How Do I Finalize My Federal Direct Student Loan?

At College Aid Pro™, we believe it’s critical that all college-bound families know that they are entitled and guaranteed Federal Direct Student Loan funding to put toward the cost of college.

If borrowing is on your radar at all, we recommend pursuing Federal Direct Student Loans (FDSL) prior to looking at any other options. Remember, these are still loans that will need to be paid back. Be sure you understand and agree to the rates, terms, and conditions of ANY loan you choose. These loans are typically the best place to begin borrowing for college.

Let’s look at a few facts about the FDSL program:

- If your FDSL is a subsidized loan, it is 0% interest rate while the student is in college.

- The loan becomes due 6 months after the student graduates.

- There are no prepayment penalties.

These loans are available to all students who have completed and submitted the FAFSA. They are designed to be “use it or lose it”. In other words, they’re available for all four years of a student’s college career, but can’t be leveraged retroactively. A student needs to take out up to the maximum amount each year in order to take full advantage of this program.

The loans total $27,000 over the four years of college.

Here’s the maximum borrowing amount for each year:

- $5,500 Freshman

- $6,500 Sophomore

- $7,500 Junior

- $7,500 Senior

Securing Your FDSL

Many college-bound students and their parents are unsure how to actually secure their Federal Direct Student Loan (FDSL) after seeing it on their financial aid award letter. With more and more college students taking government loans out to cover the college funding gap, or pay for a portion of their tuition, the Department of Education requires each student to complete two steps:

- Entrance counseling

- A master promissory note

Remember, these loans are solely in the student’s name, there is NO parent co-signor. This is an agreement between the federal government and the student. The student is expected and required to complete these two items prior to loan disbursement.

Let’s dive into what these two “to do’s” are, and why they’re important.

What Is Entrance Counseling?

Entrance counseling is a REQUIRED part of accepting an FDSL. It walks borrowers (the student) through the terms and conditions of the loan, and your rights and responsibilities.

Students learn the importance of repayment and the consequences of failing to repay your loan. The counseling discusses how interest accrues, and how it is capitalized (unpaid interest that’s added to your student loan, increasing the total you repay.) Repayment options and special resources available to you as borrowers are also explained.

The Department of Education is striving to educate college-bound students on what it means to take out a student loan. The government wants to make sure you are an informed student loan borrower. This counseling must be completed BEFORE receiving your loan. The entrance counseling is found on the Federal Student Aid website.

The student, not the parent, completes the counseling and the entire process takes about 30 minutes max, but must be completed in one sitting.

Here are the steps to complete your entrance counseling requirement:

- Student must login to https://studentaid.gov/

- Select “Log in”

- Enter STUDENT FSA ID username/password

- Click “accept”

- Enter language and email preference

- Select “Complete Loan Counseling”

- Select “Entrance Counseling”

- Follow Instructions to complete counseling (~15 minutes)

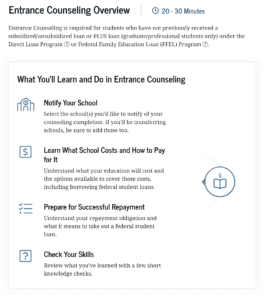

Here is a screenshot from the beginning of the counseling page. You will walk through six separate modules: Estimate the Cost of Your Education, Paying for Your Education, Federal Student Loans, How Much You Can Expect to Borrow, Prepare for Repayment After School, and Consequences of Not Repaying Your Student Loans

Why Is Entrance Counseling Important?

If you are a college-bound student, or your child will be going to school this upcoming enrollment season, entrance counseling may feel like a frustrating extra step to getting the funding you’re guaranteed by the US Department of Education.

However, this is a fantastic opportunity to educate yourself about what your federal loans entail, and what’s required of you after graduation for repayment. Too often, college students are surprised by their loan repayment when it comes due, and this is a great way to ensure that you’re empowered with knowledge on what’s expected of you post-graduation.

What is a Master Promissory Note (MPN)?

A Master Promissory Note (MPN) is the second requirement new borrowers must complete before loans are disbursed. This is a legal document that has borrowers promise to repay their student loans (and accrued interest and/or fees) back to the Department of Education. It also explains the full terms and conditions of your loan.

Promissory notes are not uncommon in the world of lending. Often, borrowers will be required to sign a promissory note for other large loans such as a mortgage. Look at this like your actual student loan application.

You’ll fill out three separate sections on the MPN.

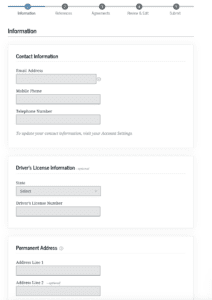

First is the Information section.

This section includes basic contact information, driver’s license information (optional), and permanent and mailing address information, and the school you’ll be attending.

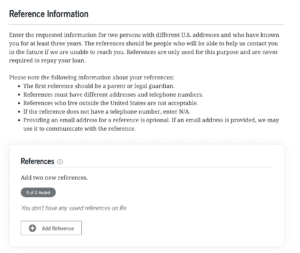

The second section is the Reference section.

You are required to have two references for your MPN. They must live in the U.S., have different addresses and telephone numbers, and they must have known you for at least three years. The first reference should be a parent or legal guardian.

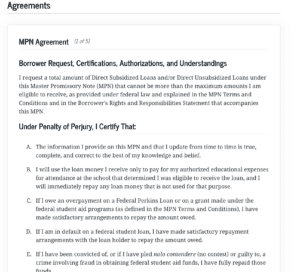

The third section is the Agreements section.

This is where you are agreeing to all the terms and conditions of the Federal Direct Student Loan you are applying for.

Here are the steps to complete your MPN:

- Select “Complete Loan Agreement (Master Promissory Note)”

- Select “MPN for Subsidized/Unsubsidized Loans”

- Follow instructions to complete agreement (~5 minutes)

Why Is a Master Promissory Note Important?

Your Master Promissory Note is a place where you’re promising to pay back your student loan – complete with interest and fees – to the Department of Education. Although this is standard practice, it’s important to keep in mind that this is a legally binding document. Before borrowing, make sure you understand what you owe and what’s required of you upon graduation.

A few things to remember when taking out a student loan. Loans are a legal obligation and you are responsible for repaying the amount you borrow plus any accrued interest. Even if you don’t begin repaying your loan until you graduate from college, it’s important to know and understand all your responsibilities as a borrower, and how NOT following through with those responsibilities could adversely affect you.