How to Reduce College Debt and Save Thousands with MyCAP

TL;DR: If your goal is to dramatically reduce college debt, MyCAP makes it doable. Stop guessing and start planning: build a smarter school list, see the real price before you apply, grab scholarships that fit, submit cleaner aid forms to lower your Student Aid Index (SAI), compare and appeal offers, and map a 4-year plan so loans are last—not first.

For millions of families, the primary goal of the college search is simple: figuring out how to reduce college debt without sacrificing a great education. Debt usually creeps in when families make common mistakes:

- Choosing colleges without knowing their true net price.

- Failing to create a ‘college budget’ that defines what you can actually afford.

- Only looking at the first-year costs instead of the four-year total net cost.

- Missing out on merit and need-based money that actually fits their profile.

- Guessing on FAFSA/CSS Profile and inflating their Student Aid Index (SAI).

- Accepting the first offer without requesting an appeal.

MyCAP tackles each step with data, not drama, giving you a clear path to reduce college debt before you even apply.

Meet MyCAP (Your Co-Pilot to Reduce College Debt – or Eliminate It!)

MyCAP is an all-in-one college planning platform that replaces financial guesswork with a proven game plan to lower your borrowing. It includes tools to:

- Forecast personalized true net price by school.

- Displays college-specific & private scholarships you can actually win.

- Understand your Student Aid Index (SAI) before ever submitting the FAFSA/CSS Profile.

- Compare award letters apples-to-apples.

- Appeal for more money with the right proof.

- Build a 4-year pay plan so loans stay tiny—or disappear.

Price: $4.99/month, cancel anytime. Because reducing college debt shouldn’t cost a fortune. Click here to enroll.

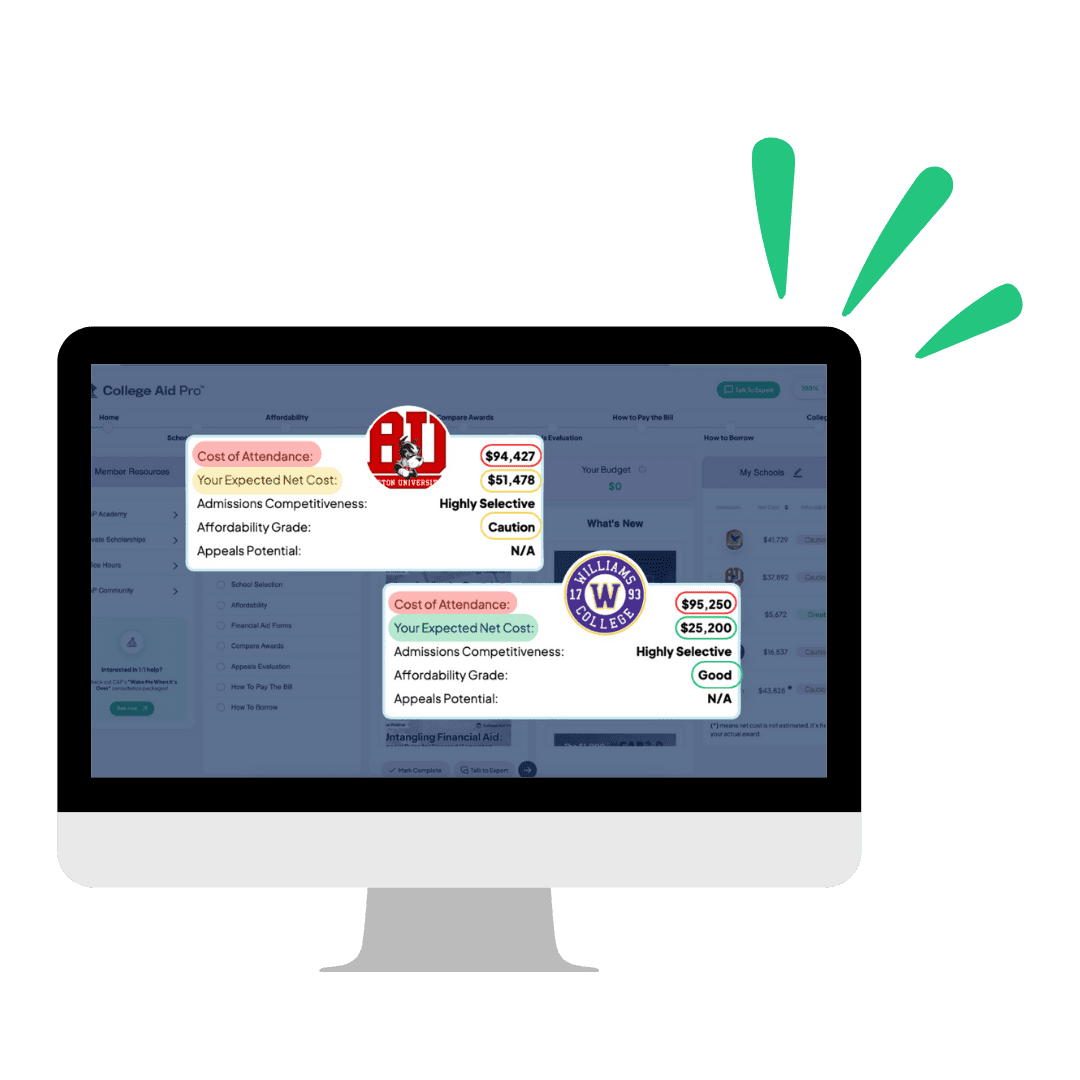

1) See the Real Price First (Not After You Fall in Love)

MyCAP estimates each college’s net price—tuition minus grants, scholarships, and discounts—then models scenarios for GPA/test scores, residency, and deadlines.

How to Reduce College Debt: You only target schools where your student is wanted (and funded), preventing you from applying to schools that are unaffordable.

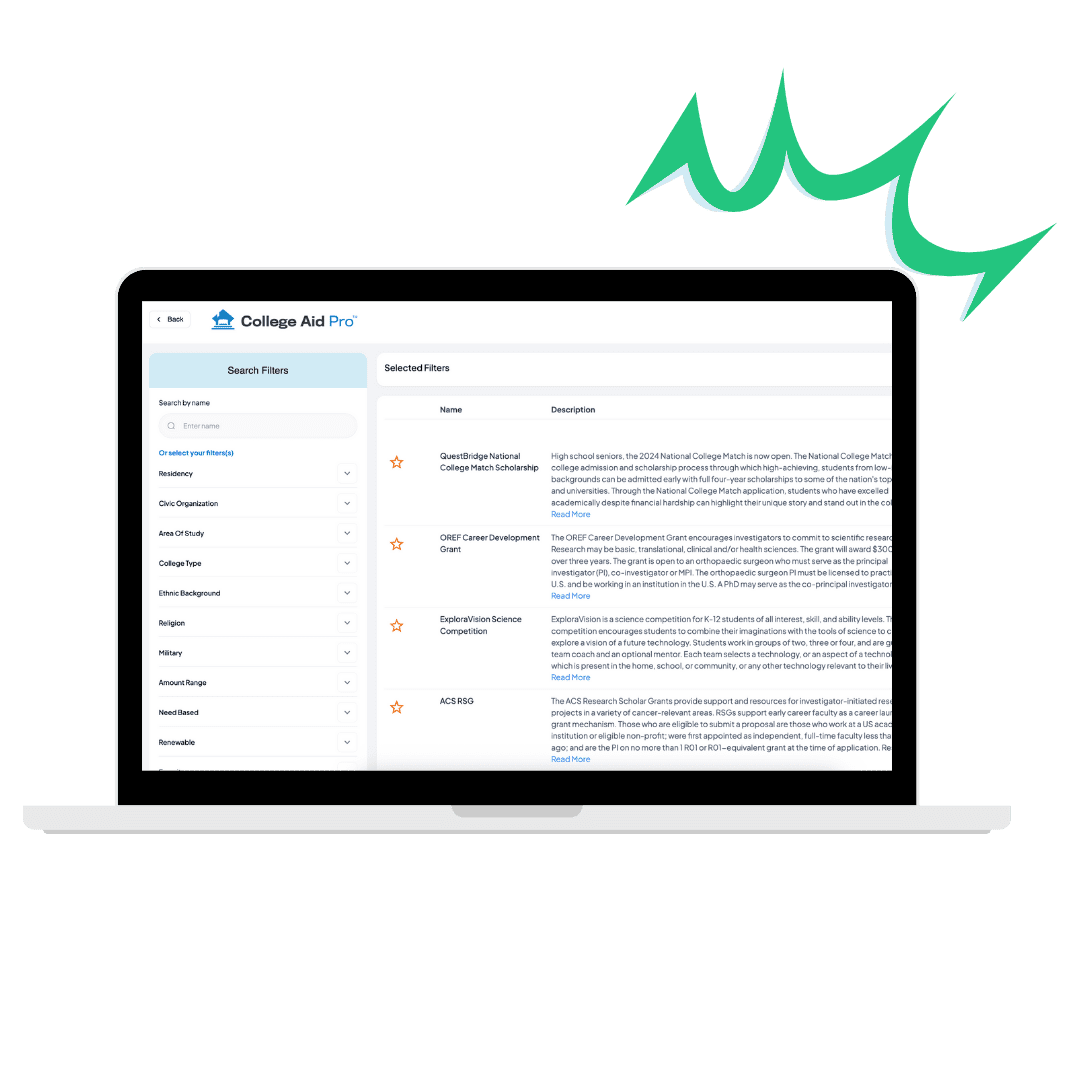

2) Find Scholarships You’ll Actually Win

Every school. Every scholarship. One place. Filter by major, interests, GPA/test profile, and deadlines—then track requirements and progress.

How to Reduce College Debt: Small wins stack into thousands, directly reducing your need for loans.

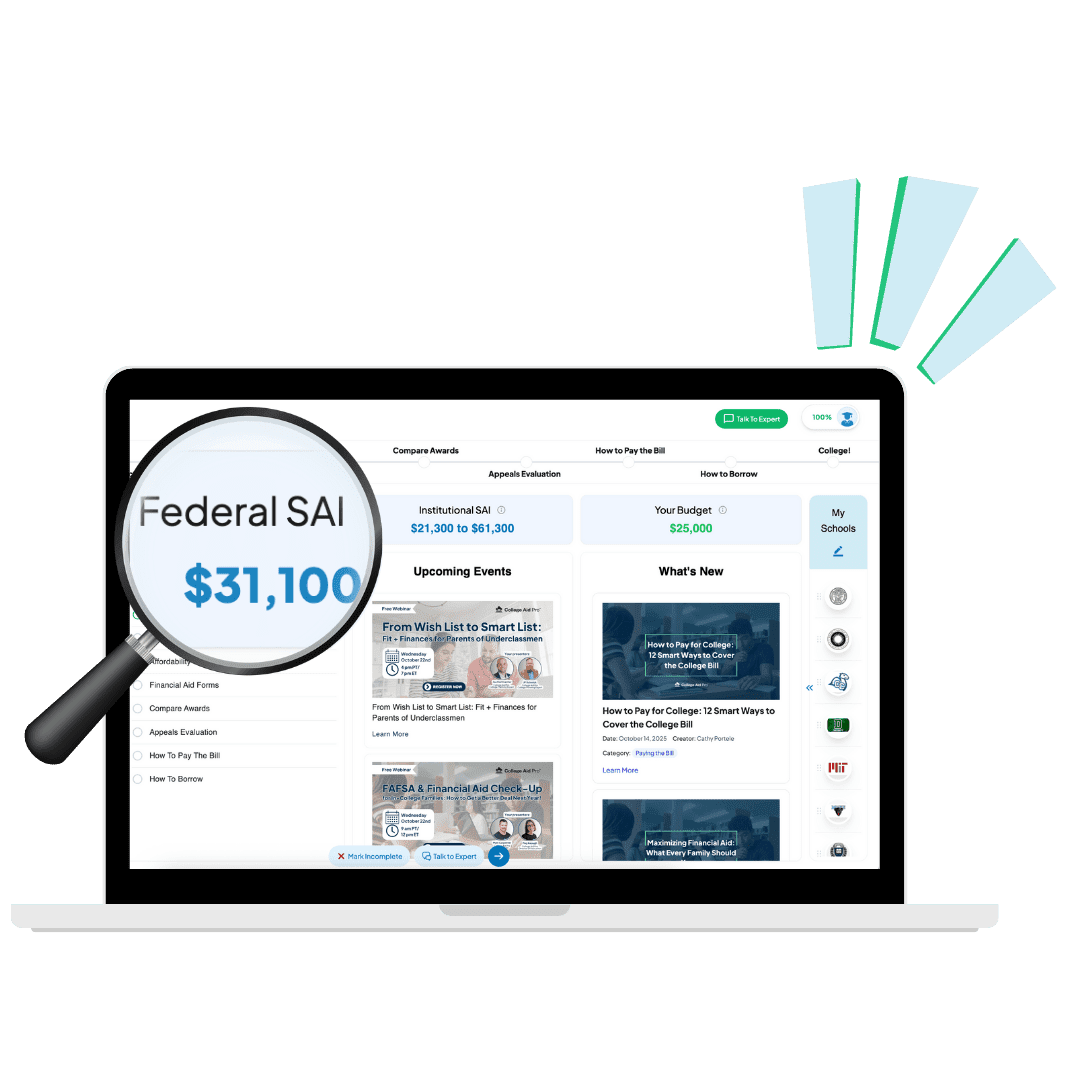

3) Control Your Student Aid Index (SAI) the Right Way

Preview your SAI before you ever hit “Submit.” MyCAP calculates your Student Aid Index up front using the same inputs the FAFSA relies on—income, assets, household size, number in college, and more—so you can see how each field moves the needle before you file. It’s the smartest way to “practice the FAFSA,” catch mistakes early, and confirm every data input is accurate.

How to Reduce College Debt: A smaller Student Aid Index (SAI) means more need-based aid and, critically, fewer loans required.

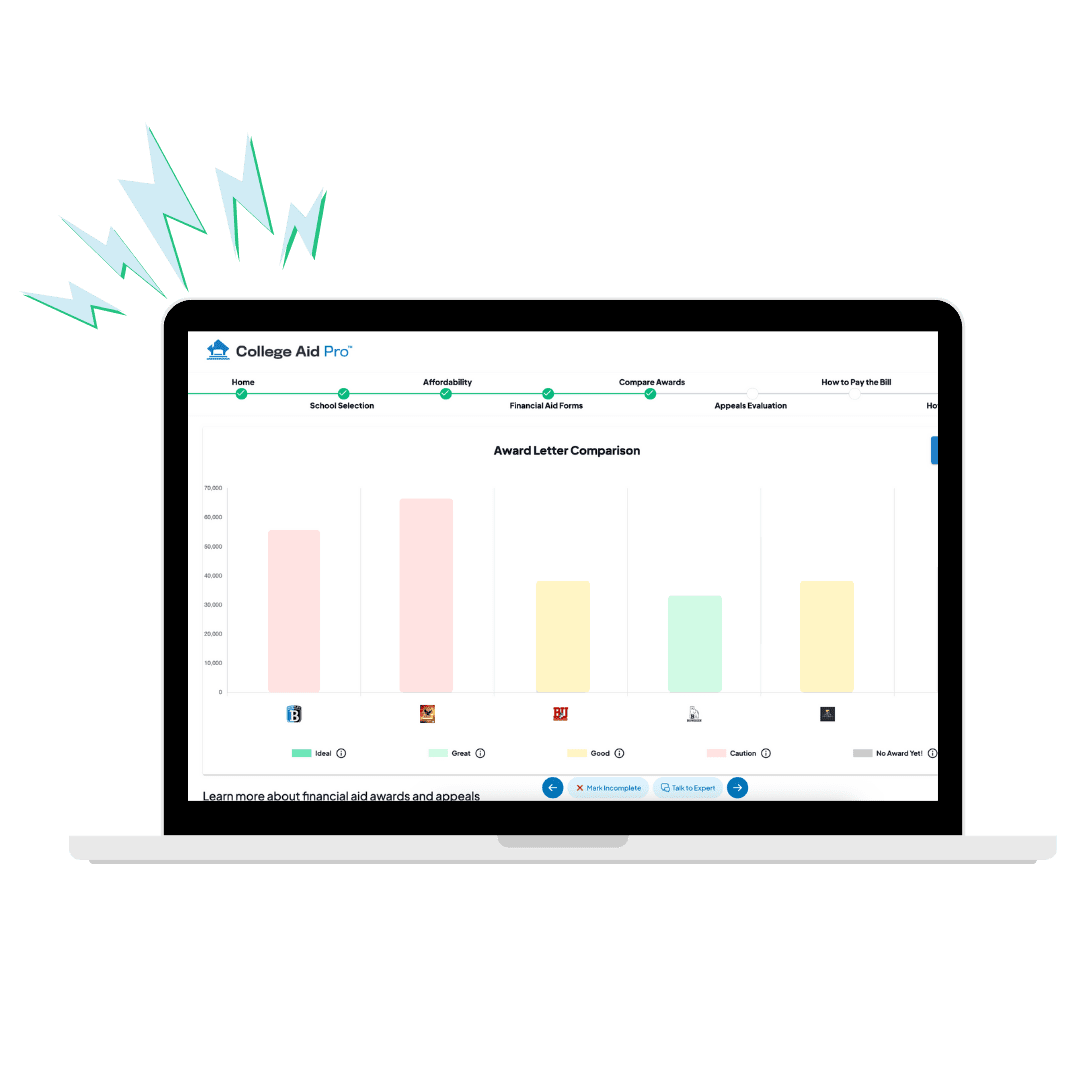

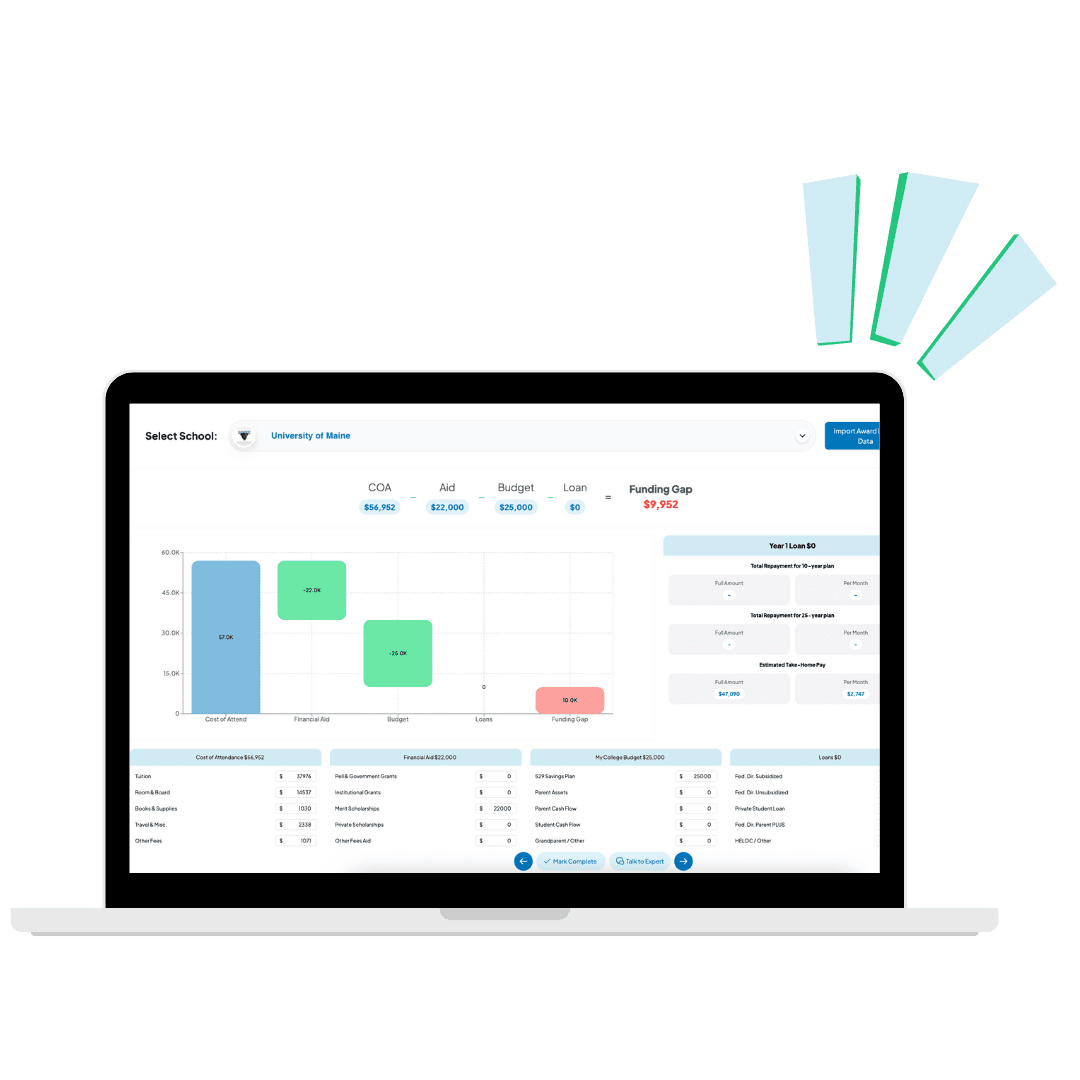

4) Compare Offers Like a Pro

This tool standardizes confusing award letters, projects the 4-year cost (including tuition hikes), and shows the exact gap you need to close.

How to Reduce College Debt: You pick true value, not just a mascot, ensuring you borrow the least amount possible.

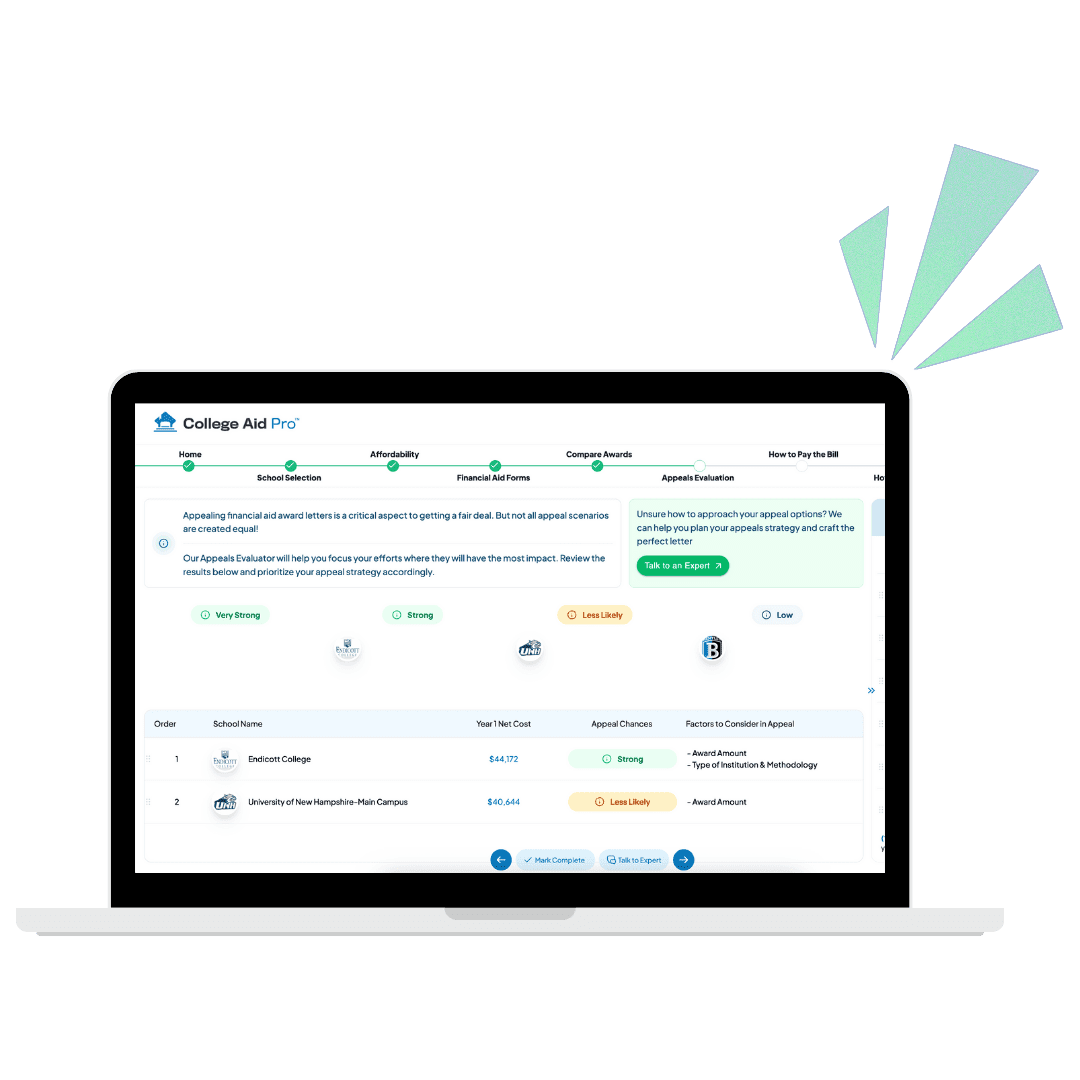

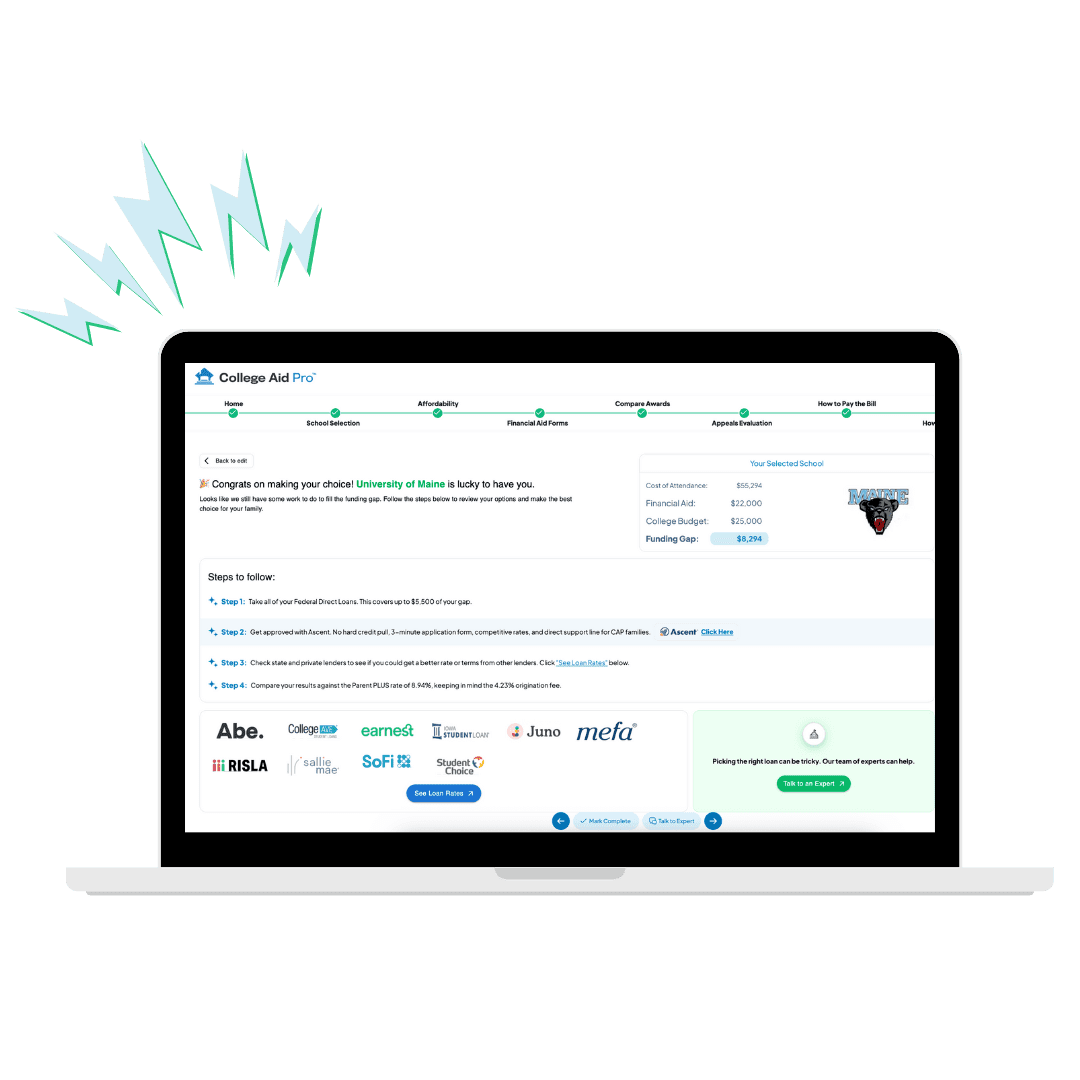

5) Ask for More (Appeal) —Confidently

Upload your financial aid awards and gain insights into whether you got a good deal or not. Instant feedback from MyCAP’s Award Analyzer lets you know if you can and should submit a merit and/or need-based appeal.

How to Reduce College Debt: Extra $2k–$10k/year in aid isn’t rare when you know the right way to ask.

6) Plan How to Pay Across Eight Semesters

Blend cash flow, 529s, outside scholarships, and work-study; then spread payments by term so August doesn’t feel like a boss fight.

How to Reduce College Debt: Planning beats panic and helps you avoid oversizing loans out of urgency.

7) If You Must Borrow, Borrow Smart (and Less)

Follow a “loans-last” sequence (federal first), model monthly payments and lifetime interest, and see savings from autopay and shorter terms.

How to Reduce College Debt: Right-sized loans today means fewer “what were we thinking?” moments later.

Ready to Finally Reduce College Debt?

MyCAP Premium includes bi-weekly office hours and member workshops with College Aid Pro experts. Bring your situation; leave with a plan.

Quick Start:

- Create your MyCAP account (2 minutes).

- Add your student and run an affordability forecast.

- Pin 6–8 target schools that match both academics and budget.

Ready to reduce college debt with a clear, numbers-first plan? Start MyCAP for $4.99/month.

FAQs (Short, Sweet, and Helpful)

Q1: Can MyCAP actually help us reduce college debt to zero? Sometimes—especially if you create a college budget first, then search for colleges that fit within that number. Also, with merit-friendly schools or strong financial-need profiles, you can search colleges that will give you the most aid. At minimum, our goal is to shrink loans to a level you can crush quickly.

Q2: Is MyCAP just another scholarship list? Nope. Scholarships are one piece. You’ll also model net price, optimize SAI, compare and appeal offers, and build a 4-year payment plan—all focused on college debt reduction.

Q3: Do we still need the FAFSA (and maybe CSS Profile)? Yes. MyCAP helps you practice and prepare for them correctly with line by line guides—while avoiding mistakes that inflate SAI.

Q4: What if our student is “average”? Great—“average” students get money too. Aim for schools where your student is above average and merit is generous.

Q5: We already got offers. Are we too late to reduce college debt? Not at all. Import award letters, compare, and use the Award Analyzer and check your appeal recommendations. Many families find more aid post-offer.