FAFSA Test Drive in MyCAP: Student Aid Index Calculator, See College Cost Estimates, Maximize Financial Aid

FAFSA Test Drive in MyCAP: Student Aid Index Calculator, See College Cost Estimates, Maximize Financial Aid

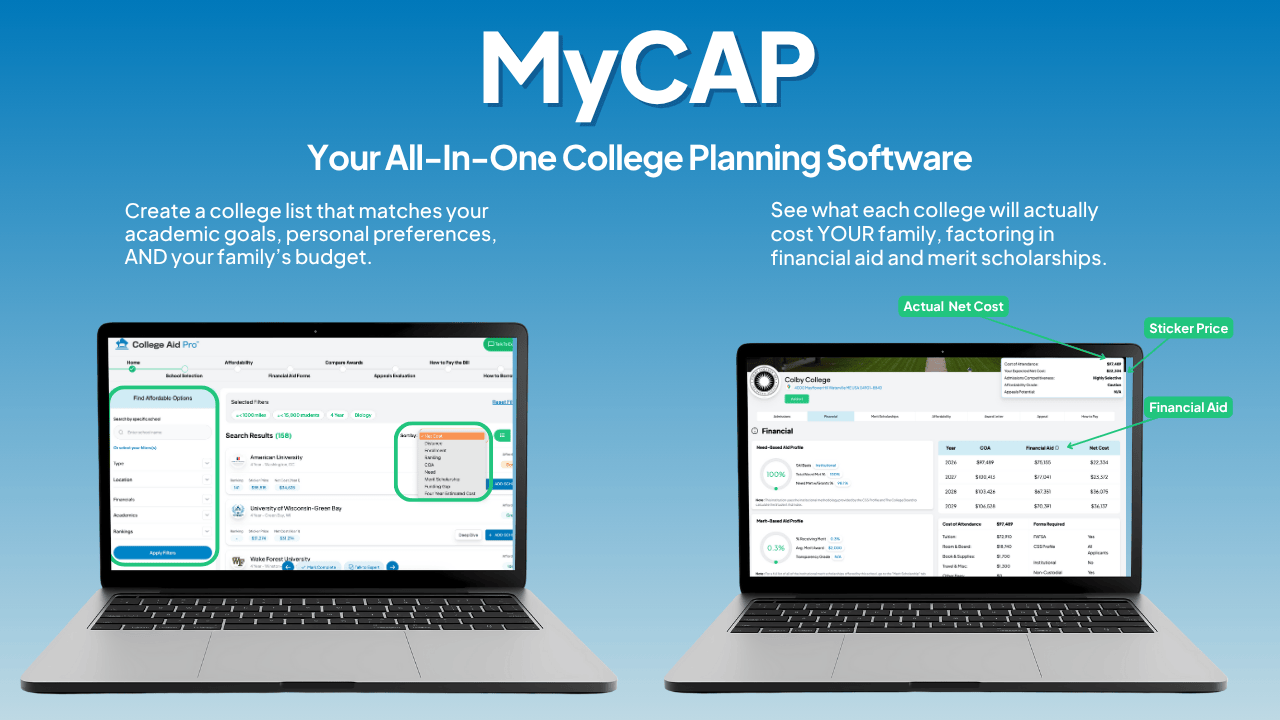

If the FAFSA feels like the financial-aid version of parallel parking during your road test…you’re not alone. The better move? Don’t go in cold. College Aid Pro’s MyCAP is the perfect practice run before you submit the FAFSA (and the CSS Profile, if required). With MyCAP, you can preview your Student Aid Index (SAI), estimate what schools will actually cost for year one and all four years, and see the grants and scholarships you’re likely to receive—before you press submit.

Upgrade to MyCAP Premium and you also get access to real experts: live office hours for FAFSA/CSS Profile questions and line-by-line walkthroughs of both forms. Translation: fewer surprises, fewer mistakes, and a much calmer “submit” moment.

Let’s pop the hood.

Why a FAFSA “test drive” beats driving blind

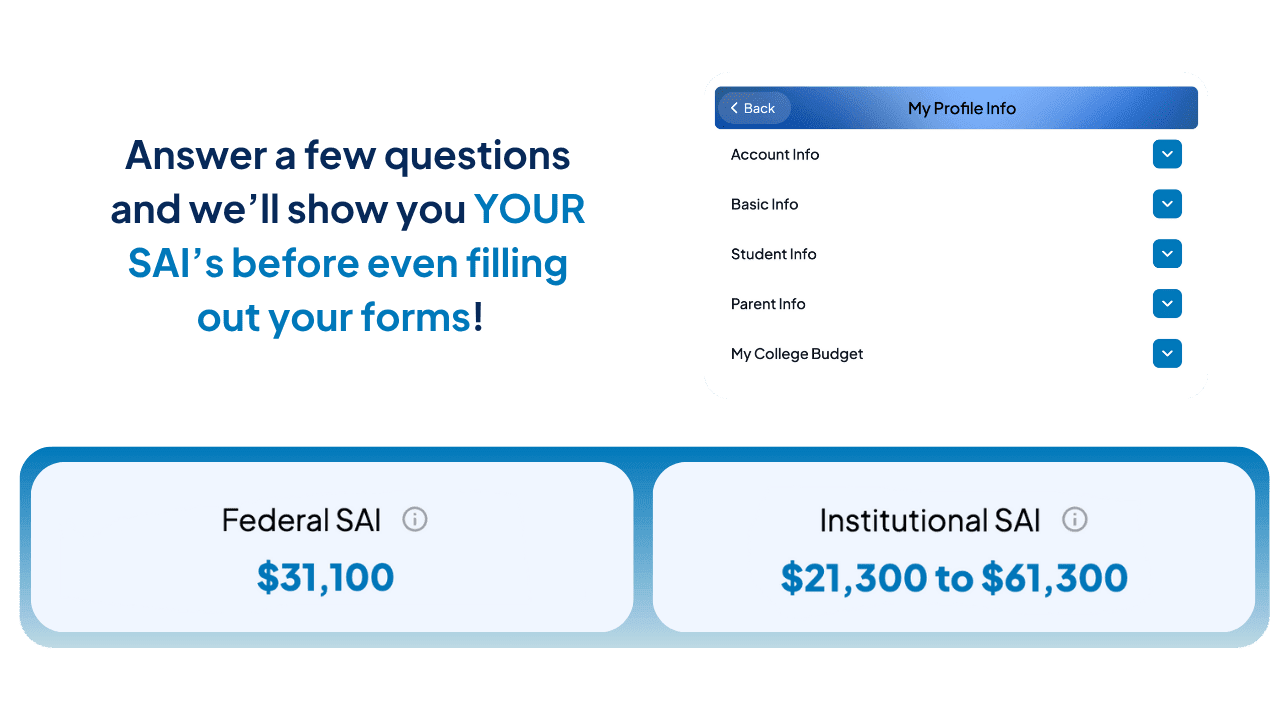

Most families don’t see their Student Aid Index (SAI) until after they finish the FAFSA. This is the number used by colleges to determine your family’s eligibility for need-based financial aid. That’s like learning your car’s price after you sign the papers. MyCAP flips the script:

- Enter your household details (income, assets, number of students in college, etc.).

- Instantly see your Student Aid Index (SAI)—the number colleges use to evaluate need-based aid.

- Research each school on your list to project your net price—what you’re likely to pay after typical grants and scholarships—for the first year and across four years.

- Run what-ifs (e.g., “What if our second child starts college in two years?” “How does using a 529 change things?”).

This proactive preview helps you build a balanced college list, budget with confidence, and avoid the “aid whiplash” that can hit in the spring.

MyCAP Premium: your personal pit crew

Software is powerful. Software plus experts is unbeatable. MyCAP Premium Members get:

- Bi-weekly office hours with FAFSA/CSS Profile pros. Bring your specifics and get clear, practical answers.

- Line-by-line walkthroughs of the FAFSA and the CSS Profile so you know what each question is asking—and how to answer accurately.

- Member workshops that keep you updated on rule changes and best practices.

Think of Premium as guardrails. You’re driving; we keep you off the rumble strip.

See your Student Aid Index (SAI) first—then predict aid and scholarships

Knowing your Student Aid Index (SAI) is step one to estimating need-based aid. MyCAP pairs your SAI with each school’s historical generosity to forecast likely grants and scholarships—both need-based and merit (where applicable). You’ll see:

- Estimated need-based grants based on your SAI and a school’s typical awards.

- Potential merit scholarships for a student with your academic profile.

- A four-year projection that factors in tuition growth and family changes (like another sibling starting college).

This turns guesswork into planning—and helps you have smart, reality-based conversations now, not last-minute scrambles later.

Practice makes (almost) perfect: common mistakes to catch early

Even careful families stumble on FAFSA or CSS Profile. Here are frequent gotchas—and how a MyCAP “test drive” helps you avoid them:

1) Mixing up parent vs. student assets and income

The issue: Mislabeling assets or income can inflate your SAI.

How MyCAP helps: Practice assigning items correctly and see the impact instantly; confirm questions during Premium office hours.

2) Misreporting 529 plan ownership

The issue: Treating a grandparent-owned 529 as a parent asset, or overlooking a sibling’s beneficiary status.

How MyCAP helps: Model different ownership scenarios and review the correct treatment in the walkthroughs.

3) Missing business or rental details

The issue: Over- or underreporting business equity, depreciation, or rental income.

How MyCAP helps: Organize the numbers the way the forms expect; bring edge cases to office hours for clarity.

4) Forgetting untaxed income categories

The issue: Skipping items like certain retirement contributions or disability benefits that must be reported.

How MyCAP helps: Data entry prompts reduce omissions; Premium videos show exactly where these items belong.

5) Using wrong-year tax data or transposed numbers

The issue: Pulling from the wrong return or flipping digits.

How MyCAP helps: The tool nudges you to the right year and shows how small changes alter SAI—helping you file cleanly.

6) Miscounting household size or number in college

The issue: Including/excluding the wrong people can materially shift your SAI.

How MyCAP helps: Toggle assumptions, see the difference immediately, and get confident about who “counts.”

7) Misunderstanding asset timing

The issue: Not realizing balances are snapshots and timing (e.g., paying bills before submission) can matter.

How MyCAP helps: Experiment with timing scenarios to understand impacts, then follow best practices while staying fully compliant.

From “we’ll see” to “we’ve planned”: the proactive advantage

Proactive families:

- Start in MyCAP to preview SAI and projected aid.

- Finalize a school list with financial fit in mind.

- Use Premium office hours for complex situations (divorced/separated households, self-employment, unique assets).

- Complete forms using the line-by-line walkthroughs for fewer errors and less chance of verification delays.

- Submit early and clean—so decisions and offers arrive without drama.

Result: better outcomes, fewer do-overs, and more time celebrating acceptances instead of correcting forms.

Your FAFSA/CSS Profile rehearsal plan (quick start)

- Create a free MyCAP account and add your student.

- Enter household financials (income, assets, 529 details, special circumstances).

- Preview your Student Aid Index (SAI) and note any surprises or questions.

- Build or import your college list inside MyCAP.

- Review net price projections for year one and for four years at each school.

- Tweak variables (merit ranges, sibling in college, savings strategy) to see how aid and net price respond.

- Upgrade to MyCAP Premium if you want expert backup:

- Join office hours with your specific questions.

- Watch line-by-line FAFSA/CSS Profile walkthroughs.

- Complete and submit your FAFSA/CSS Profile with confidence.

Quick hits (for the parents who skim)

- What is SAI (Student Aid Index)? The number colleges use to determine need-based aid. MyCAP shows it before you file.

- Can I estimate my financial aid? Yes. MyCAP forecasts grants and scholarships per school for one year and all four.

- How do I avoid FAFSA mistakes? Practice in MyCAP, then use Premium office hours and line-by-line videos to file cleanly.

- Does this include CSS Profile? MyCAP supports planning for CSS Profile schools, and Premium includes line-by-line guidance.

Final lap: submit with confidence

You wouldn’t drive a new route in a snowstorm without checking the map. Don’t file the FAFSA or CSS Profile without a dry run either. MyCAP lets you practice, preview your Student Aid Index (SAI), project real costs, and strategize—while MyCAP Premium gives you direct access to experts and crystal-clear walkthroughs to reduce errors.

Take your FAFSA test drive today. Your future self (and your budget) will thank you. Don’t guess—go Premium.