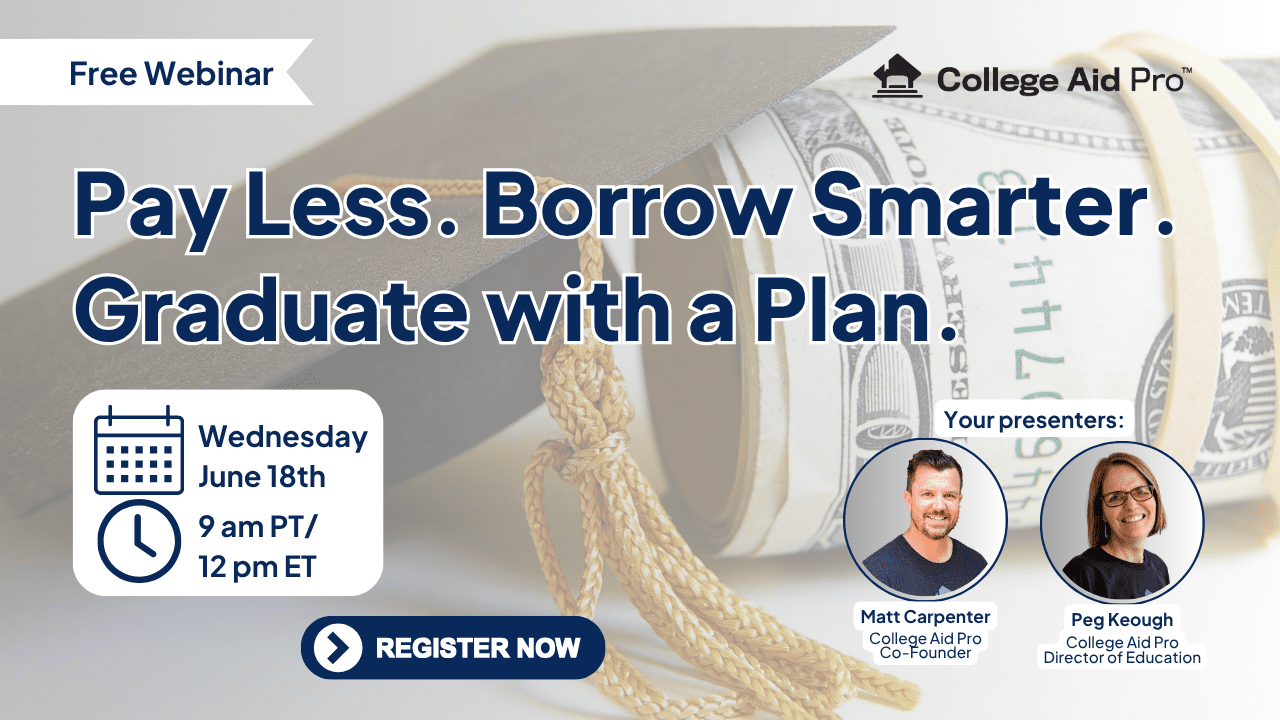

Pay Less. Borrow Smarter. Graduate with a Plan.

Webinar Details:

You’ve built a college list, run the net price calculators, and gotten the financial aid offers—but now comes the big question:

How the heck do you actually pay for it?

This webinar is all about what comes next: a clear, strategic plan to fund your student’s education—without derailing your finances.

Whether you’re facing a small gap or a six-figure price tag, we’ll walk you through the options so you can make smart, confident decisions.

💰 What You’ll Learn:

🎓 Paying for College: Step-by-Step

-

What to pay out of pocket, and when to do it

-

Avoiding the top mistakes families make when trying to “just figure it out”

🏦 Borrowing the Smart Way

-

Parent PLUS Loans vs. Private Loans vs. Student Loans: What’s the difference, and which should you choose?

-

How much is too much to borrow?

-

Strategies to reduce borrowing and minimize long-term repayment pain

🧾 Planning Ahead

-

How to forecast your four-year cost before committing to a school

-

How borrowing now can affect your retirement and future financial goals

-

Building a sustainable plan to support all your children (not just the first)

Why You Should Attend

✅ Get clear, practical advice without the financial jargon

✅ Learn how to fund college without giving up your savings or lifestyle

✅ Understand your options and real-life numbers

🎯 It’s not about what you can afford today—it’s about how you protect your tomorrow.

📌 Seats are limited for this financial deep dive. Reserve your spot and start making confident money moves.