Don’t Guess, Know: Why Parents Need College Financial Planning Software Like MyCAP

The sticker price of college can feel like a punch to the gut. With costs soaring past six figures at many top institutions, it’s no wonder that a conversation about college quickly turns into a stressful discussion about money. For parents of college-bound students, the journey often feels like a high-stakes game of guesswork, with a potential mountain of debt on the other side.

But what if you didn’t have to guess? What if you could know the true cost of a college before your student even applies?

This is where a dedicated college financial planning software becomes an indispensable tool. While you’ve likely heard of “net price calculators” on individual college websites, these are often just a starting point. They can be unreliable, outdated, and only give you a one-year snapshot. A comprehensive tool like College Aid Pro’s MyCAP goes much further, giving you the power to find the “financial fit” that is right for your family.

What is MyCAP and Why is it the Right College Financial Planning Software for You?

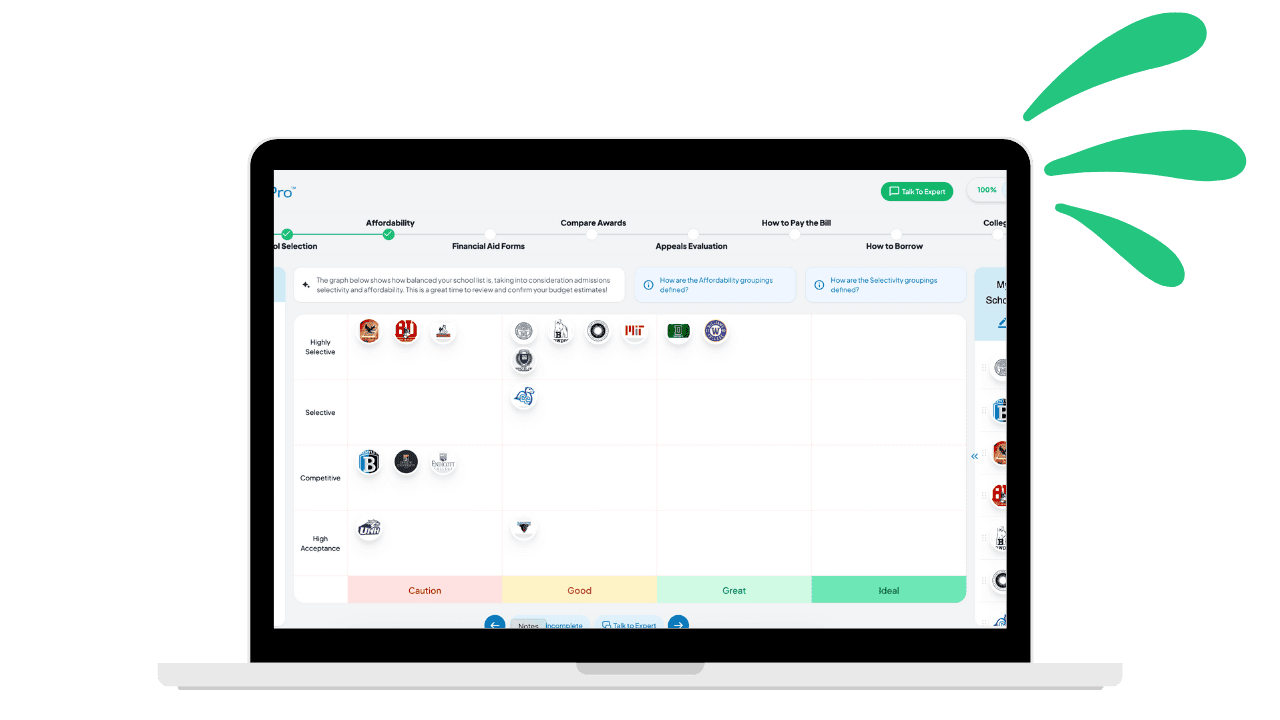

Think of MyCAP as your personal command center for college funding. It’s a robust platform that moves beyond simple calculations to provide personalized, data-driven insights. It’s designed to help you:

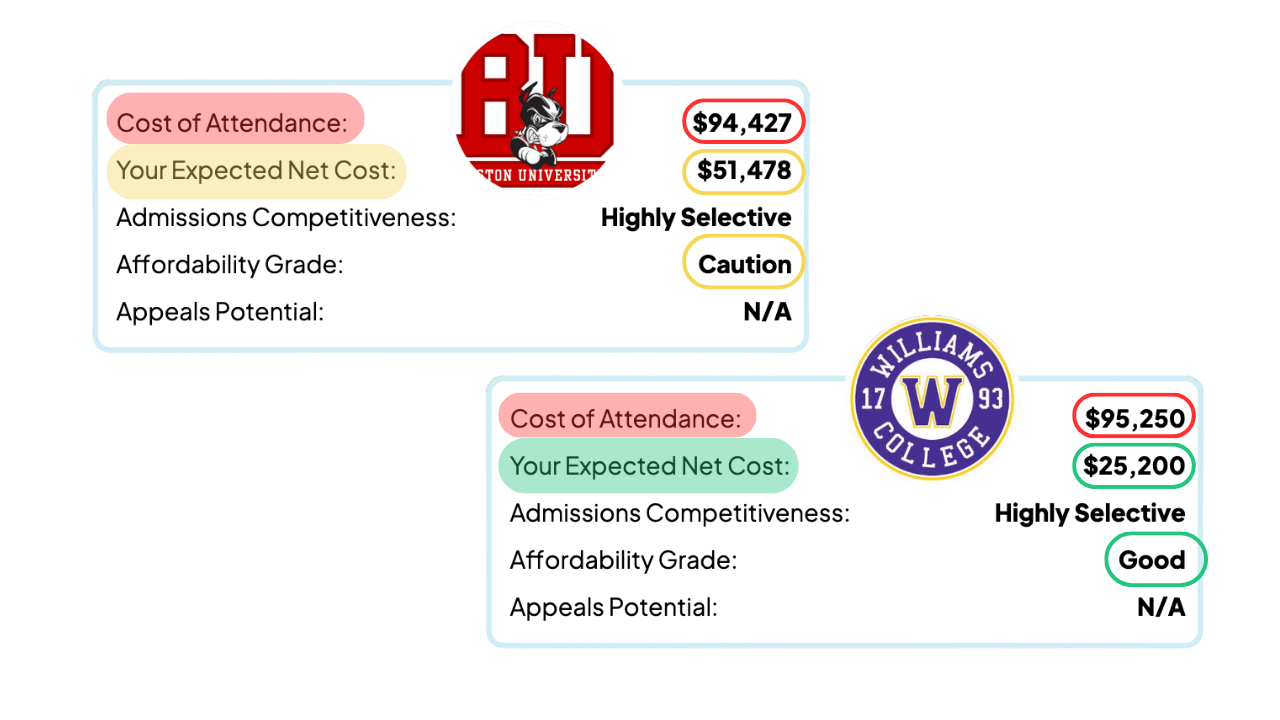

- Go Beyond the Sticker Price: The most important number is not the cost of tuition, but the “net cost”—the amount your family will actually pay after scholarships and grants. MyCAP takes your unique financial data and provides accurate, customized net cost projections for any school in the country. This means you can build a college list based on affordability from day one.

- Get Accurate, Not Generic, Projections: Unlike many generic calculators, MyCAP’s projections are based on real-world data, including actual award letters and school-specific financial aid policies. This ensures that the estimates you see are much closer to the final offer, preventing a costly and shocking surprise when the award letter arrives.

- Simplify a Confusing Process: Financial aid is complicated. The forms (like the FAFSA and CSS Profile), the terminology, and the appeal process can be overwhelming. MyCAP streamlines this by providing a single dashboard where you can manage your data, compare schools on an apples-to-apples basis, and get a clear, four-year cost breakdown.

Key Features That Make MyCAP a Game-Changer for Parents

A good college financial planning software isn’t just a calculator—it’s a comprehensive tool. Here are the features that make MyCAP stand out:

- Personalized Financial Aid and Scholarship Projections: Input your financial information once and see personalized estimates for every school on your list. MyCAP can help you identify schools that are likely to offer more “free money” (grants and scholarships) and help you prioritize them.

- Side-by-Side Award Letter Comparison: When you receive offers from different schools, MyCAP translates and organizes them into a single, easy-to-read format. This allows you to quickly compare the true net cost, identify the difference between grants and loans, and make an informed decision without the stress of deciphering complex financial jargon.

- Financial Aid Appeals Evaluation: Believe you should have received more aid? MyCAP helps you evaluate if you have a strong case for an appeal and provides guidance on how to craft a successful appeal strategy. This single feature can potentially save your family tens of thousands of dollars.

- Long-Term Planning and “Financial Fit” Grading: MyCAP doesn’t just focus on year one. It provides four-year cost projections and even offers an “Affordability Grade” based on your student’s projected salary versus their potential student loan debt. This holistic view helps you make a truly smart investment decision.

The “MyCAP Way”: A Smarter Approach to College Planning

The traditional approach to college planning is often backwards. Families fall in love with a dream school and then scramble to figure out how to pay for it. This can lead to overwhelming student debt and a lifetime of financial strain.

The “MyCAP way” flips this model. It empowers you to start with your family’s financial reality and build a college list that is both academically and financially sound. By focusing on schools that offer the best “financial fit,” you are not only securing your family’s future but also giving your student the freedom to choose a career based on their passion, not their loan balance.

Conclusion

Choosing a college is one of the biggest financial decisions a family will ever make. You don’t have to navigate it alone or with outdated tools. By investing in a powerful college financial planning software like MyCAP, you can replace the stress and guesswork with clarity and confidence. Take control of your family’s financial future and make a decision that sets your student up for success, both in and out of the classroom.

Take a tour of MyCAP today!