The New MyCAP 2.0 User Journey: Explore the Enhanced Layout and Streamlined College Planning Phases

Let’s face it—planning for college can feel like juggling a million things at once. From choosing the right school to figuring out how to pay for it, it’s easy to get overwhelmed by the process. But don’t worry, MyCAP 2.0 is here to help!

We’ve broken everything down into clear, manageable phases so you can focus on one thing at a time. This not only makes the process easier but also empowers families to make the most of each phase of the college planning process.

In this article, we’ll explain the new layout of MyCAP 2.0 and walk you through the enhanced user experience. By the end, you’ll see how our step-by-step approach helps you tackle each phase with confidence, reducing stress while maximizing every opportunity along the way.

1. New Home Dashboard

The New Home Dashboard is your mission control for the entire college planning process. Think of it as your personal planner, guiding you through every step and keeping things on track.

- Track Your Progress: Easily see your next steps, important action items, and how much you’ve accomplished so far.

- Personalized Financial Insights: View your Student Aid Index (SAI)—the amount colleges think you can afford—and compare it to your actual College Budget, showing what you can really afford.

- Cut Through the Noise: Forget the glossy brochures—this dashboard helps you focus on the right financial fit, not just the college’s marketing hype.

- Stay Informed: With quick access to upcoming live webinars, blog articles, and 1:1 expert help, you’ll always have the resources you need at your fingertips.

Summary: The Home Dashboard keeps everything organized & educated to help you stay grounded in your college planning journey, with a strong focus on finding the right academic and financial fit.

2. College Search & School Selection Page

Choosing the right college is huge, and MyCAP’s College Search feature makes it easier—and smarter. You can filter through schools based on academics, location, and more, but we take it a step further.

- One-Time Profile Input: Once you input your info, you’ll get personalized results that show the real cost of each college after scholarships and financial aid are factored in.

- Search for Financial Fit: You can search for colleges that fit within your budget, offer scholarships, or even limit the amount of student debt you’re willing to take on.

- 1-Click Personalized Net Cost: Instantly see your net cost for the first year and over four years, compared to your College Budget, to understand exactly how much you might need to borrow.

- Proprietary Database: We use our own database of merit scholarships and financial aid statistics, so you get a truly customized, data-driven experience.

Summary: MyCAP’s College Search goes beyond typical search engines by showing you personalized net costs and factoring in financial aid and scholarships—making it easier to find a college that fits your budget.

3. Affordability Page

The Affordability Page gives you the full picture of your college costs—not just for the first year, but for all four years. We help you compare your four-year net cost to your four-year College Budget so you can plan ahead with confidence.

- Multi-Year Projections: See how much financial aid and scholarships you can expect every year, not just Year 1. This is huge for families with multiple kids in college or those who may see an increase in aid in later years.

- Two-Household Support: Unlike traditional net price calculators, we can help divorced or separated families by providing personalized cost estimates that reflect your unique situation.

- Affordability vs. Selectivity Grid: A brand-new feature that shows how balanced your school list is—combining both admissions selectivity and affordability. It’s a great way to make sure your choices match both your academic goals and budget.

Summary: The Affordability Page gives you a clear, long-term financial picture, including a new Affordability vs. Selectivity Grid, and it’s tailored for families in any situation—especially those with multiple kids or two households!

4. Financial Aid Forms

The Financial Aid Forms page just made your life a whole lot easier! Now you can select the colleges you’re applying to and indicate whether you’re applying through Early Decision, Early Action, Regular Decision, etc. MyCAP instantly lets you know which financial aid forms(FAFSA, CSS Profile, Non-Custodial Profile, IDOC, etc.) are required for each school.

- Instant Form Requirements: No more guessing! MyCAP shows you exactly which forms are needed for each college based on your application type.

- Direct Links: We link directly to the financial aid page of each school, so you can easily access deadlines and ensure you’re on top of the requirements.

- Line-by-Line Guidance: Need help with the forms? We’ve got you covered. The page offers step-by-step instructions on how to strategically fill out the FAFSA and CSS Profile, ensuring you’re maximizing your financial aid opportunities.

- 1:1 Expert Help: If you’d rather get personalized guidance, we provide easy access to CAP’s college planning experts for 1:1 help with completing your financial aid applications.

Summary: The Financial Aid Forms page shows you exactly what’s needed for each school, provides step-by-step instructions for completing the FAFSA and CSS Profile, and offers 1:1 expert help—making it easy to stay organized and submit your forms with confidence!

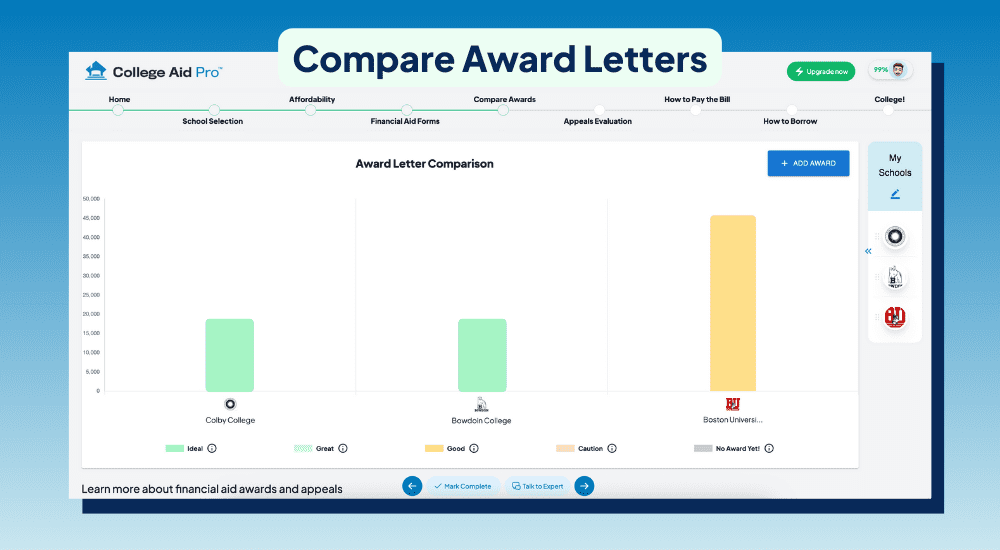

5. Compare Awards

Keeping track of financial aid awards can feel like a huge headache. They often come in so many different formats—emails, hard copies, and even separate college portals. It can be tough to know what’s what, and it’s easy to get lost in the details.

That’s where MyCAP’s Compare Awards feature comes in to save the day! We make it simple and automated by allowing you to upload your financial aid awards directly to your account. MyCAP will instantly translate the information and organize it, so you can see everything side by side.

- Instant Comparison: MyCAP takes all the awards you’ve received and shows them in an easy-to-read, side-by-side format.

- Cut Through the Noise: Financial aid offers often mix “free money” (like grants and scholarships) with “self-help” aid (like loans and work-study). MyCAP makes it easy to see what’s truly free versus what will need to be paid back, helping you focus on the real cost of attending each school.

- No More Guessing: By displaying the net price clearly, MyCAP helps you quickly assess what you’ll actually pay after all the aid is applied.

With MyCAP, you get a clear view of your options, allowing you to cut through the confusion and figure out exactly how much each school is going to cost you. No more searching through emails or portals to track down the details!

Summary: The Compare Awards feature allows you to easily upload and compare financial aid offers, breaking down the “free money” versus “self-help” aid, so you can get a real picture of what each school will cost.

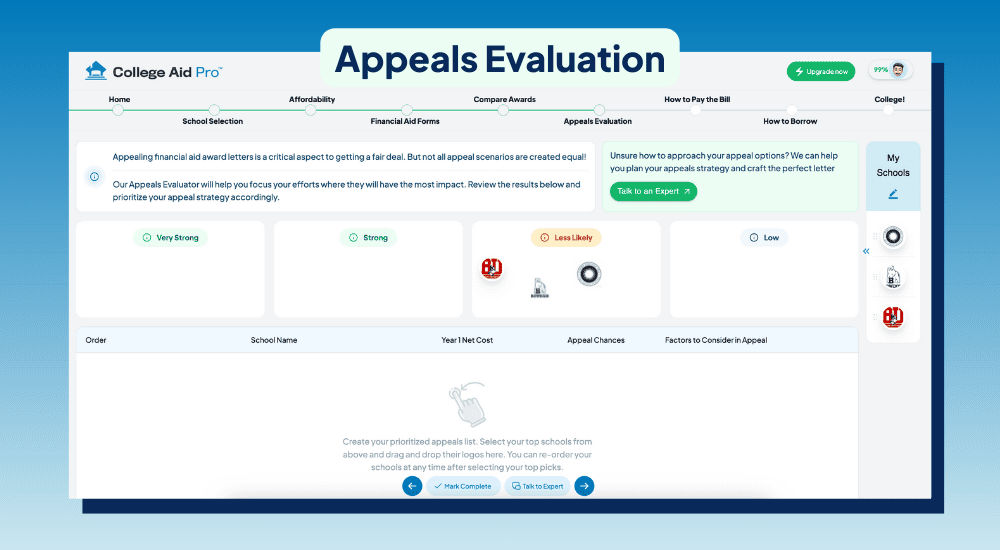

6. Appeals Evaluation

Appealing financial aid award letters is a critical part of getting a fair deal, but not all appeal situations are the same! MyCAP’s Appeals Evaluation feature helps you focus your efforts where they’ll have the biggest impact, so you can get the best possible financial aid and merit scholarship offers.

- Focus Where It Counts: Our Appeals Evaluator will help you identify the key areas of your financial aid package that are most likely to result in additional aid. Whether it’s a change in your family’s financial situation, errors in the initial offer, or new documentation, we’ll help you prioritize your appeal strategy for the highest chance of success.

- Clear, Actionable Steps: We guide you through the appeal process with easy-to-follow steps, ensuring you know exactly what to include and how to present your case to maximize your aid.

- 1:1 Expert Support: Need extra help? We offer easy access to MyCAP’s college planning experts, who can work with you 1:1 to craft a successful appeal. Our experts have helped families secure an additional $1M+ in financial aid and merit scholarships this year alone!

Appealing your financial aid offer can feel overwhelming, but with MyCAP, you’ll have the resources and expert support you need to navigate the process and potentially secure more funding.

Summary: The Appeals Evaluation feature helps you identify the most effective appeal strategies and provides easy access to CAP experts for personalized 1:1 help.

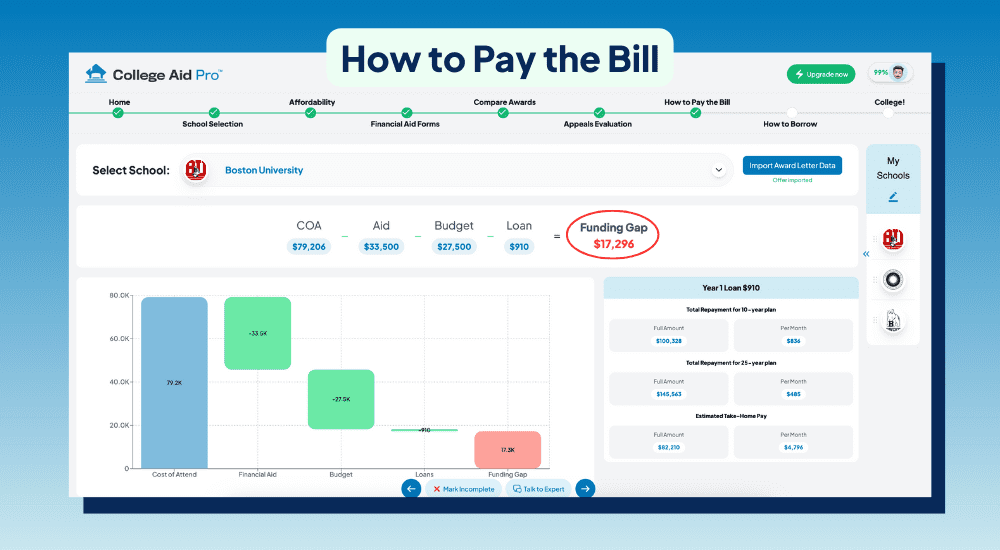

7. How To Pay the Bill

Congrats! Your student has been accepted to college—now comes the next step: figuring out how to pay for it all. The How to Pay the Bill page helps you easily break down the costs for the first year and plan strategically to cover tuition without stressing your finances.

- Understand Your Full Costs: Once you have your Financial Aid Award Letter, you’ll know the estimated costs for Year 1. Keep in mind, these costs typically increase 3-5% each year, so MyCAP helps you project future costs and prepares you for all four years.

- Strategic Fund Allocation: Use available resources like scholarships, grants, and 529 savings in a smart way. The goal? Minimize borrowing and delay taking out student loans for as long as possible.

- Break Down Funding Sources: Whether it’s parent savings, student savings, 529 plans, or ongoing cash flow, MyCAP helps you allocate these funds effectively.

Plus, if you need personalized guidance, we’ve made it easy to get 1:1 help from CAP’s college funding experts. Whether you’re navigating the complexities of paying for the first year or planning for future years, our experts are here to help.

Summary: The How to Pay the Bill page helps you break down Year 1 costs and strategically allocate resources, with easy access to CAP’s experts for personalized guidance to make sure you stay on track across all four years.

8. How to Borrow

Alright, you’ve done everything you can to minimize your out-of-pocket costs, but there might still be a gap that needs to be filled with loans. The good news? Not all loans are created equal, so MyCAP is here to help you find the right loan(s) that make the most sense for your situation.

Step 1: Take Direct Loans

Start with the Federal Direct Student Loan, which can cover up to $5,500 (Year 1) of your funding gap. These loans offer competitive rates and flexible repayment terms and are the only loan that does not require a parental co-signor.

Step 2: Check Private Rates

Next, explore private loan options to fill the gap. Check out the rate table for several top private lenders and their rates to see which ones offer the best terms for you.

Step 3: Check State Loans

Don’t overlook state loan programs! Check out loan options available through your state or other states that allow out-of-state students to borrow.

Step 4: Compare vs Federal PLUS Loan

Finally, consider the Parent PLUS Loan as an option. While these loans have a ~9% interest rate and a 3% origination fee, they offer another way to cover the remaining costs. We’ll help you compare this option against other funding sources to make the best decision.

Summary: The How to Borrow page helps you map out the best loan options to cover your funding gap, starting with Direct Loans, and includes comparisons to private loans, state programs, and Parent PLUS Loans.

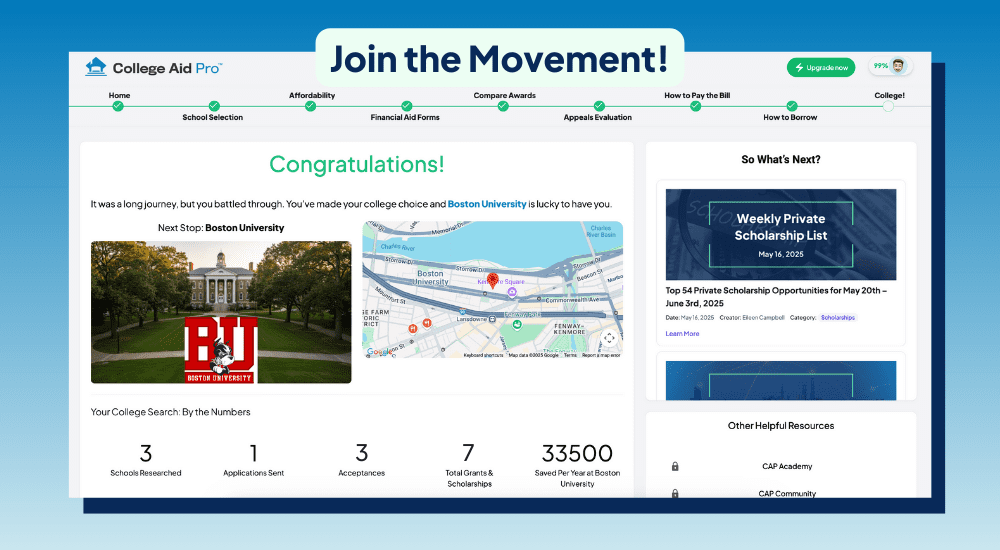

Join the Movement!

At MyCAP 2.0, we’re on a mission to end the student debt crisis, and we want YOU to join us! Hundreds of thousands of college-bound families are already reaping the benefits of working with us and using our MyCAP software to make smarter, more informed decisions about paying for college.

Here’s why becoming a MyCAP member is an absolute no-brainer:

- Low-Cost, No Barrier Pricing: Our new low-cost pricing and monthly subscription model mean you can join anytime, and cancel whenever. No long-term commitment, just a smarter way to plan for college.

- Smarter, Personalized Tools: From comparing colleges to navigating financial aid, MyCAP gives you the tools to find the best financial fit for your family and make better decisions.

- Easy Access to Experts: Get personalized guidance and expert advice when you need it—no more stress or confusion.

- Part of a Bigger Movement: Join hundreds of thousands of families already using MyCAP to avoid student debt and take control of their future.

Summary: Hundreds of thousands of families are already experiencing the benefits of MyCAP. With our new low-cost access and expert support, now’s the time to join and help us end the student debt crisis!