Stop Leaving Cash on the Table: Your Guide to Free Money for College (It’s Easier Than You Think!)

Let’s be real: college is expensive. But guess what? A huge chunk of the bill is often covered by free money for college that you never have to pay back! We call this “gift aid,” and it comes in two main flavors: grants (based on need) and scholarships (based on merit). Think of them as surprise cash drops. Ready to grab your share?

Below, we’re breaking down how grants and scholarships work, how to keep the funds flowing, and the simple steps to maximize every dollar before you even look at a loan.

The Two Paths to Free Money for College

Both options reduce your out-of-pocket cost and don’t require repayment. Huzzah!

1. Grants: Need-Based Aid

This is your primary source of need-based aid. Think of grants as a direct subsidy—they’re awarded because your family needs financial help based on the info you submit on the FAFSA (and sometimes the CSS Profile).

Where Grants Come From:

- Federal: The big ones like the Pell Grant

- State: Programs specific to your state of residence.

- Institutional: Money from the college’s own budget or endowment.

Key Things to Know:

- It’s an Annual Check-Up: Your financial need is recalculated every year—it’s not a lifetime guarantee. If your family strikes it rich (hello, lottery win!) or gets a big raise, your grant money might shrink. If life throws a curveball (job loss, major medical bills), your aid could increase.

- Time is Money: Some programs (especially state and campus-based funds) are first-come, first-served. File the FAFSA and CSS Profile early to get in line.

2. Scholarships: Merit-Based Aid

This is the ultimate “atta-boy/girl” money. Scholarships reward you for being awesome at something—academics, athletics, music, or just being a dedicated volunteer.

Types of Scholarships:

- Academic Merit: For your stellar GPA, course rigor, and test scores.

- Talent-Based: For music, art, theater, eSports, or athletics.

- Private: Money from foundations, employers, or local nonprofits.

Key Things to Know:

- The Renewal Clause: Most merit awards are guaranteed for four years, provided you meet renewal criteria (like maintaining a certain GPA). Read this fine print carefully!

- The Stacking Game: This is where you need to be a detective. Some schools let you “stack” a private scholarship right on top of your institutional aid. Others might use it to replace their institutional grants—called displacement. Always ask your financial aid office!

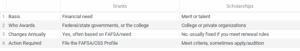

Grants vs. Scholarships: Quick Comparison

How to Become a Free Money for College Magnet (Your Action Plan)

- Don’t Sleep on the FAFSA: File it ASAP every single year! Even if you think you’re “too rich” for need-based aid, many schools and states require it just to be considered for merit scholarships. Don’t leave free money on the table over paperwork.

- Complete the CSS Profile: If your colleges require it, complete this, too. It unlocks institutional grants at many private schools.

- Be a Big Fish in a Smaller Pond: Want the biggest merit scholarships? Apply to colleges where your GPA and scores put you in the top 25% of accepted students. That’s where they hand out the giant awards.

- Treat Private Scholarships Like a Side Hustle: Seriously. Dedicate 1–2 hours a week to applications. Start with local and niche scholarships—fewer applicants means better odds!

- Read Your Award Letter (Like, Really Read It): Confirm which dollars are need-based (can change yearly) versus merit (more stable). If it’s unclear, ask the financial aid office to clarify the rules on stacking and displacement.

- Appeal When Life Changes: New hardships or got a better offer from a competitor school? Contact the aid office and ask about a professional judgment review or a financial aid appeal.

FAQs: Free Money for College

Q: Is all financial aid “free money”? A: Nope! Only grants and scholarships are free money. Loans must be repaid; work-study is earned through a job.

Q: Can I get both grants and scholarships? A: Absolutely. Most students receive a mix. Just be sure to check each school’s stacking and displacement policy to avoid surprises.

Q: Do I need to file the FAFSA if I only want merit aid? A: Often, yes. Many colleges and some states require the FAFSA for any type of institutional funding, including merit consideration.

Your Next Step (and Best Shortcut)

Want a personalized estimate of grants and scholarships at the colleges on your list—before you apply? Create a free MyCAP account to compare awards side-by-side, find merit-friendly schools, and track private scholarships. If you prefer guidance, join our bi-weekly office hours or book time with a CAP expert.