Are College Net Price Calculators Accurate? Here’s the Data to Prove They’re Not

If you’ve ever run a college Net Price Calculator (NPC) and thought, “Sweet, now I know what this school will actually cost,” we have some tough love for you:

You probably don’t.

And that’s exactly why “are college net price calculators accurate?” is the question every family should be asking.

Because for most families, that cute little “estimate” on a college website is a lot closer to a marketing tool than a money plan.

In this article, we’ll walk through:

- A quick history of how Net Price Calculators came to be

- Why, in theory, they seem helpful

- Why, in reality, they’re often inaccurate and misleading

- The especially risky situations (Early Decision, divorced/separated families, etc.)

- And how tools like MyCAP (and our partners like Niche) finally bring real transparency to the college cost conversation

What Is a Net Price Calculator (and Why Do Colleges Have One)?

To understand whether college net price calculators are accurate, you need to know where they came from.

After years of families being blindsided by actual college bills, Congress stepped in. The Higher Education Opportunity Act of 2008 required any college that participates in federal Title IV aid to publish a Net Price Calculator on its website. By October 29, 2011, every Title IV school needed one live.

The idea was simple:

Let families estimate “net price” — cost of attendance minus grants and scholarships — before they apply.

The U.S. Department of Education even provided a federal template calculator colleges could plug their data into. But here’s the important part:

- There is no federal approval or quality check on a school’s NPC

- Schools are responsible for deciding whether they meet the requirements

- They’re only expected (not required) to update annually

So yes, colleges have to have a calculator.

But no authoritative body is checking how good—or how current—it is.

Why Net Price Calculators Should Be Great (In Theory)

Before we tear them apart, let’s give Net Price Calculators some credit.

They were designed to:

- Improve transparency

Show something closer to the real cost instead of just the scary sticker price.

- Simplify financial aid

Pull cost of attendance, grants, and scholarships into one tool.

- Support informed decisions

Help students and parents compare schools and build a realistic college list.

- Reduce student debt

The idea was: if families see costs earlier, they’re less likely to say, “Oops, we just signed up for $200K in loans.”

So if you’re wondering, “Are college net price calculators valuable in theory?” — yes, the concept is solid.

The execution? Not so much.

Are College Net Price Calculators Accurate? The Problems Beneath the Surface

This is where things get messy.

Over time, the main issue with NPCs has shifted from “hard to find and use” to “okay, but wildly inaccurate.”

A Net Price Calculator is supposed to estimate what you’ll actually pay for college after financial aid. In reality, it’s only as good as the data and logic behind it.

Here’s why many NPCs fail families.

1. The Compliance Rules Are Too Vague

To “count” as a legal NPC, a calculator basically has to:

- Use the school’s cost of attendance

- Include median grants and scholarships by income or Student Aid Index (SAI) range

- Ask a minimal set of questions to approximate Expected Family Contribution / SAI

That’s it.

There is:

- No requirement that merit scholarships be included

- No requirement that data be up to date (just a soft “we expect annual updates”)

- No approval or oversight from the Department of Education

So colleges can:

- Use old data (we routinely see numbers from 2020–2023 being used for 2026–2027 planning)

- Skip important cost items like books, transportation, and personal expenses

- Exclude merit aid entirely — even at schools where almost everyone gets some

And they’re still “in compliance” and are able to participate in Federal aid programs.

So if you’re asking “Are college net price calculators accurate enough to plan around?” the honest answer is: not even close.

2. The Federal Template Is the Most Popular… and the Worst

A big insight from our work: the schools using the federal template NPC are almost always the most out of date.

That template:

- Collects very limited financial information

- Does not handle merit-based aid well (or at all)

- Was never designed for the complex institutional aid strategies colleges use today

Yet it’s widely promoted as the easy way for schools to “check the box.” So it ends up everywhere — and families assume it’s official, therefore accurate.

Spoiler: “official-looking” and accurate are not the same thing.

3. Not All Third-Party Tools Are Created Equal

Almost no college actually builds its own Net Price Calculator. They outsource to third-party vendors.

From our analysis and work with families:

- College Raptor NPCs tend to be the most up to date and accurate.

- Most schools using it include both merit and need-based aid.

- Many allow you to enter financial info flexibly, including a known federal SAI.

- Most schools using it include both merit and need-based aid.

- College Board NPCs are the go-to for institutional-methodology schools (those with their own aid formulas).

- But at the start of the 2026–2027 admissions season, only about 17% had updated their NPCs to that aid year.

- That means most families were planning with stale cost and aid data.

- But at the start of the 2026–2027 admissions season, only about 17% had updated their NPCs to that aid year.

To make things worse, many schools hide the data year in tiny fine print—or don’t show it at all. If you can’t tell what year the numbers are from, that’s your sign: do not trust that estimate.

NPCs, Privacy, and the Third-Party Data Machine

There’s another layer to this story that most families never think about.

No college actually “owns” its Net Price Calculator.

Almost every NPC is hosted and powered by a third-party vendor.

Colleges often use boilerplate language like:

“We do not sell or trade your personally identifiable information… however we may share it with third parties who help us operate our website or provide services to you.”

Translation: your data can absolutely flow to vendors — and many of those vendors do monetize or use that information for marketing.

Because you’re technically on a third-party site, you’re also agreeing to their privacy policy, which may be very different from the college’s.

So you’re not just getting a shaky estimate…

You might also be feeding a marketing machine you never knew you opted into.

When Inaccurate NPCs Are Truly Dangerous

If you’re still wondering “are college net price calculators accurate enough for high-stakes decisions?” the answer is a loud no in a few specific situations.

Early Decision (ED)

ED is already high stakes. You’re emotionally and practically committing to a school before seeing the final financial aid offer.

If a college says, “Don’t worry, just use our Net Price Calculator,” that should be a giant red flag.

- There’s often no formal financial pre-read of your actual information.

- The NPC may be using old data, ignoring merit aid, or making assumptions that don’t fit your family.

- Backing out of ED over affordability is possible—but stressful, messy, and emotionally brutal for your student.

Families should enter ED knowing, not guessing, that the school is affordable. NPCs rarely give you that level of certainty.

Divorced / Separated / Two-Household Families

This is where calculators really break down.

Most NPCs assume a simple, single-household situation. For split households, especially when both parents have meaningful financial factors:

- NPCs often can’t accurately capture both households

- Schools may refuse to do a pre-read and just point families back to the NPC

- We’ve seen families make decisions based on a $0 estimated institutional grant… only to later receive an actual award with $30,000+ in institutional aid — or the opposite

When the difference between “this is affordable” and “this will wreck us” is tens of thousands of dollars, using a flawed calculator isn’t just unhelpful.

It’s dangerous.

Sibling Discounts at Institutional Methodology (IM) Schools

Here’s another major blind spot that families never get warned about:

Most Institutional Methodology schools do NOT include the sibling discount in the results displayed in their Net Price Calculators.

This is a huge problem because:

- At IM schools, having two (or more) children in college at the same time can drastically reduce the calculated parent contribution.

- That reduction can translate to tens of thousands of dollars in additional institutional aid—but the typical NPC won’t show it.

- Families with multiple college-bound kids often see artificially high net prices and walk away from schools that may, in reality, end up being far more affordable.

- Worse, some families assume the NPC “must be accurate,” make ED or application decisions based on inflated net prices, and miss opportunities entirely.

If you have or will soon have more than one student in college, relying on an NPC without the sibling discount applied isn’t just misleading—it can completely distort your planning and lead to major financial and strategic missteps.

Why Colleges Aren’t in a Hurry to Fix Net Price Calculators

Let’s be direct about incentives:

An uninformed consumer is a profitable consumer.

Colleges — even the “nonprofits” — are businesses. Confusion around cost works in their favor:

- If families overestimate aid, they’re more likely to apply, visit, and fall in love.

- If families underestimate the complexity, they’re more likely to borrow heavily later.

- A messy, opaque system makes it hard to compare schools apples to apples.

It’s a lot like the insurance industry: most people have no idea what the difference really is between two policies. Complexity keeps consumers from switching or negotiating.

Net Price Calculators create the appearance of transparency without any real accountability.

It’s like if used car dealers got to write their own Kelley Blue Book values — and no one ever checked their numbers.

So when you ask, “Are college net price calculators accurate?” remember: they weren’t built primarily to serve you. They were built to satisfy a regulation.

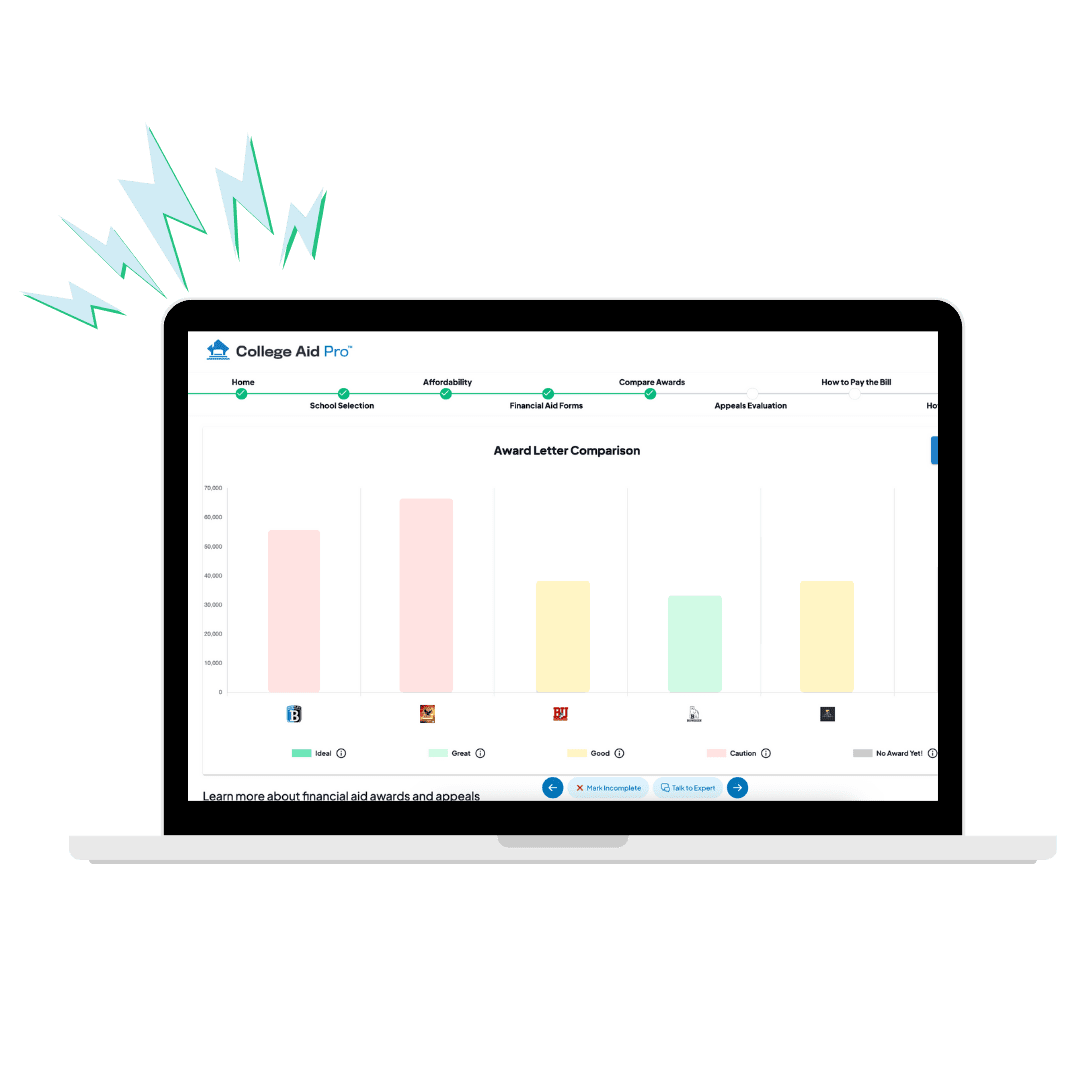

A Better Way: MyCAP = Real Transparency

This is exactly why College Aid Pro exists.

We were tired of watching families make six-figure decisions based on half-baked calculators. So we built MyCAP to do what NPCs were supposed to do in the first place — but with real accuracy and transparency. Oh, and the data entry only has to be done one time.

With MyCAP, families can:

- See real-time cost projections for every school on their list

- Get both merit and need-based aid estimates using the most current data

- Compare schools side by side with consistent assumptions

- Properly model divorced/separated/two-household scenarios

- View year 1 and all 4 years of costs and projected debt

- Compare net costs to their actual budget and see the student loan impact per college

And we’re not the only ones who think this matters.

Platforms like Niche are partnering with College Aid Pro because they know that honest, accurate price information leads to better outcomes for students — even if it makes some colleges uncomfortable.

Colleges should be a little scared of us. We give families the tools to ask, “Is this cost really worth it?” — and the data to push back when something doesn’t add up.

What You Should Do Next

Before you trust another college Net Price Calculator:

- Check the fine print

- Find the aid year and data year. If you can’t, assume it’s outdated.

- Treat NPCs as a starting point, not a final answer

- They’re guesses, not guarantees. Especially if it’s the federal template.

- Cross-check with MyCAP

- Use MyCAP (or MyCAP through Niche) to get updated, apples-to-apples comparisons across your full college list.

- Be extra cautious with Early Decision and split households

- Do not rely solely on an NPC to decide if ED is affordable.

- Talk about cost early

- The admissions timeline was designed by colleges, for colleges. Getting real cost info early shifts the power back to you.

The Bottom Line: Are College Net Price Calculators Accurate?

Short answer: not accurate enough to trust with major decisions.

Don’t take a college’s Net Price Calculator at face value. The system wasn’t built to keep you fully informed; it was built to check a compliance box.

At College Aid Pro, our mission is to flip that script.

We combine verified data, smart technology, and real human expertise so families can:

- See the true cost of college

- Compare schools fairly

- Avoid unnecessary debt

- Make decisions they’ll still feel good about four years from now

So before you believe that “estimated cost” on a college website, remember:

- 📅 Outdated data = inaccurate results

- 💸 Inaccurate results = expensive mistakes

- ✅ Use MyCAP (or MyCAP through Niche) to get the real numbers

Colleges may not love that.

But your future self — and your bank account — definitely will.

Click Here to Download our Report on Which Colleges’ have out-dated NPC’s and which schools estimates you can trust!