FAFSA Tips for Parents: A Guide to Getting it Right

FAFSA Tips for Parents: A Guide to Getting it Right

If you’re anything like me, the thought of filling out the FAFSA (Free Application for Federal Student Aid) might make you groan. The form seems intimidating at first glance, with its government lingo and endless requests for information. But let me assure you, with the right preparation and guidance, you can get through this—and even feel confident about it. After all, this isn’t just about grants and scholarships. Filling out the FAFSA is the first step in securing federal student loans, which are often the best loan options available if your family needs to borrow for college.

I’ve been there, fumbling through instructions, worrying about making a mistake, and learning from other parents and experts along the way. With help from resources like College Aid Pro and their free MyCAP tool (more on that later!), I’ve picked up some tips that can make the process smoother and less stressful for families. Here’s what you need to know.

Start Early: Get Your FSA ID Before You Need It

The FAFSA officially opened last week, and if you have a senior in high school or a student already in college, you’ll need to submit it for the 2025-26 school year. To even begin the FAFSA, both the student and one parent (as the “contributor”) will need an FSA ID—a login for the Federal Student Aid website.

Here’s what I wish I had known right away:

- You, the parent, and your student each need your own FSA ID.

- If you’re married and file taxes jointly, only one parent needs to create an account.

- If you’re divorced or separated, the parent who provided the most financial support over the past 12 months (the “custodial parent”) is responsible for completing the FAFSA and needs the ID.

The FSA ID isn’t something you want to leave until the last minute. It might take a day or two for your account to be verified before you can log in and complete the FAFSA. Plan ahead so you don’t end up frustrated by delays.

Gather Your Financial Documents

The FAFSA will ask for detailed financial information, and having everything ready ahead of time can save you a lot of back-and-forth. Here’s what you’ll need:

- 2023 tax returns (for the 2025-26 FAFSA). The FAFSA now requires you to provide consent to pull tax information directly from the IRS. This step is mandatory for most families, so don’t be caught off guard.

- Records of child support received.

- Balances of cash, savings, and checking accounts on the day you are submitting your FAFSA.

- Net worth of investments, businesses, and farms.

One thing that surprised me: 529 plans owned by parents are reported as parent assets, but 529 plans owned by grandparents or others are not reported at all. Similarly, if you own a UGMA/UTMA account, it’s considered a student asset and must be reported.

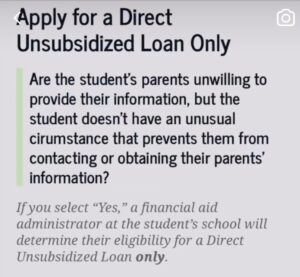

The Direct Loan Question That Trips Families Up

This is the part I wish someone had told me about before my student and I worked on our FAFSA. There is a question on the student portion of the form that asks about applying for a direct unsubsidized loan. The headline of this section is very confusing. Here is a picture of what your student will see in their portion of the FAFSA.

The wording is tricky, and the consequences of answering incorrectly are huge.

- If your student answers “YES” to this question, it means you are NOT planning to provide your financial information as a parent. It essentially opts your student out of being considered for federal aid programs like Pell Grants, Federal Work-Study, and Subsidized Direct Loans.

- To be considered for all forms of aid, including loans and work-study, your student should answer “NO.”

It feels counterintuitive, I know. But if you’re willing to provide your financial information and complete the FAFSA as a contributor, make sure your student answers “NO” to this question.

The FAFSA Is Your Student’s Form—But Parents Play a Big Role

Even though parents fill out most of the financial details, the FAFSA technically belongs to your student. Here’s how you can work together to avoid hiccups:

- Your student will need to invite you as a contributor to their FAFSA.

- Make sure your student enters your personal details—like your name, Social Security number, and date of birth—exactly as they appear on your official documents. A small typo can lead to frustrating delays.

- If you already have an FSA ID, double-check that the personal information matches exactly.

If your student is comfortable, they can share their FSA ID with you so you can access and complete their section. Just be careful to switch back to your own FSA ID for the parent section.

What You Don’t Need to Report

Here’s some good news: not everything needs to be disclosed. For example:

- You don’t need to report the value of your primary residence (the home you live in).

- Retirement accounts like 401(k)s, IRAs, and pensions are not reported.

- As mentioned earlier, only report 529 plans that you, the parent, own.

Why You Should Submit the FAFSA (Even If You Think You Don’t Qualify)

One of the biggest mistakes families make is assuming they won’t qualify for aid and skipping the FAFSA altogether. Here’s the truth: the FAFSA isn’t just about grants and scholarships. It’s also your student’s ticket to federal student loans—specifically Direct Subsidized and Unsubsidized Loans.

Federal direct student loans are your student’s loans (they don’t need you as a co-signor) and there is a cap on how much your student can borrow each year. You can read more about federal direct student loans here and here.

Even if you don’t think you’ll receive need-based aid, a completed FAFSA form is required to be eligible for these loans if you need them.

The MyCAP Tool: Your FAFSA & College Planning Ally

Make FAFSA season simple. With MyCAP Premium you’ll get step-by-step, line-by-line FAFSA & CSS Profile tutorials, plus real expert help in bi-weekly office hours. Run your Student Aid Index (SAI) in MyCAP before you file to see what to expect—and how to improve it. Use MyCAP to “test-drive” your FAFSA, catch mistakes, and submit with confidence. All this for $4.99/month—cancel anytime.

Final Thoughts: You’ve Got This!

I get it—filling out the FAFSA can feel like navigating a minefield. But if you take it step by step, prepare your documents in advance, and lean on tools like MyCAP for ongoing support, it’s absolutely manageable. The key is to start early, read everything carefully, and not be afraid to ask for help if you get stuck.

Remember, the FAFSA isn’t just about financial aid—it’s about opening doors to opportunities that make college more accessible. So, take a deep breath, dive in, and give yourself credit for taking this important step for your family.