Scholarships & Financial Aid 101: The Debt-Free College Blueprint

When most parents think about paying for college, one word comes to mind: overwhelming. The price tags are intimidating, the jargon is confusing, and the fear of student debt—lasting for decades—can feel crushing.

But here’s the good news: there is a smarter way to approach the college money equation. By understanding college financial aid and scholarships, you can help your student graduate with less debt, or even none at all.

That’s why we created our resource, Scholarships & Financial Aid 101: The Debt-Free College Blueprint. This free guide gives parents a step-by-step plan to make college affordable, without gambling on hacks or hoping for miracles.

What You’ll Learn: A Smarter Way to Pay for College

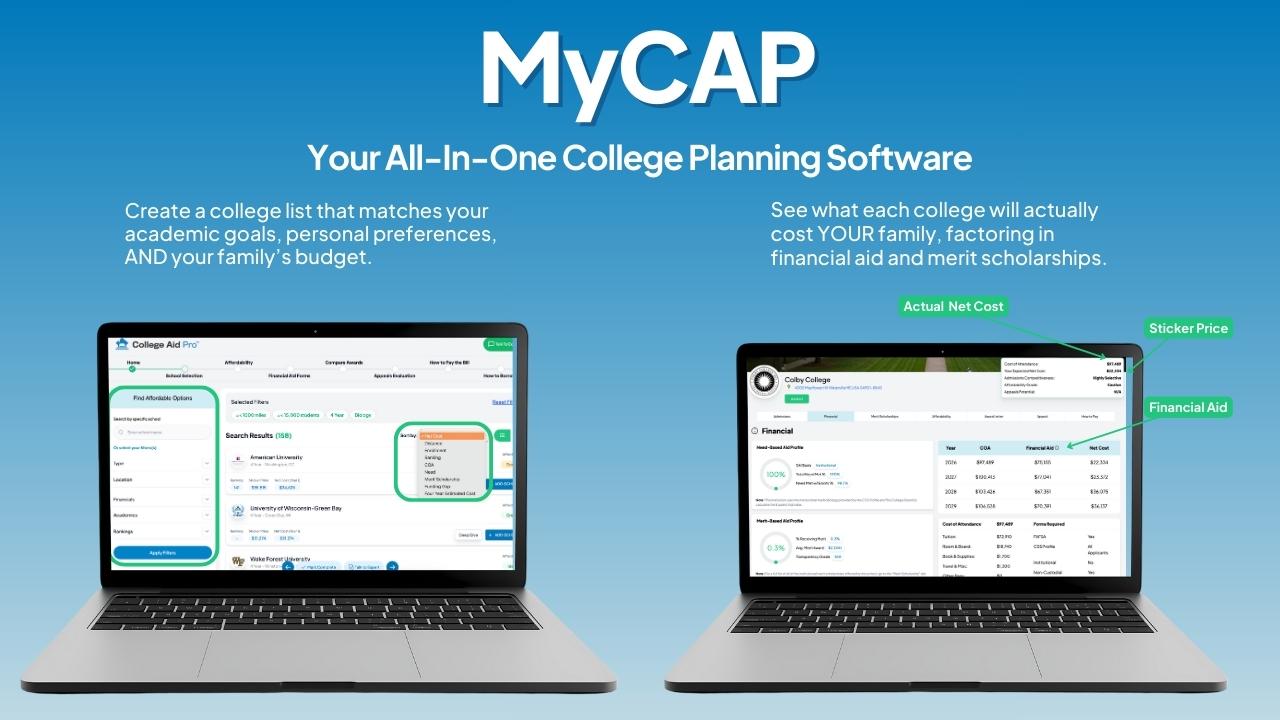

This guide provides a comprehensive plan to help your family navigate the complex world of college scholarships, financial aid, and paying the bill. Here’s a peek at what’s included:

The Number That Matters Most: Your Student Aid Index (SAI)

The Student Aid Index (SAI) is a crucial number that replaced the old Expected Family Contribution (EFC). This index is a key part of how colleges determine how much financial aid you’re eligible for. The Blueprint will teach you how the SAI is calculated and what it means for your family’s aid package. Understanding this number is the first step to unlocking more aid.

Two Paths to Financial Success: Need-Based vs. Merit Scholarships

Not every family fits into the same box. That’s why we outline two distinct blueprints for financial aid: one for families in the need-based aid lane and one for those focused on merit scholarships. We’ll show you how to maximize your results no matter which path you’re on, from grants and institutional aid to a variety of private scholarships.

The Merit Scholarship Blueprint

This section of the guide shows you why being at the top of a college’s academic profile can mean thousands in guaranteed scholarships. We’ll explain how your student can become a top candidate and attract significant financial awards, simply by applying to the right schools.

College is a major investment. Approach it like an investor, and you’ll make smarter decisions.

A high price tag doesn’t always equal a good investment. Many families make the mistake of choosing a “beautifully expensive” college without considering the net price vs. ROI. Our guide will help you compare these factors so your student doesn’t graduate with debt that delays their future. This is a critical step in making a smart long-term decision.

Your 4-Step College Budget Plan

Building a clear budget is essential to making college affordable. We provide a clear framework to set limits, shop for schools strategically, and make a confident decision. This plan takes the guesswork out of the process, giving you the control to build a clear path to paying less for college.

Get Your Free Copy of the Debt-Free College Blueprint

Don’t let the fear of student debt hold your family back. The sooner you have a plan, the more options you’ll have. This guide will help you:

- Cut through the financial aid jargon.

- Avoid costly mistakes.

- Build a clear path to paying less for college.

Download your free copy of Scholarships & Financial Aid 101: The Debt-Free College Blueprint today and start your journey toward a debt-free college experience.

Understanding the ins and outs of financial aid and scholarships is more crucial than ever in today’s landscape of rising tuition costs. The “Debt-Free College Blueprint” provides a strategic roadmap, moving beyond the traditional, often stressful approach to college funding. It emphasizes proactive planning and informed decision-making, which are key to avoiding the burden of student loan debt. The guide’s focus on key concepts like the Student Aid Index (SAI) and the distinction between need-based and merit-based aid empowers families to navigate the financial aid system with confidence. By demystifying the process, it helps parents and students identify and secure the most beneficial financial packages available.

The path to affordable college education starts with researching schools for financial aid and scholarship opportunities, not just academic programs. The Blueprint promotes a smart shopper mentality, emphasizing the net price—cost after grants and scholarships—over the sticker price. This approach ensures the college choice is both academically and financially sound. By following these principles, families can make paying for college manageable and secure a brighter future for students without incurring significant debt.