Top 3 Case Studies for How High Income Families Can Still Get Need-Based Aid

For many families, filling out the FAFSA and CSS Profile feels like an exercise in futility. “If our income is too high, why bother?” is one of the most common questions we hear at College Aid Pro.

But here’s the truth: even high-income, high-SAI families can still qualify for meaningful need-based aid — if they understand how colleges calculate financial need and how to present their information strategically.

In this article, drawn from a recent College Aid Pro webinar, we’ll walk through real case studies of high-income families who still received tens of thousands of dollars in financial aid, plus the FAFSA and CSS Profile tactics that made it happen.

Understanding SAI: Why High Income Doesn’t Always Mean No Aid

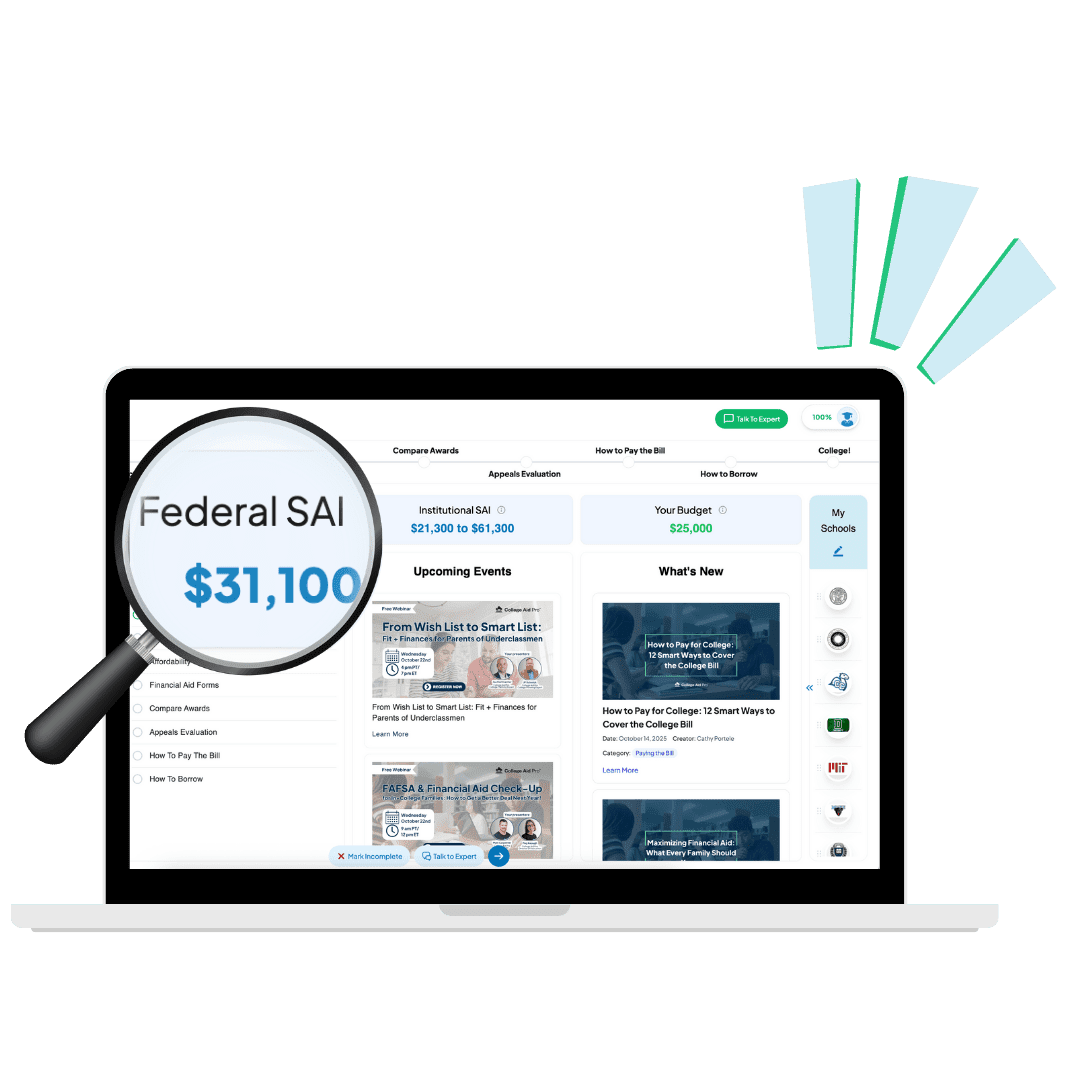

Your Student Aid Index (SAI) — formerly known as the Expected Family Contribution (EFC) — is the number colleges use to determine your eligibility for need-based aid.

A high SAI usually means a lower chance of qualifying for federal need-based aid, but colleges each have their own formulas. Many schools also use the CSS Profile, which allows them to dig deeper into your family’s finances — but also gives you more levers to pull.

There’s no simple cutoff for income or assets.

We’ve helped families earning $600,000 to over $1 million qualify for need-based aid at top schools. The key is knowing how to interpret, and legally minimize, the assets and income that colleges consider “available” to pay for tuition.

Case Study #1: The Million-Dollar Business Owner Who Got Need-Based Aid at Tufts

One College Aid Pro family earned more than $1 million in adjusted gross income — two commas on their tax return. On paper, you’d think they had no shot at need-based aid.

But here’s what happened:

- The family’s high income came from a business with significant year-to-year fluctuation.

- We helped them present that variability clearly on their CSS Profile and in a subsequent financial aid appeal, emphasizing that the prior year was an unusually strong one.

- We guided them on how to frame business equity and taxable income properly — not inflated as liquid assets.

✅ Result: Tufts University awarded them a meaningful need-based grant, saving tens of thousands of dollars over four years.

The takeaway? It’s not just what you earn — it’s how your financial story is presented.

Case Study #2: The $600,000 Family With Three Kids in College

Another family earned over $600,000 annually and held a few hundred thousand in assets and home equity. On paper, it looked like a textbook “no-aid” case.

But they had three kids in college at the same time — a game changer.

Here’s how it worked:

- The FAFSA and CSS Profile formulas divide your SAI by the number of children enrolled in college.

- The family’s effective SAI per student dropped dramatically, making them eligible for institutional aid.

- They also benefited from CSS Profile schools that count private K–12 tuition for younger children as an allowable expense.

✅ Result: They received $20,000+ in annual need-based aid from schools like Holy Cross and Boston University.

Even high-earning families can qualify when multiple tuition bills hit at once.

Strategic FAFSA & CSS Profile Tips for High-SAI Families

Here are some of the same strategies our experts — including former financial aid directors from Harvard, MIT, and Boston College — use to help families position themselves for maximum aid.

1. Always File for Financial Aid — Even If You Think You Won’t Qualify

Skipping the FAFSA or CSS Profile freshman year can disqualify you for future years.

Most colleges won’t let you appeal or reapply later if you didn’t file originally.

Even for merit aid or appeals, schools usually ask: “Do we have your FAFSA on file?”

Pro tip: Filing doesn’t obligate you to take loans — it just keeps every door open.

2. Be Smart About Assets

- Don’t include retirement accounts (401(k), 403(b), pensions, etc.) on the FAFSA. They’re excluded by law.

- List 529 plans correctly: they’re parent assets, not student assets.

- Home equity in your primary residence does not go on the FAFSA, though CSS Profile schools may count it. If so, report a reasonable, defendable value and show as much mortgage debt as possible.

- Small business owners: put $0 for business value unless you have over 100 employees.

Each of these steps can significantly lower your reported asset base — and your SAI.

3. Use the CSS Profile Strategically

The CSS Profile digs deeper than FAFSA, and how you answer matters.

- When asked, “How much can your parents pay?” — keep the number low. Colleges can and do use your answer against you.

- Skip the “Special Circumstances” section — save those details for a well-timed appeal once you’ve received your aid offer.

- For divorced or separated families, the FAFSA requires only one parent’s info (the one providing the most support). But the CSS Profile often requires both — unless you’re applying to schools like Vanderbilt, UChicago, or Santa Clara, which waive the non-custodial parent form.

Case Study #3: The Barnard Appeal That Saved a Six-Figure Bill

A family initially declined to apply for aid because a grandparent had planned to cover tuition. When that changed at the last minute, the family faced a $100,000 bill from Barnard College — and no aid on the table.

Through a well-crafted appeal letter and documentation of the change in circumstance, our team helped them reopen their aid file and secure institutional support.

✅ Result: A successful appeal and thousands in recovered aid — proof that persistence (and proper process) matters.

Why Professional Guidance Pays Off

Even the most financially savvy parents can overlook the nuances of college aid formulas. That’s why our “Wake Me When It’s Over” families work one-on-one with experts like Ryan Callahan (former Director of Financial Aid at Harvard Medical School and MIT) and Josh DiMaio (current Director of Financial Aid at MIT Sloan).

They don’t just fill out forms — they know how each college “does business” and how to leverage that for the best outcome.

“How you complete your FAFSA and CSS Profile dictates the size of your discounts,” our team explains. “It’s not about guessing — it’s about strategy.”

On average, College Aid Pro families save thousands per year — even those with high incomes or complex financial pictures.

Final Thoughts

If you’ve ever thought, “We make too much to qualify,” it’s time to rethink that assumption. The FAFSA and CSS Profile are tools — and when used strategically, they can unlock opportunities for aid that families at every income level can benefit from.

Your SAI may be high, but with the right guidance and presentation, you can still get a great deal.

Ready to see how much you could save?

👉 Next Step: Create your free MyCAP account to see how much you could save.

Ready for expert-level strategy and access to biweekly member workshops on topics just like this one?

Upgrade to MyCAP Premium — and get all the bells and whistles, including live sessions, Q&As, and insider strategies from our financial aid experts.

Create your Premium MyCAP account today ✅