GPA and a 1250 SAT might qualify for $10,000/year at one school—but bump that SAT to 1350, and that could jump to $20,000/year.

Key Takeaway:

Use MyCAP to find your “magic number”—the test score that unlocks more merit aid.

🧾 Seniors

Now’s the time to make decisions—and maximize every opportunity. MyCAP helps you:

- Compare final financial aid offers

- Understand the real net cost of each college

- Find private scholarships that are still open

Key Takeaway:

MyCAP brings clarity to financial aid offers and gives you one last edge with private scholarships.

How MyCAP Simplifies the Whole Process

Families don’t just need scholarship lists—they need clarity. MyCAP is built to do just that.

With MyCAP, you can:

- Compare merit scholarships across schools

- Track eligibility based on your student’s GPA, test scores, and more

- See your real net cost—after aid—for every school

- Stay on top of deadlines, requirements, and next steps

No spreadsheets. No guessing. Just smart planning.

Key Takeaway:

MyCAP helps you find, track, and compare scholarships so you can make confident, informed decisions about college costs.

Take Control of the Scholarship Process

Merit scholarships are one of the best ways to reduce college costs—and they’re available to families at all income levels. But finding the right ones takes time, strategy, and the right tools.

MyCAP makes it easier by putting the full picture—scholarships, net costs, eligibility, comparisons—in one place.

Ready to See What’s Possible?

Wherever you are in the process, MyCAP can help you make smarter decisions—and save more money. From building GPA goals to finding hidden scholarships, it’s your one-stop college planning tool.

👉 Create your free MyCAP account and start planning with confidence today.