What We Know, What We Predict, and How You Can Stay in Control

Families across the country are feeling uneasy about the latest news regarding the Department of Education (DOE). With headlines swirling about its possible shutdown, it’s easy to feel powerless. But here’s the truth: you’re not powerless in this process.

At College Aid Pro, we believe in controlling what you can and not stressing over what you can’t. Let’s break down what’s happening, what it could mean for families, and what steps you can take to stay ahead.

The Higher Ed Watch Series

This is the first installment in our Higher Ed Watch Series, where we’ll break down ongoing changes in higher education policy and how they impact families. As new developments emerge, we’ll continue updating you with clear, actionable guidance to help you stay in control of your college planning journey.

What We Know

On January 31, 2025, a bill (H.R. 899) was reintroduced to Congress that proposes the termination of the DOE by December 31, 2026.

- This is not a new initiative for the Republican party; efforts to eliminate or scale back the DOE have been around since its creation under President Jimmy Carter in 1979.

- The goal is to shift control from the federal government to state and local authorities.

- Federal student aid programs (FAFSA, student loans, and forgiveness programs) may be reassigned to other agencies, such as the Department of Treasury.

- Some programs (parent loans) may shift entirely to the private sector

- Congress must approve the bill, so no immediate changes are guaranteed—but shifts in DOE operations are already happening.

We’re already seeing some movement within the department, and we anticipate more.

What We Predict & What You Can Control

Prediction #1: Delays in Student Loan Disbursements

Some DOE personnel have already been placed on leave. If this continues, it could slow down student loan disbursements, causing delays in getting funds to colleges and students.

✅ What You Can Do:

- Don’t panic. We’ve seen similar delays before (hello, FAFSA 2024!), and while frustrating, the money eventually comes through.

- Take action now. Complete your FAFSA, sign your Master Promissory Note, and finish entrance counseling.

- Colleges should be sweating this out—not you. Institutions rely on federal dollars, and they will push for solutions.

Prediction #2: Delays in Student Loan Forgiveness Processing

Similar to administering student loans, there is a human element to approving and processing student loan forgiveness. Even when students (or parents) qualify for forgiveness, they must take the appropriate steps to apply and wait for approval. In most cases, payments are required until the loan has been officially forgiven. Delays in processing could result in unnecessary payments for these borrowers.

✅ What You Can Do:

- When applying for forgiveness, request a payment pause until your application is processed.

- Stay on top of deadlines and required documentation.

Prediction #3: Potential Changes to Parent PLUS Loans

There’s a possibility that the federal Parent PLUS loan program could be altered or eliminated. While this loan isn’t ideal for all families, it serves two key functions:

- For some parent borrowers this is the best or only option available to them.

- It holds the private student loan marketplace in check.

Although the PLUS loan has a high interest rate (~9%), it serves as an anchor for private sector loans. Without this benchmark, private lenders could increase rates significantly—especially if they collude with one another (not that they ever would, right?). This loan also serves as a ‘last resort’ option for many families that are denied from other lenders.

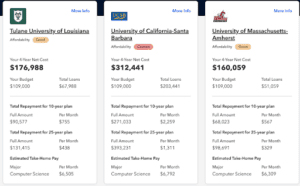

Here is an overview of the rate ranges from last year:

✅ What You Can Do:

- Understand all borrowing options. Some private lenders offer better rates than PLUS loans, particularly for those with strong credit.

- Research state-based loan programs. States like MA, RI, and IA offer loan options to all students, regardless of residency.

- Improve your credit score. Your borrowing options and interest rates depend heavily on your credit profile.

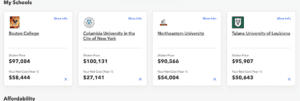

- Run the numbers now. Before committing to a college, use MyCAP to see what you’ll actually pay and compare borrowing options so you have clear visibility into the future. Knowledge is power and this is an easy way to increase your knowledge and understanding on all aspects of your financial options for college:

MyCAP shows your 4-year net cost, total loan amounts to cover the cost, along with total loan repayment amounts based on a 10-year and 25-year loan repayment. We show you how much MORE you end up paying. See the figures now (and show them to your kids). It matters!

Prediction #4: Less Oversight on Title IV Regulations (Potential Impact on Student Support Services)

Almost every college in the country receives federal funding and relies on it to remain in business. To qualify for these funds, colleges must adhere to Title IV guidelines. With reduced DOE oversight, some institutions may not fully participate in certain Title IV requirements, particularly those aimed at student support and financial transparency.

Students with Disabilities (Section 504)

All colleges are required to have personnel and policies in place to support students with disabilities. However, if enforcement weakens, some schools may scale back their support systems. Will colleges continue prioritizing disability services if there’s no financial incentive? That’s a big question mark.

✅ What You Can Do:

- Ask direct questions about disability services at each college:

- How many full-time staff work in the Disability Services Office?

- What is the administrator to student ratio?

- Can someone meet with you to discuss your needs and accommodation requests?

- What accommodations are available?

- Is there a dedicated office or community for students with disabilities?

- What scholarships or job placement programs exist for students with disabilities?

- Is there a community for students with disabilities on campus? Can you meet with any of them?

- Does the school have relationships with specific employers for students with disabilities?

- Prioritize colleges that are already strong in these areas. Don’t assume services will remain the same—verify them.

Prediction #5: Net Price Calculators Could Become Less Reliable

Since October 29, 2011, colleges have been required to post a Net Price Calculator (NPC) on their website in order to qualify for Title IV funds. A school’s Net Price Calculator (NPC) is designed to give current and prospective families an estimate of their expected cost for one year of college, based on their unique financial situation.

While the intention was to improve transparency, the reality has been hit or miss. Many NPCs are outdated, misleading, or flat-out inaccurate. If oversight weakens further, we fear that more schools will let their NPCs become even less reliable—or remove them altogether.

✅ What You Can Do:

- Don’t rely solely on college NPCs. Many are inaccurate or incomplete.

Use the most accurate cost comparison tool available: Create a free MyCAP account to see real, personalized cost estimates and compare colleges.

MyCAP runs accurate net price calculators and shows you all the results in one place so you can compare apples to apples.

Prediction #6: Federal Pell Grants and Direct Student Loans Are Unlikely to Change

I sure hope we get this one right. There has been no mention of reducing or eliminating Pell Grants and Direct Student Loans as of today. These programs are the backbone of college affordability, and there has been no indication that they will be reduced or eliminated.

✅ What You Can Do:

- Ignore the doomsday headlines.

- Stay informed and focus on what’s within your control.

Why We Remain Optimistic

While uncertainty can be unsettling, we see this as an opportunity for families to take more control of their college planning. The DOE’s current structure is far from perfect—there is room for improvement. However, it is important to fully understand the downstream impact of decisions before moving forward with sweeping changes.

The proposed shakeup to the DOE probably comes with the best of intentions, but we anticipate significant negative consequences. The most troubling? The impact will likely hit the families and students who need the most help—those with disabilities, limited resources, and little support.

So, why do we remain optimistic? Because we still have agency, and we are still in control of our own destiny.

Maybe this will be the push that so many Americans need to take ownership of their college journey. For years, families have blamed colleges, Wall Street, and the federal government for making college an expensive, overwhelming, and opaque venture. And while they’re not wrong, we also need to recognize the power we hold as consumers.

We choose to apply to these colleges. We choose to attend these colleges. We choose to pay for these colleges and assume the subsequent debt.

It’s time to shift our mindset. Let’s embrace these challenges and take full accountability for our journey and outcome. Get educated. Start today. There is an affordable path to college, and we—and many others—are here to help you find it.

We’ll continue to monitor changes and break them down for you in our Higher Ed Watch Series.

👉 Need clarity on your college costs? Create a free MyCAP account and start making informed decisions today.