Your Complete Pell Grant Guide: Are You Eligible?

In today’s world, the cost of college continues to rise. Many families can’t pay out of pocket for a college degree. That’s where financial aid comes in. The Pell Grant is a crucial part of this aid, making it possible for lots of students to afford college. In this complete guide, we’ll break down everything you need to know about the Pell Grant, from the basics and who qualifies to the recent changes due to the FAFSA Simplification Act. By the end of this, you’ll have the knowledge to navigate and understand the world of Pell Grants with confidence.

What is the Pell Grant?

The Pell Grant is a cornerstone of federal financial aid that aims to make higher education more accessible for financially disadvantaged undergraduate students. Think of it as a helping hand from the government to make college more affordable for your child. It is a need-based grant, meaning eligibility is determined primarily by a student’s financial need, which is calculated through the Free Application for Federal Student Aid (FAFSA). The Pell Grant does not need to be repaid.

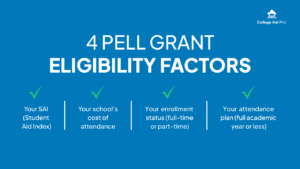

The amount awarded through the Pell Grant can fluctuate from year to year and hinges on several factors. These include the Student Aid Index (SAI), formerly known as the Expected Family Contribution (EFC), the cost of attendance at the student’s chosen institution, and whether the student intends to attend full-time or part-time. The grant’s primary objective is to provide financial support to individuals who might otherwise find college expenses insurmountable.

Pell Grant Eligibility

Beginning with the 2024-2025 aid year, the Pell Grant amount a student can be eligible to receive is no longer determined by the SAI and Pell Charts.

Maximum Pell Grant Eligibility

- Eligibility for the Maximum amount of Pell is determined by a student’s adjusted gross income, tax filing status, and the annual U.S poverty level guidelines for family size and state of residence.

- SAI is -1500 to 0

Student Aid Index (SAI) Calculated Pell Grant Eligibility

- For students who do not qualify for Maximum Pell, they may be eligible to receive a Pell amount calculated by their SAI.

- Maximum Pell Amount – SAI = Calculated Pell Grant Amount rounded to the nearest $5.

Minimum Pell Grant Eligibility

- Students who do not qualify for the Maximum Pell or Calculated Pell may be still be eligible to receive the Minimum Pell Grant based on adjusted gross income, tax filing status, and the annual U.S poverty level guidelines for family size and state of residence.

Not eligible for Pell Grant

- Students whose calculated SAI is greater than the Maximum Pell Award OR the calculated Pell amount is less than the Minimum Pell Award will not qualify for the Pell grant.

Families making less than 175% and single parents making less than 225% of the federal poverty level will see their students receive a maximum Federal Pell Grant award. Minimum Pell Grants will be guaranteed to students from households below 275%, 325%, 350%, or 400% of the poverty level, depending on household structure. Pell awards between the maximum and minimum amounts will be determined by SAI.

Here are a few more eligibility factors:

- Enrollment Status: You must be enrolled or accepted for enrollment as an undergraduate student in an eligible degree or certificate program.

- Citizenship Status: You must be a U.S. citizen, U.S. national, or an eligible non-citizen with a valid Social Security number.

- Degree Pursuit: Pell Grants are generally awarded to students seeking their first bachelor’s degree. However, in some cases, students pursuing post-baccalaureate teacher certification may also be eligible.

- Satisfactory Academic Progress: You must maintain satisfactory academic progress, as defined by your institution, to remain eligible for the Pell Grant.

- Default Status: Being in default on a federal student loan, owing a refund on a federal grant, or exceeding the lifetime Pell Grant limit will disqualify you from eligibility.

Meeting these criteria does not guarantee that you will receive a Pell Grant, as the grant’s amount depends on factors such as federal funding and the number of eligible applicants.

Pell Grant Updates and Limits Based on the FAFSA Simplification Act

The FAFSA Simplification Act, which brought about significant changes in the financial aid application process, has implications for Pell Grants. Here are some noteworthy updates and limits under this act:

- Simplified FAFSA: The act streamlines the FAFSA, making it easier to complete and understand. This simplification will hopefully encourage more students to apply for financial aid, potentially increasing the number of Pell Grant recipients.

- Expansion of Income Eligibility: The act increases the income limit for automatic zero SAI/EFC, allowing more families with moderate incomes to qualify for the maximum Pell Grant award.

Eligibility for federal student aid will also be expanded by removing the questions related to Selective Service registration and drug conviction status, and restoring access to Pell Grants for incarcerated students under specific programs.

- Increased Grant Amounts: While the act does not directly dictate Pell Grant amounts, by simplifying the FAFSA process and expanding eligibility, it indirectly supports the goal of increasing the maximum Pell Grant amount, making higher education more affordable.

- Access to Data Retrieval Tool: The act requires the use of the IRS Data Retrieval Tool within the FAFSA, ensuring that applicants can easily and accurately input their financial information.

- Streamlined Dependency Status: Dependency status determination has been simplified, making it easier for students to understand their eligibility status.

Adjustments to the new Student Aid Index (SAI) calculation and eligibility formulas are estimated to increase the number of Pell Grant recipients by nearly 15%.

Potential Pell Grant Dollar Amounts

The exact dollar amount you may receive through a Pell Grant depends on various factors, including your financial need, the cost of attendance at your chosen institution, and your enrollment status (full-time or part-time). However, it’s essential to understand the maximum and minimum amounts possible:

- Maximum Pell Grant Amount: The Maximum Pell Grant award for the 2025-26 aid year is $7,395. This amount remains unchanged from last year, but it is reevaluated each year based on federal appropriations and other factors, and can change.

- Minimum Pell Grant Amount: Pell Grants can be as low as a few hundred dollars per year, depending on your SAI/EFC and other factors. Some students may receive small grants to help cover educational expenses.

- Proration for Part-Time Students: If you’re enrolled part-time, your Pell Grant amount will be prorated based on your credit hours. Part-time students receive a reduced grant compared to full-time students.

The Pell Grant is a lifeline for many students who want to go to college, especially with tuition costs going up. Understanding how the Pell Grant works and how much money you might receive, can really make a big difference in your education.

With recent changes that make it easier to apply for financial aid, now is a good time to check if you qualify, and get the help you need to make your academic dreams come true. Whether you’re going for a bachelor’s degree or aiming for post-baccalaureate teacher certification, remember that the Pell Grant can be a valuable help on your way to success.

Are You Pell Grant Eligible?

The first step in determining your Pell Grant eligibility is learning what your SAI is. Your SAI is calculated through your FAFSA. If you haven’t submitted your FAFSA yet and you are a rising college freshman, or already in college make sure you get this submitted! The FAFSA opens on October 1 for the following school year. If you aren’t eligible to submit a FAFSA yet – you are a freshman, sophomore, or junior in high school, or you are a senior and it is before October 1 you can calculate your estimated SAI here using MyCAP – our college planning search engine and net price calculator all in one tool!