NPC Reality Check: Northwestern Net Price Calculator

If you have read our deep dive on college Net Price Calculators (NPCs), you already know our stance:

You cannot blindly trust a college’s net price calculator.

Now we are taking the next step and putting specific schools under the microscope. First up in our NPC Reality Check series: Northwestern University.

Northwestern is a perfect test case. It is a dream school for a lot of families, it has strong financial aid branding, and it uses all the “official looking” tools. On the surface, everything feels polished and reassuring.

Under the hood, things look very different. This is why we have put Northwestern on our NPC naughty list and have to agree with Mr. Gilmore.

“I know what you’re doing…….And I Don’t Like it!”

–Happy Gilmore

In this spotlight, we will walk through how Northwestern University presents affordability, how its net price calculator actually behaves, and why families need a second opinion before they plan around those numbers.

Quick Recap: Why Net Price Calculators Are Such A Mess

Let us zoom out for a minute.

Net Price Calculators were created to help families answer a simple question:

“What will this college really cost my family after financial aid?”

In practice, they rarely deliver on that promise.

From our nationwide NPC audit:

- Only about 4% of college NPCs were using current-year cost of attendance when this application season began. Said another way, 96% ARE WRONG.

- Roughly 70% were using cost information that was at least two years old.

- Many calculators leave out key pieces of a school’s own financial aid formula.

That means families are often planning around numbers that are outdated, incomplete, or both. When you are talking about four-year costs that can easily cross the $300,000 mark, those gaps are not minor.

What The NPC Reality Check Series Is All About

Our NPC Reality Check series has two big goals:

- Audit colleges and their Net Price Calculators

We look at how each college’s net price calculator works, how current the data appears to be, and how closely it lines up with actual awards. - Give a fair, balanced view of the school

We are absolutely going to call out bad NPC practices. We are also going to highlight what the school does well, both academically and financially.

Northwestern University is our first featured school for a reason. Its calculators look polished and credible. Its aid philosophy sounds generous. Yet in real life, we are seeing NPC results that are nowhere near the final offers and nowhere near what the school’s own methodology suggests should happen.

They also refused to speak with us when we approached them to discuss the flaws in their net price calculator…in fact they hung up on us!!!

How Northwestern Talks About Cost And Aid

If you skim Northwestern’s financial aid site, the message is pretty appealing.

The university:

- Promotes itself as a place where an education is “more affordable than you might think”

- Highlights that it meets 100% of demonstrated financial need

- Emphasizes grant-based aid instead of loan-heavy packages

The cost of attendance at Northwestern University is not small. Depending on the year you are looking at, the full cost of attendance (tuition, fees, housing, meals, books, and personal expenses) is in the mid-90 thousand dollar range per year.

That is a big number. The good news is that for many families, Northwestern’s actual aid packages can cut that number way down.

The problem is the road you travel to get that information.

To estimate affordability, Northwestern points families to two tools:

- MyinTuition Quick College Cost Estimator – A short, fast tool that claims to give a rough need-based estimate in about six questions.

- Northwestern University Net Price Calculator – (provided by College Board)

A more detailed survey that is supposed to show your personalized “net price” after grants and scholarships.

On paper, this setup looks great. Two levels of detail, serious branding, clear cost tables. The question is whether these tools actually behave like Northwestern’s own financial aid formula.

Spoiler: not consistently.

Where The Northwestern Net Price Calculator Breaks Down

Northwestern uses the CSS Profile and Institutional Methodology for its own aid. That system considers a long list of allowances and adjustments meant to reflect what a family can reasonably pay.

From our work with Northwestern cases, the university’s NPC appears to ignore several (7!) important pieces that its real formula uses. These are not small details. They can materially change a family’s Student Aid Index (SAI).

Here are some of the allowances that do not seem to be fully reflected in the Northwestern net price calculator results:

- Federal income tax allowance

- State income tax allowance

- Medicare Hospital Insurance tax

- OASDI (Social Security payroll tax)

- Income protection allowance

- Education savings allowance

- Sibling discount, even though the NPC asks how many kids are in college

In plain English, the calculator is asking you detailed questions, then apparently failing to give you credit for several major factors that would lower your expected contribution in Northwestern’s actual aid formula.

The result is obvious.

For certain types of families, the Northwestern NPC spits out a net price that is much higher than what they should qualify for and in some cases higher than what Northwestern eventually awards.

That is not a rounding error. That is a planning trap.

Real Family Example: Northwestern NPC vs MyCAP vs Actual Award

Let us walk through a real family case that shows just how far off Northwestern’s NPC can be.

The family:

- From New Jersey

- Upper middle income

- Significant home equity in a high cost of living area

- One student applying to Northwestern

- A sibling already in college at Duke

This is exactly the type of situation where a CSS Profile school’s methodology, including sibling discounts and allowances, can make a huge difference.

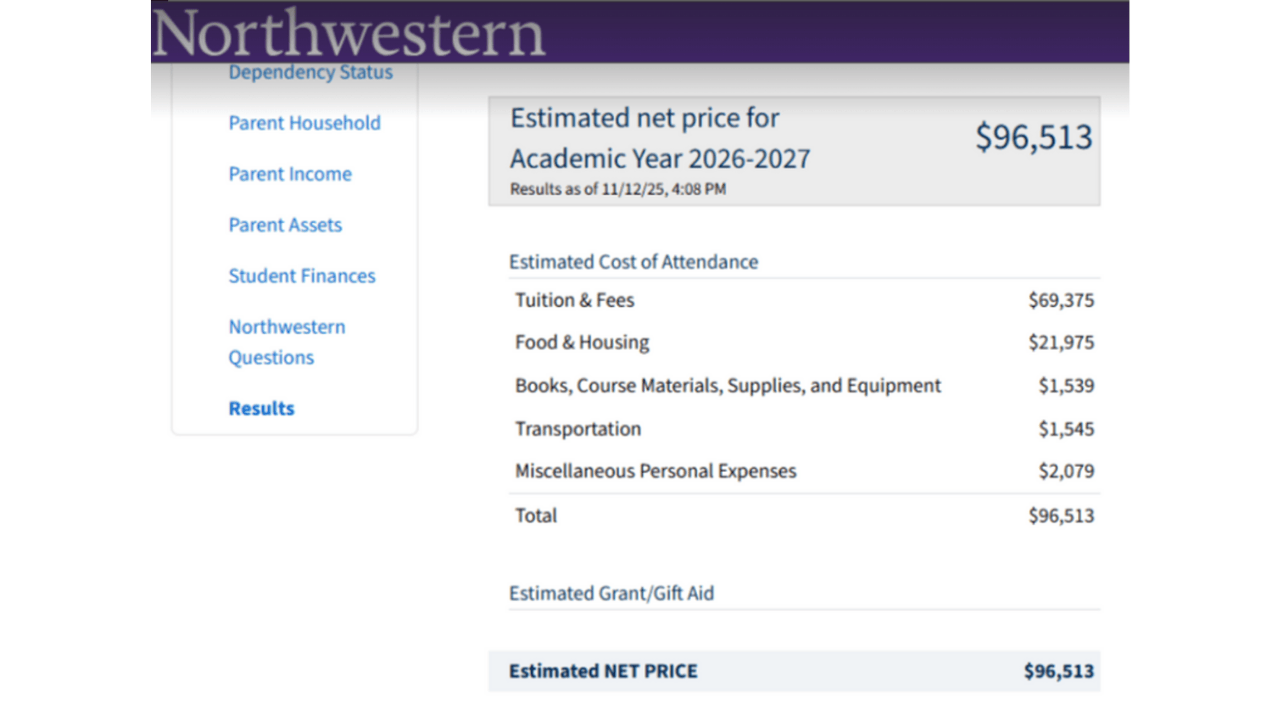

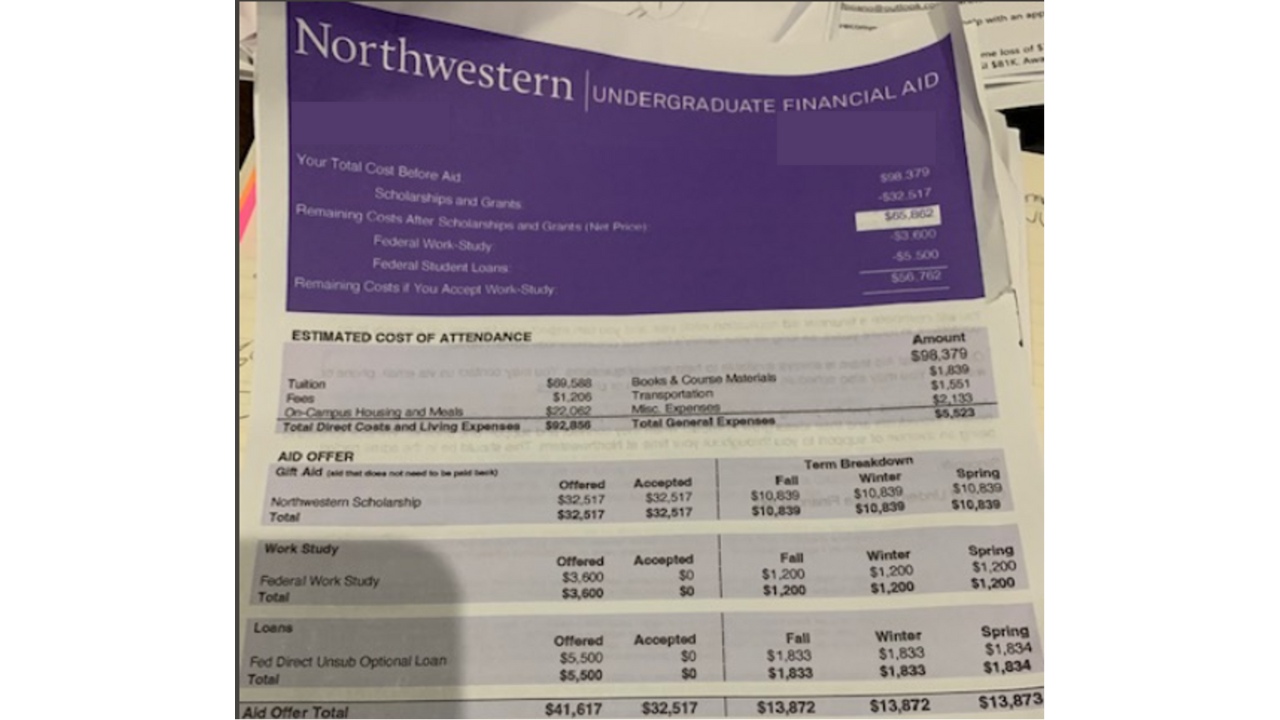

Step 1: Northwestern’s Official NPC

The family runs the Northwestern University net price calculator with all their real numbers.

The result:

- Estimated need-based aid NW Calculator: $0

- Implied net price: a full sticker price north of $95,000 per year

If you are a parent, you can probably hear the conversation already.

“We knew Northwestern was expensive, but wow.

I guess we are not getting any help there.”

For most families, that is the end of the story. Northwestern gets scratched off the list, or they risk enrolling and over-borrowing.

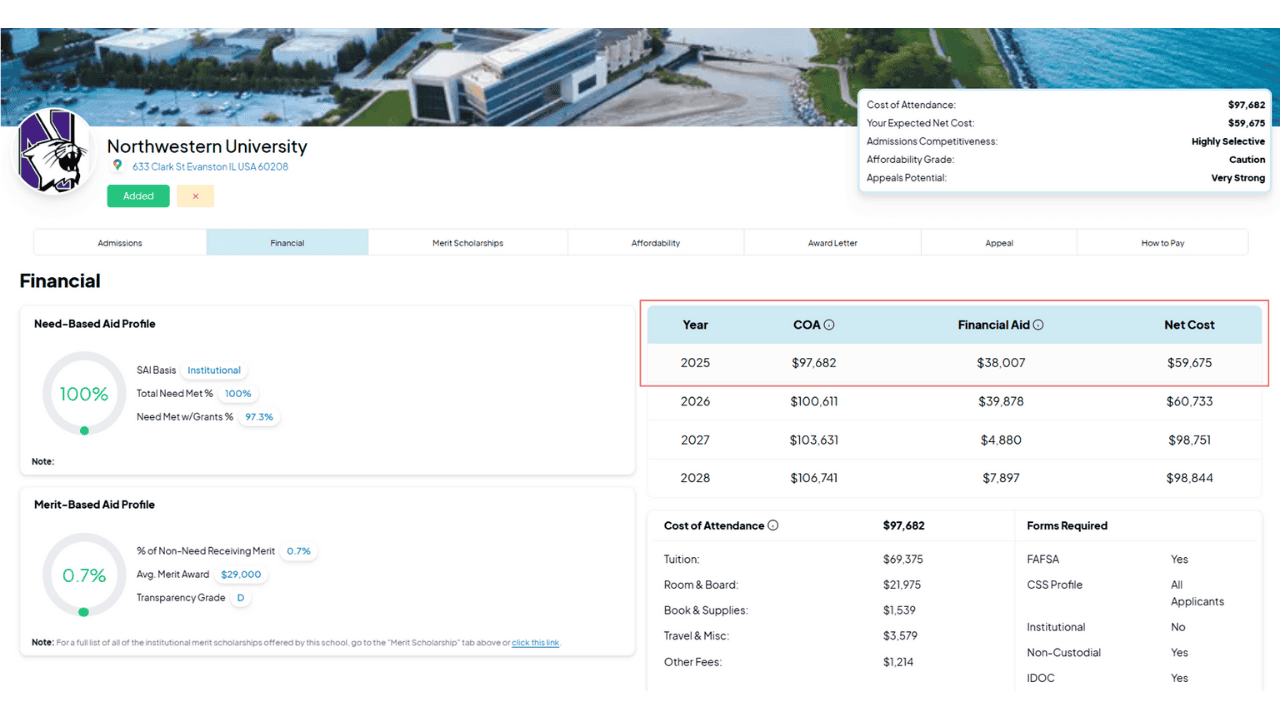

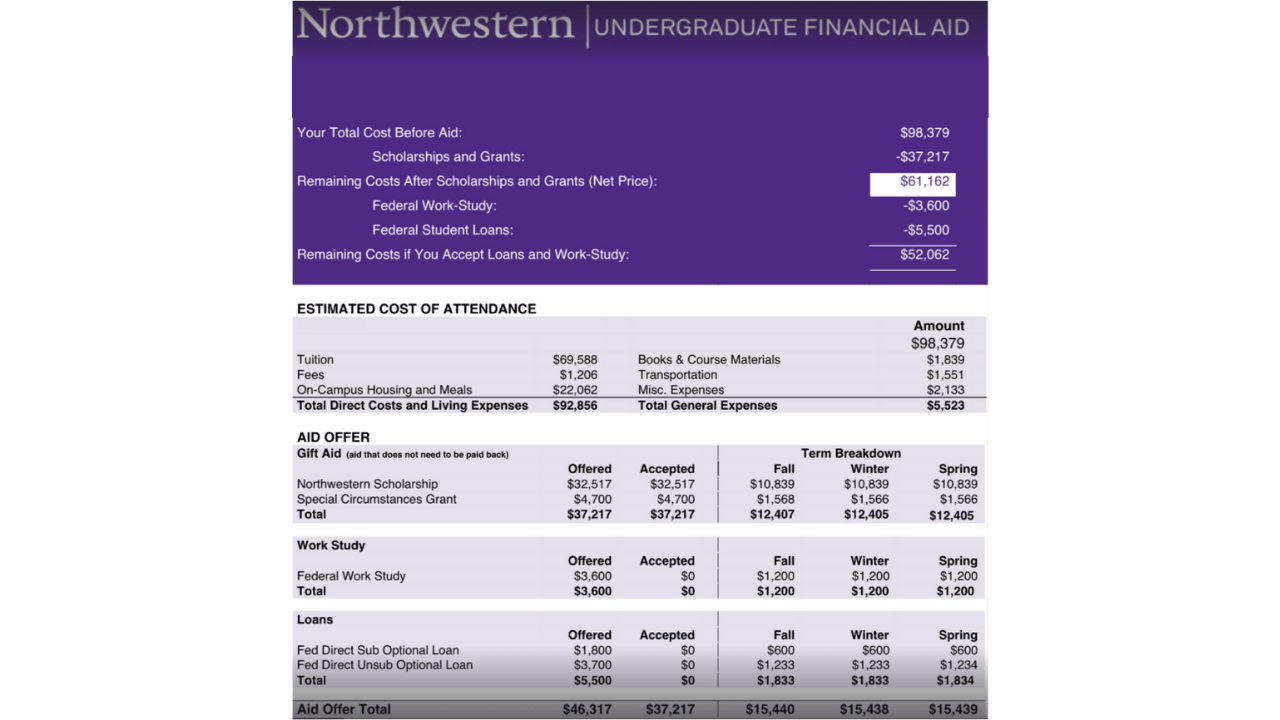

Step 2: The MyCAP Estimate

The family then ran the same data through the MyCAP college planning software.

Using Northwestern’s own published policies and a more complete version of institutional methodology, our engine projected roughly:

- Need-based aid: around $38,000

- Estimated net price: closer to $50,000 per year

Same family. Same year. Same financial data.

The Northwestern NPC said “you have no need.”

MyCAP showed a very real possibility of nearly forty thousand dollars in institutional aid.

Step 3: The Actual Northwestern Offer

When Northwestern finally released its official financial aid package, the award came in at roughly:

- About $30,000 in aid

That was already wildly different from the “$0” suggested by the NPC.

Still, based on the allowances and sibling impact that should be in play at a CSS Profile school, our team believed the family was being shorted.

Step 4: The Appeal

So we appealed.

We walked the family through the logic, documented the missing factors, and helped them approach Northwestern with data rather than just emotion.

The result:

- An extra $10,000 per year in institutional aid

- A final net price that landed within about $750 of the original MyCAP projection

Let that sink in.

- Northwestern’s NPC: $0 in aid

- Initial award: $30,000

- Final award after appeal: around $40,000

- MyCAP: within $750 of the real net price

If this family had trusted only the Northwestern net price calculator, they either would have walked away from a school that was more affordable than it looked or dramatically overpaid.

This is why we say NPCs are not just “a little off.” They can be dangerously misleading.

Is This Malice Or Just Sloppiness?

To be clear, we cannot read minds in Northwestern’s financial aid office.

What we can see is the incentive structure and the pattern across higher education:

- If the NPC shows no aid and the actual award comes in higher, the school looks generous.

- If families do not understand the formula, they are less likely to question whether they received the full amount they should have.

- If every college uses a slightly different, opaque method, families cannot compare schools side by side in a clean, apples-to-apples way.

Colleges are technically “nonprofit,” but they are still businesses. Any business would love a market where customers struggle to make fair comparisons and where the appearance of transparency does more work than the actual numbers.

Net Price Calculators create exactly that kind of environment.

They look official. They carry the school’s crest. They live on the financial aid page. For the average family, that is enough to feel safe.

Unfortunately, it is not enough to be accurate.

How Northwestern Responded When Pushed

You might be wondering whether Northwestern has explained why its NPC can miss by tens of thousands of dollars.

Short answer: not really.

When journalists and our team tried to get clarification on the gap between the NPC results and real awards, Northwestern did not offer a public explanation. In at least one attempt to follow up by phone, the call did not exactly end in a friendly, open-door conversation.

None of that proves intent. It does tell you something about urgency. If a college knows its calculators are badly out of sync with what families actually receive, and it is in no rush to fix them, you should assume the burden of protection is on you.

To Be Fair: What Northwestern Actually Does Well

Time to give credit where it is due.

We are hard on Northwestern’s net price calculator. We are not here to pretend Northwestern is a bad school or stingy institution. They are world class institution that meets a high percentage of need for most eligible families.

There are real positives:

- Strong need-based commitment. Northwestern publicly commits to meeting full demonstrated need for admitted students.

- Loan-light language. The school emphasizes grants and scholarships instead of leaning primarily on federal loans to make packages look bigger.

- Clear cost tables. The cost of attendance breakdown is relatively straightforward and includes more than just tuition and fees.

For the right family, Northwestern can be far more affordable than the sticker price suggests. That is exactly why an inaccurate NPC is so frustrating. It pushes families away from opportunities that might actually fit, or it leads them to accept offers that are less generous than they should be.

How College Aid Pro (MyCAP) Fixes The Picture

This is exactly why we built College Aid Pro’s MyCAP software.

When college net price calculators are using stale data or skipping key parts of the formula, families need a neutral source of truth that is not trying to enroll them. That is MyCAP’s entire job.

With MyCAP, you can:

- Enter your family’s data once

Income, assets, household details, siblings in college, the whole picture. - See your true projected cost at Northwestern and every other school on your list

Same inputs, same assumptions, apples-to-apples across the board. - Model real-life complexity

Divorced or separated households, business owners, high home equity, multiple kids in college at once, and more. - Look at both year one and all four years

Including how things change when a sibling starts college and what the likely loan impact will be if you choose each school.

The goal is simple:

Give you a clear, realistic estimate before you fall in love with a number that was never accurate to begin with.

If Northwestern’s Net Price Calculator says one thing and MyCAP says something very different, that is your signal to slow down, dig deeper, and be ready to appeal if your student is admitted and the offer does not match what the data suggests you should be getting.

Introducing The NPC Challenge

Our “NPC Reality Check” Starts With You

We are not content to just write about this and move on. We want families, counselors, and advisors to help us expose where college net price calculators are failing.

So we are launching The NPC Challenge, part of our larger “NPC Reality Check” campaign.

Here is how to participate:

- Run the college’s official Net Price Calculator. Use the NPC for Northwestern University or any other school on your list. Save the result.

- Run the same scenario in MyCAP or on Niche’s True Cost tool. Same income, same assets, same household information.

- If the numbers are way off, show us. If the difference is thousands of dollars, email your case (screenshots, PDFs, or details) to NPC@collegeaidpro.com.

Consider that inbox your College Neighborhood Watchdog for sketchy NPC behavior.

What our team will do:

- Audit the NPC result versus what the school’s formula appears to be

- Explain why the numbers might not match

- Help you decide whether to trust, verify, or challenge the offer

- Use anonymized versions of these cases to fuel future NPC Reality Check spotlights

Colleges may not love that level of scrutiny. Your future self (and your bank account), however, will.

If You Are Considering Northwestern, Here Is Your Game Plan

If Northwestern is on your student’s list, here is how to approach the cost conversation without getting tricked by a calculator.

- Do not treat the Northwestern net price calculator as the final answer.

- It is a data point, not a verdict.

- Always cross-check with MyCAP.

- If MyCAP shows significantly more aid than the NPC, that is a strong signal that allowances and family context are being handled very differently

- Scary or confusing NPC Number? Hit Pause, Not Delete

- Do not cross Northwestern off your list just because of a scary NPC number. Use MyCAP and also wait for an actual offer before you decide what is possible.

- Be prepared to appeal.

- If the award seems out of line with your situation or with what MyCAP estimated for you, especially with sibling discounts or complex finances, build a data-driven appeal.

- Share your Northwestern case with us.

- If you are comfortable, send your NPC result and award to NPC@collegeaidpro.com so we can keep shining a light on what is really happening.

Final Verdict: Can You Trust The Northwestern Net Price Calculator?

So, is the Northwestern University net price calculator accurate?

For many families, the answer is simple:

No. It is not accurate enough to plan your college strategy around.

Northwestern’s actual financial aid policies can be very generous. Its published cost tables are clear. Its academic value is undeniable.

The NPC is the weak link.

It appears to leave out key allowances, often understates a family’s eligibility for aid, and can differ from final awards by tens of thousands of dollars. That is exactly the kind of tool that looks helpful and “official,” while quietly steering families in the wrong direction.

That is why College Aid Pro exists.

We are here to:

- Provide clear, apples-to-apples cost comparisons across schools

- Show you what you are really likely to pay, not just what one calculator claims

- Equip you to question and appeal confusing offers

- Hold colleges accountable when their tools do not match their promises

Welcome to the NPC Reality Check series and the NPC Challenge.

Northwestern, you just happen to be first in the spotlight.