Grad PLUS Phase Out: How CAP × Juno Helps You Borrow (and Repay) Smarter

The Grad PLUS phase out is reshaping how graduate and professional students pay for school. Federal borrowing caps are tightening, repayment plans are changing, and the stakes for smart planning just jumped. That’s why College Aid Pro (CAP) and Juno teamed up—to give you clarity, negotiating power, and real options from Day 1 through repayment.

Why We’re Announcing CAP × Juno Now

The Grad PLUS phase out removes the nearly uncapped federal loan many grad students relied on. As new annual and lifetime borrowing caps roll in, students and families will face built-in funding gaps. On top of that, repayment plans are consolidating, changing how monthly payments and interest work over time.

CAP × Juno combines:

- CAP’s Graduate Borrowing Guidance

Plain-English breakdown of federal vs. private loans, what capped federal limits really mean, and the program-specific trade-offs for MBA, law, medical, and other professional degrees. - Juno’s group-powered marketplace (negotiated graduate loan and refinance offers that may include lower rates and potential perks).

Together, we help you avoid over-borrowing, fill gaps strategically, and repay smarter.

Grad PLUS Phase Out, Explained (in Plain English)

What’s changing?

- Grad PLUS ends for new borrowing.

- Federal borrowing caps tighten for graduate programs (MBA, JD, MD, etc.).

- Repayment plans consolidate—fewer, simpler paths, but different math than today.

Why it matters

High-cost programs may no longer be coverable by federal loans alone. You’ll need a plan that preserves federal protections where they help and uses competitive private options only for the precise gap.

Your Graduate School Game Plan

Join our group to unlock smarter grad loan options.

- Lower-than-direct rates: Exclusive discounts you won’t get going straight to a lender

- Cash-back perks: Earn money back as part of your loan

- No-cosigner paths: Options that don’t require a cosigner or current income

- Rate-match assurance: If you find lower, we’ll match it

- No gotchas: No hidden fees, no prepayment penalties, flexible deferment options

👉 Join the negotiation group today!

How Juno Uses Collective Bargaining to Save Families Money

Founded in Harvard’s Innovation Lab in 2018, Juno is a community-first organization with a mission to lower the financial burden of higher education. By harnessing the voices of our 200,000+ members, we’re able to force lenders to give our group a better deal.

Rate Match Program

If you find a lower elsewhere, let us know! We have a rate match program that gives you a cash back bonus.

Free 1:1 with our Experts

Our US based team of experts is happy to speak on the phone about all your options.

No Cost and No Commitment

All of our offerings are free and come with no commitment.

Lower Rates and/or Cash Back

Loans are historically ~1.5% lower than going directly through a lender, and some options have a cash back bonus.

Click here to get started on your journey.

Already Graduated? Repayment & Refinancing Under the New Rules

The Grad PLUS phase out doesn’t just affect in-school borrowing—it changes the trajectory of repayment for new cohorts, too. If you’re already in repayment:

- Keep federal benefits if you’ll need PSLF or an income-based plan.

- Refinance private loans (or federal loans you’re certain don’t need protections) if a new APR clearly lowers total cost or fits your cash flow better.

- Use Juno to compare negotiated refinance offers.

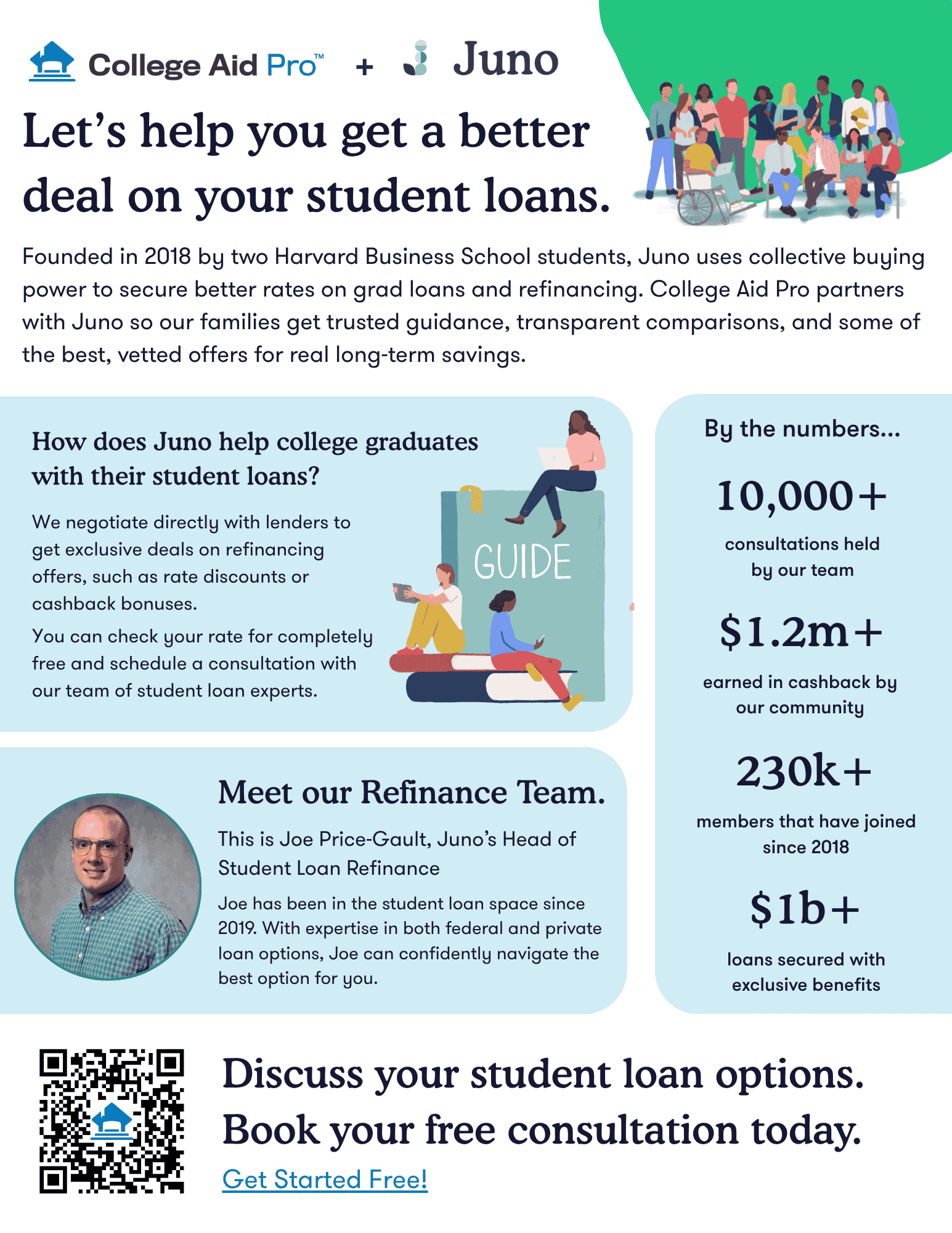

How does Juno help college graduates with their student loans?

We negotiate directly with lenders to get exclusive deals on refinancing offers, such as rate discounts or cash back bonuses.

You can check your rate completely free and schedule a consultation with our team of student loan experts.

FAQs About the Grad PLUS Phase Out

What exactly is the Grad PLUS phase out?

It’s the end of new Grad PLUS borrowing and a shift to lower federal caps for graduate students. You’ll likely need to plan a funding mix earlier and more precisely.

Will I still have income-based repayment options?

Yes, but the menu is consolidating. The math (payments, interest handling, timelines) will look different than today’s setup. Strategy matters.

Is there a “best time” to refinance?

There’s a best time for you—when your profile is strong and the new APR beats your current total-cost math. Revisit periodically.

Bottom line: The Grad PLUS phase out doesn’t have to derail your plans. With CAP × Juno, you’ll borrow less where you can, cover only what you must, and repay with a strategy—so your degree fuels your future, not your debt.