Paying the College Bill in 2025: A Guide to Smart Borrowing

Navigating the costs of college is no small feat, especially with rising interest rates and the abundance of loan options on the market. For families gearing up to pay the bill in 2025, making confident and informed borrowing decisions is essential.

Here’s your go-to toolkit for understanding your options, finding the best student loans, and ensuring you make the smartest financial move for your student’s education.

Understanding the Current Loan Landscape

As of 2025, Federal Parent PLUS Loans come with a nearly 9% interest rate and a 4% origination fee—a costly option for many families.

If you or your cosigner have good credit, private student loans may offer a significantly better deal, with interest rates starting under 5% and no fees. But navigating these options can feel overwhelming.

That’s where our step-by-step guide comes in.

Step-By-Step Guide to Choosing the Best Student Loan in 2025

We always recommend starting with theFederal Direct Student Loan (FDSL)for students. After that, it’s time to compare private lenders and PLUS loans to see which makes the most financial sense for your family. Consider starting your comparison with these top private lenders.

Step-By-Step Guide to Choosing the Best Student Loan in 2025:

Step 1: Apply through College Ave to get your rate.

- Apply in 3 Minutes

- Soft Credit Pull

- Reputation for rewarding high FICO scores

Step 2: Apply through Sofi Student Loans to get your rate.

- Apply in minutes

- Soft Credit Pull

- Reputation for rewarding high FICO scores

Step 3: Check Your Rate with Ascent Student Loans

- Soft Credit Pull

- Apply in Minutes

- Updated Lowering Pricing/Rates as of July 1, 2025.

- Co-signer Release after 12 months

- Dedicated College Aid Pro Support Line

- 📧 Email: capsupport@ascentfunding.com

- ☎️ Phone: 877.685.5780

Step 4: Compare your private rates to Federal PLUS & State Programs (Massachusetts , Rhode Island, Iowa)

Even with competitive private rates, it’s important to compare your final offers to federal and state-specific loans. State options in Massachusetts, Rhode Island, and Iowa offer additional choices to residents of any state.

Parent PLUS Loan rates have are just under 9% for all borrowers, plus a 4% origination fee. For some, private loans will be a better option. Follow these steps above and you’ll get a view of the loan rates and terms available to your family so you make an informed, thoughtful borrowing decision.

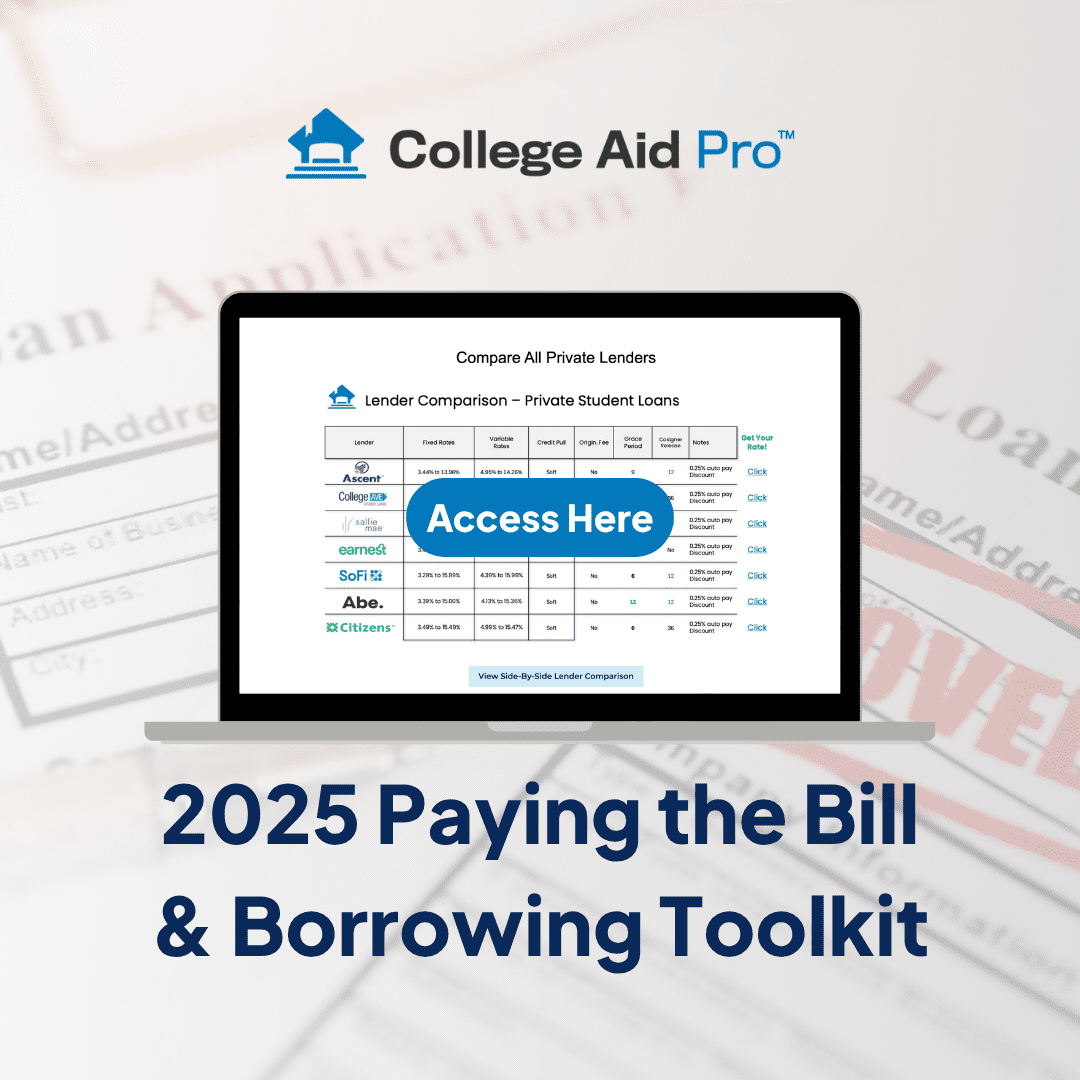

Private Lender Quick Comparison

| Lender | Fixed Rates | Fees | Cosigner Release | Grace Period | Auto-Pay Discount |

| Ascent | 3.44% – 13.96% | No Fees | After 12 On-Time Payments | 9 Months | 0.50% |

| SoFi | 3.29% – 15.99% | No Fees | After 12 On-Time Payments | 6 Months | 0.25% + 0.125% (multi-student) |

| Abe | 3.39% – 15.00% | No Fees | After 12 On-Time Payments | 12 Months | Not specified |

👉 Compare All Private Lenders Side-by-Side

Want Help from an Expert? Try the Paying the Bill Package

For families who want expert guidance, our Paying the Bill Package provides everything you need to make smart borrowing decisions with confidence.

What’s Included For$499:

- Review of financial aid forms, award letters, and final bills

- Guidance on 529 usage, savings strategy, and loan recommendations

- A curated list of 1,500 private scholarships and low-interest loans

- Insight into key legal and insurance topics for college-bound families

📄 You’ll Need:

- FAFSA/CSS Profile Summary

- Award Letters and/or Final Bill

🎓 Sign Up & Schedule Your Meeting

Other Resources for Students and Parents

Paying for college doesn’t have to be overwhelming. With the right tools, guidance, and expert support, you can cover the costs with clarity and confidence—without overborrowing.

Let us help you take the first step toward smarter student loan decisions in 2025.