MyCAP 2.0 New College Details Page: Scholarships, Financial Aid, Costs & Affordability Explained

MyCAP 2.0: A Smarter College Planning Tool

We’re excited to introduce the all-new School Details Pages in MyCAP 2.0—your ultimate college planning tool for making smarter, more informed decisions. Think of it as your college search sidekick, but way more powerful. MyCAP goes beyond basic college stats by offering personalized insights tailored to your student’s profile. Complete your profile once and get 1-click personalized information on the 7 key areas we believe every college-bound family should focus on: Merit Scholarships, Financial Aid & Net Costs, Affordability, Admissions, Award Letters, Appeals, and How to Pay the Bill.

College is a major financial investment, and we want to ensure you’re fully equipped to handle it. With so many colleges marketing their shiny campus buildings and state-of-the-art facilities, it’s easy to get distracted. But the most important factor in choosing the right school is finding the real right fit—one that works both academically and financially.

In this blog, we’ll dive into the first four critical sections of the School Details Pages: Merit Scholarships, Financial Aid, Affordability, and Admissions. Our goal is to show you how MyCAP can empower you to become an educated college consumer, shop smarter, and get the best value for your money. Most importantly, we want to help you ensure your student won’t be buried under student debt for decades.

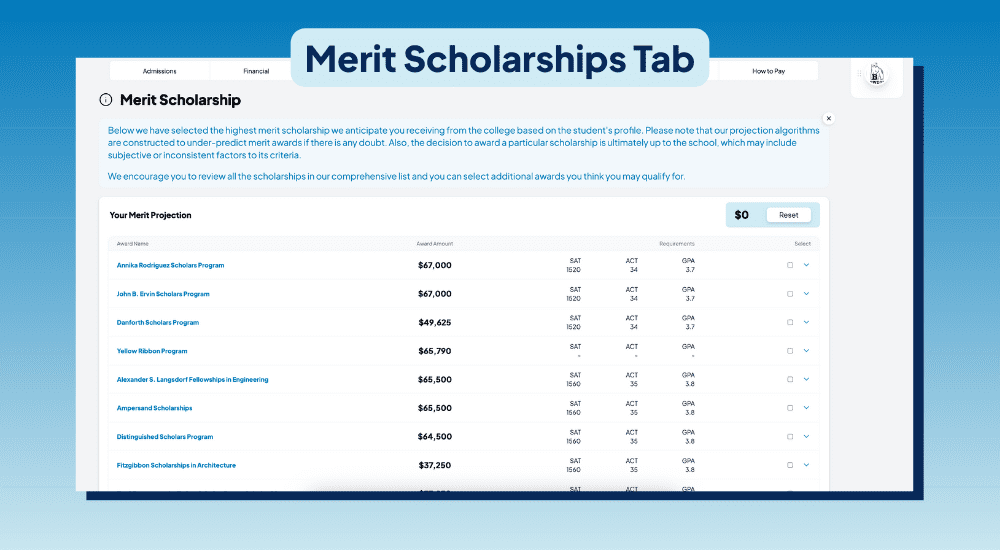

Merit Scholarships: Unlock Free Money for College

Merit scholarships are a powerful way to reduce college expenses. These awards are based on your student’s academic achievements, talents, or special skills, and the best part? They don’t have to be repaid. But how do you know if your student is eligible? That’s where MyCAP comes in. After completing your profile just once, MyCAP’s smart algorithms predict your student’s Merit Scholarship eligibility at each school on your list—or any college in the country for that matter—with just one click.

What sets MyCAP apart is our proprietary merit scholarship database, built and maintained to provide accurate, personalized projections. These projections help you understand how much free money your student could receive, allowing you to focus on schools that not only meet your student’s academic needs but also reward their accomplishments.

For families who may not qualify for need-based financial aid, merit scholarships are especially important. If you want to avoid paying the full sticker price, it’s crucial to look at schools that offer substantial merit-based awards. Whether your student excels academically, athletically, or artistically, MyCAP helps you explore all available merit-based options and find the schools that provide the best value.

Why It Matters:

Merit scholarships are an essential tool for reducing out-of-pocket costs, and MyCAP’s personalized projections make it easier to identify schools where your student can secure significant financial support.

Financial Aid & Net Cost: Get the True Picture of College Affordability

Understanding the financial impact of a college is crucial when making your decision, and MyCAP makes it easier than ever. While most colleges and other college search engines provide basic financial aid information (like average merit scholarships or average financial aid awards), is that really helpful? To be honest, we think it’s actually quite misleading. General averages don’t paint an accurate picture of what your family will actually receive, and they can lead to unrealistic expectations.

MyCAP takes this a step further by giving you a personalized breakdown of how much free money (scholarships + financial aid) you can expect to receive. This allows you to see your true net cost at each college—something that can vary dramatically from the sticker price.

What’s even better? We don’t just focus on year one. College is a four-year investment, and MyCAP provides a breakdown of net cost across all four years. This is especially important if you have multiple kids going to college at the same time, as you may qualify for additional aid in those years.

And if you’re navigating a two-household situation (divorced or separated), MyCAP is one of the few tools that can accommodate those complexities. Our algorithms provide projections and insights tailored to two-household financials—something most college net price calculators can’t handle. This feature is a major differentiator, ensuring that your financial aid projections are as accurate as possible.

Why It Matters:

With MyCAP, you get a much clearer, more accurate view of the total cost of a college education, not just for the first year, but for all four years. Our personalized projections help you plan smarter and avoid surprises, whether you have one child in college or multiple, or even if you have a non-traditional family structure. This is the transparency and insight you need to make the best financial decisions for your family.

Affordability: Rethinking the College Search: Why MyCAP Flips the Script

The traditional college search model has been broken for years, and we’re here to fix it. In the old way (as we like to call it), families start their college search by focusing on the fun stuff—academics, majors, size, location, campus life, and so on. You then apply to a bunch of schools, get accepted (hopefully), and wait until the end of senior year to learn exactly how much your family will have to pay. It’s like picking out a car based on how it drives, how it looks, and how it feels—only to find out, at the last minute, that the price tag is way out of your budget. Not exactly an ideal situation, right?

Here’s the problem with this approach: by the time you get the financial details, you’ve already emotionally invested in certain schools, making it harder to make an objective decision based on what you can actually afford. It’s a setup that leaves families scrambling to figure out how to cover the gap between their dream school and their realistic budget—often resulting in more student debt than expected.

Now, here’s where MyCAP comes in to turn things around. We call it the MyCAP way—and it’s a much smarter, more efficient approach. The first step? Start by building your College Budget, which tells you exactly how much your family can afford to spend on college without having to take on excessive student loans. Once you know what you can afford, you can shop for colleges that meet both your academic and social goals, but also fit financially.

The ideal situation? Of course, you’ll find a school your student loves that’s affordable and doesn’t require any student loans. But even if that’s not the case, that doesn’t mean you’ve failed. MyCAP helps you make an educated decision by offering an Affordability Grade based on your student’s expected first-year salary versus the estimated student loan total. Our grading system works like this:

- No Loans = Ideal

- Loans under $27,000 (FDSL) = Great

- Total Loans Below Expected 1st Year Salary = Good

- Total Loans Above Expected 1st Year Salary = Caution

Why It Matters:

The MyCAP way gives you the power to approach the college search with transparency and confidence. By focusing on affordability first, you’ll avoid the stress of unexpected financial surprises later and ensure that your student’s college choice is a smart financial investment. With MyCAP’s personalized insights, you can balance academic aspirations and financial reality, making sure you’re not setting your family up for a future of overwhelming student debt.

Admissions: A Smarter Approach to College Search & Admissions

If you’ve read through the Affordability section, you probably guessed that we approach admissions a bit differently, too. While admissions criteria are important when choosing the right college, the MyCAP way goes beyond just focusing on whether a student gets in. We believe in being fully educated college consumers, where the goal is to find a school that fits academically and financially.

Each college profile on MyCAP includes a detailed Admissions section, packed with everything you need to know about the school’s qualifications. With both admissions and financial insights in one place, MyCAP makes it easy to find the real right fit for your student. You can compare schools side by side—not just by their admissions potential, but also by cost and affordability. This comprehensive approach helps you identify the schools where your student has the best chance of acceptance while ensuring those schools fit within your family’s budget. It’s a smarter, more well-rounded way to approach the college search—focused on finding the best fit for your student’s goals, not just the most selective or prestigious schools.

Why It Matters:

Understanding admissions and affordability upfront helps you make informed decisions, reducing the stress of the college application process. With MyCAP, you’ll know where your student is likely to be accepted and which schools match their academic goals and your family’s budget—making the entire process more efficient and less overwhelming.

Won’t You Join Us?

You’ve learned how MyCAP can make the college planning process a whole lot easier—from merit scholarships and financial aid to affordability and admissions. Now, it’s time to make it happen!

Getting started with MyCAP is super easy—and guess what? It’s free to kick things off. With MyCAP, you’ll get personalized insights that help you make the smartest college decisions for your student, both academically and financially. No more guessing about costs or wondering if a school is the right fit.

Create your MyCAP account today and start optimizing your college planning process—for free. Get personalized insights on merit scholarships, financial aid, and affordability to make smarter college decisions.

Create your MyCAP account today!

🖥️Watch the Full Tutorial of the School Details Section Here!