Student Loan Refinancing 101

If you’ve got student loans, you’re probably thinking about at least one of these:

How do I get this monthly payment down? Why do I have so many separate loans and due dates? Am I paying way more interest than I should?

That’s where student loan refinancing comes in. Done right, it can help you lower your rate, shrink your monthly payment, or just clean up the chaos of multiple loans.

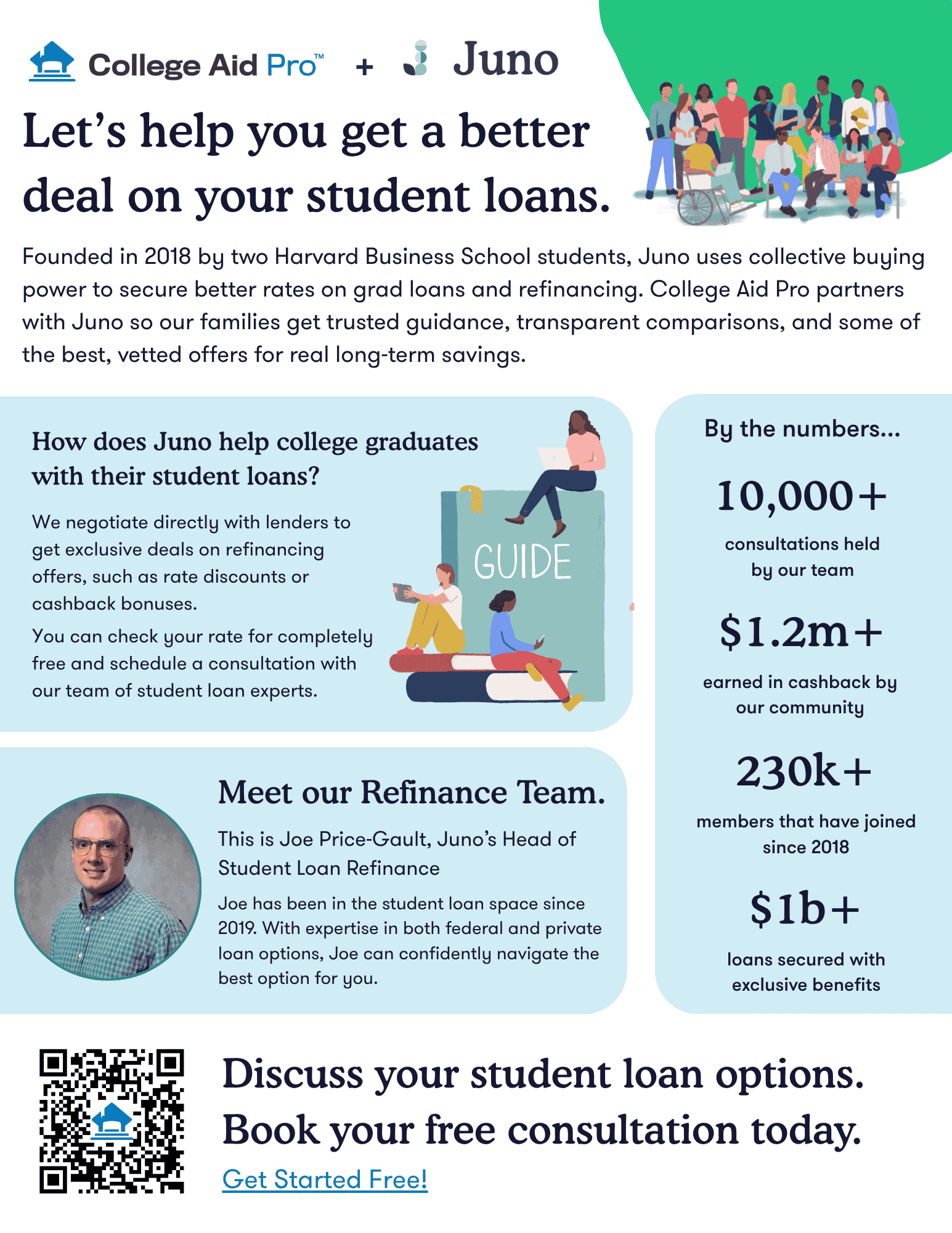

At College Aid Pro, our mission is to help families pay less for college and still sleep at night. Part of that mission includes a partnership with Juno, a company that uses group buying power to negotiate student loan refinancing deals for borrowers.

This article will walk you through:

- What student loan refinancing is

- Who it might be right for (and who should be very careful)

- Why we chose to partner with Juno

- How College Aid Pro + Juno work together in your bigger college and financial plan

Quick note: This article is educational, not individual financial advice. Always talk with a qualified financial professional before making big decisions about your loans.

What Is Student Loan Refinancing?

Let’s start simple.

Student loan refinancing means you take one or more existing student loans and swap them for a new private loan with a different lender.

That new loan ideally comes with:

- A lower interest rate

- A new repayment term (shorter or longer)

- One single monthly payment instead of several

Here’s the basic flow:

- You apply with a private lender (or via a marketplace like Juno).

- If you’re approved and you accept an offer, the new lender pays off your old student loans.

- You start making payments to the new lender under the new terms.

If you can get a lower rate and a term that fits your budget, student loan refinancing can:

- Reduce your total interest cost over time

- Lower your monthly payment

- Help you pay off your loans faster, if you keep paying aggressively

Who Is Student Loan Refinancing For?

Every lender sets its own eligibility criteria, but most look for a few common things.

You’re more likely to qualify for student loan refinancing if you:

- Have at least $5,000 in student loan debt

- Have no recent bankruptcies or defaults

- Have a solid credit score (often mid-600s or higher; stronger is better)

- Are employed with a stable income

- Are a U.S. citizen or eligible non-citizen

Some lenders also consider:

- Borrowers in their last semester of school with a job offer

- Borrowers who did not graduate but left school several years ago and built strong credit

Not sure if you’ll qualify? That’s okay. Many refinance lenders allow you to check rates using a soft credit check, which lets you see potential offers without impacting your credit score.

The Big Caution Flag: Federal vs. Private Loans

Before you make any moves, you need to know what kind of loans you have.

- Federal student loans (Direct Subsidized/Unsubsidized, PLUS, etc.)

- Private student loans (from banks or private lenders)

When you use student loan refinancing with a private lender on federal loans, those federal loans become private loans forever. That means you permanently give up federal benefits such as:

- Income-Driven Repayment (IDR) options

- Public Service Loan Forgiveness (PSLF), if you qualify

- Certain deferment and forbearance protections for economic hardship

You cannot refinance a private loan back into a federal loan later. Once it’s private, it’s private.

Because of that, student loan refinancing may be more attractive for:

- High-interest private loans, especially those in the high single or double digits

- Federal loans for borrowers who are confident they don’t need and won’t qualify for federal protections or forgiveness programs

It may be less appropriate if:

- Your income is modest or unpredictable

- You’re counting on IDR or PSLF

- You need the built-in flexibility federal loans provide

What About Parent PLUS Loans?

Parent PLUS loans can feel like a second mortgage on top of raising kids.

The good news: many private lenders do allow Parent PLUS loans to be refinanced as part of student loan refinancing. In some cases, the loan can even be refinanced into the student’s name, depending on the lender’s rules and the student’s credit profile.

Things to think about:

- Who should legally carry the debt long-term (parent vs. student)

- How the new payment fits into retirement planning and other financial goals

- Whether giving up any federal protections on the Parent PLUS loan is worth the trade-off

This is one of those situations where running the numbers and getting advice is especially important.

Why College Aid Pro Partnered with Juno

So where does Juno come into all of this?

What Juno Does

Juno is a company that uses group buying power to help borrowers get better deals on student loan refinancing. Instead of every individual borrower trying to negotiate with lenders alone, Juno:

- Brings together a large community of borrowers

- Negotiates with select lenders for rate discounts, cash-back bonuses, or other perks

- Offers access to those deals for free – lenders compensate Juno, not you

- Curates a short list of competitive refinancing options, so you’re not sifting through the entire internet

The goal is simple: if you choose to refinance and you qualify, you shouldn’t get the worst deal on the market—you should have a shot at some of the strongest options available.

Why We Like Juno (and Why We Partnered)

At College Aid Pro, we live and breathe:

- Paying less for college

- Protecting long-term financial health

- Helping families understand their options before they sign anything

We decided to partner with Juno because:

- Mission alignment: We both care about helping borrowers lower the real cost of their education-related debt.

- Negotiated value: Juno works to secure deals that are better than the standard public offers from those same lenders.

- Time savings: Instead of you applying randomly to multiple lenders, Juno’s process lets you compare competitive student loan refinancing offers more efficiently.

We don’t set interest rates. We don’t originate loans. Our role is to help you understand where student loan refinancing fits into your entire financial picture—and to connect you with partners who can potentially improve your terms if refinancing is right for you.

How Student Loan Refinancing Works with College Aid Pro + Juno

Step 1: You decide what your goal is

- Lower monthly payment

- Lower total cost over the life of the loan

- Faster debt-free date

- Or a combo of all three

Step 2: Use Our Juno Partnership Link

When you’re ready to shop, you can click through our College Aid Pro + Juno link to:

- Join Juno for free

- Access the negotiated student loan refinancing offers from their participating lenders

- Check potential rates using an initial soft credit check (so your credit score isn’t impacted just for shopping)

There’s no obligation to refinance just because you checked your rates.

Step 3: Compare Student Loan Refinancing Offers

You’ll likely see multiple options with different:

- Interest rates / APRs

- Repayment terms (shorter or longer)

- Monthly payments

- Perks like autopay discounts or hardship protections

Key questions to ask yourself:

- Is the interest rate meaningfully lower than what I’m paying now?

- Does the monthly payment fit easily into my budget?

- How does the new term affect my total interest cost over time?

- Am I giving up any important federal protections if I refinance this particular loan?

If a student loan refinancing offer clearly moves you in the right direction—and you’re not sacrificing benefits you need—then it may be worth taking the next step with that lender.

If it doesn’t? You can walk away. No harm done.

Is Now a Good Time to Refinance My Student Loans?

There’s no one-size-fits-all answer here, but a few guiding principles can help.

Student loan refinancing might be worth exploring if:

- You have high-interest private loans (especially in the 8–10%+ range)

- Your credit score and income are stronger now than when you originally borrowed

- You’re not relying on federal programs like IDR or PSLF for the loans you’re considering refinancing

- You want to streamline multiple private loans into one simple monthly payment

On the other hand, you might want to hold off or be very cautious if:

- You’re carrying mostly federal loans and your income is modest or variable

- You’re counting on federal protections, forgiveness options, or IDR

- You’re not sure how a new payment would fit into your long-term plan

Remember: student loan refinancing is not a one-time window. Some borrowers refinance more than once over the years as their credit improves or the rate environment changes. The key is to run the numbers each time and understand the trade-offs.

Your Next Step

If you’re staring at your loans and wondering whether student loan refinancing could help you:

- Identify which loans are federal and which are private.

- Decide your main goal: lower monthly payment, lower total interest, faster payoff, or a mix.

- Use our CAP + Juno link to check what student loan refinancing offers you might qualify for.

- Talk through your options with a free consultation with Juno’s refinance team.

Student loans don’t have to feel like a life sentence. With the right information, the right strategy, and partners like Juno in your corner, you can turn a stress-inducing bill into something far more manageable—and keep the rest of your financial life on track while you do it.