College Net Price Calculator vs Reality: Join College Aid Pro’s NPC Challenge

If you have ever used a college net price calculator and thought, “Perfect, now we know what this college will really cost,” you might be giving it way too much credit. Many of these tools use outdated data, ignore merit money, and skip real world costs like travel and books. Families then lean on those shaky numbers to decide where to apply, whether Early Decision is smart, and how much debt they are willing to take on.

That is exactly why College Aid Pro created College Aid Pro’s NPC Challenge. We put each college net price calculator head to head with MyCAP, and we are confident enough in our numbers to put 100 dollars on the line.

What Is College Aid Pro’s NPC Challenge?

College Aid Pro’s NPC Challenge is a public stress test of the entire college net price calculator system.

We are inviting families and counselors to do three simple things:

- Use the Net Price Calculators (NPCs) for the colleges on your list

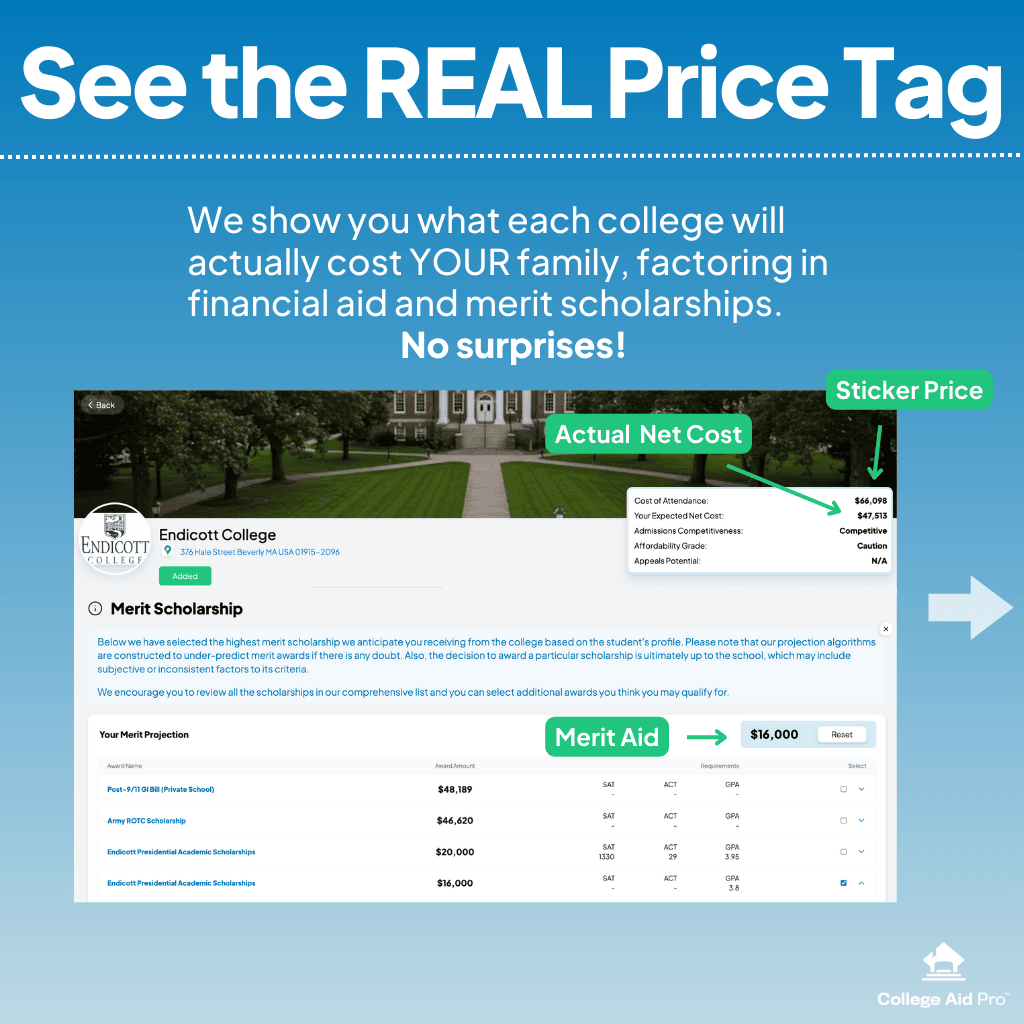

- Check the net prices for those same colleges in MyCAP

- Tell us when there is a big gap between the two (send us an email at npc@collegeaidpro.com)

When you send us a major difference, our team audits the case. We look at:

- What aid year and data the college is using

- How that college net price calculator treats need based and merit aid

- Which real world calculations and costs are missing or misrepresented.

- How MyCAP is modeling the same family

Then we tell you which number is closer to reality and why you should or should not trust that NPC.

If you find a case where the college NPC is right and MyCAP is wrong in a meaningful way, College Aid Pro pays you $100 dollars. When that happens, we also highlight you and that school as NPC Challenge winners, if you are cool with that.

What A College Net Price Calculator Is Supposed To Do

On paper, a college net price calculator is supposed to be a good thing. You plug in your info and it shows your “net price” after grants and scholarships so you are not scared off by the sticker price.

In practice, many calculators:

- Use outdated cost and aid data

- Ignore some or all merit scholarships

- Skip books, transportation, and personal expenses

- Hide the aid year or data year in tiny fine print

- Ignore sibling discounts

The end result is an official looking number that feels trustworthy, even when it is not. For something as big as college, that can easily turn into a six figure mistake.

College Aid Pro’s NPC Challenge is designed to expose those weak calculators and give your family a better way to plan.

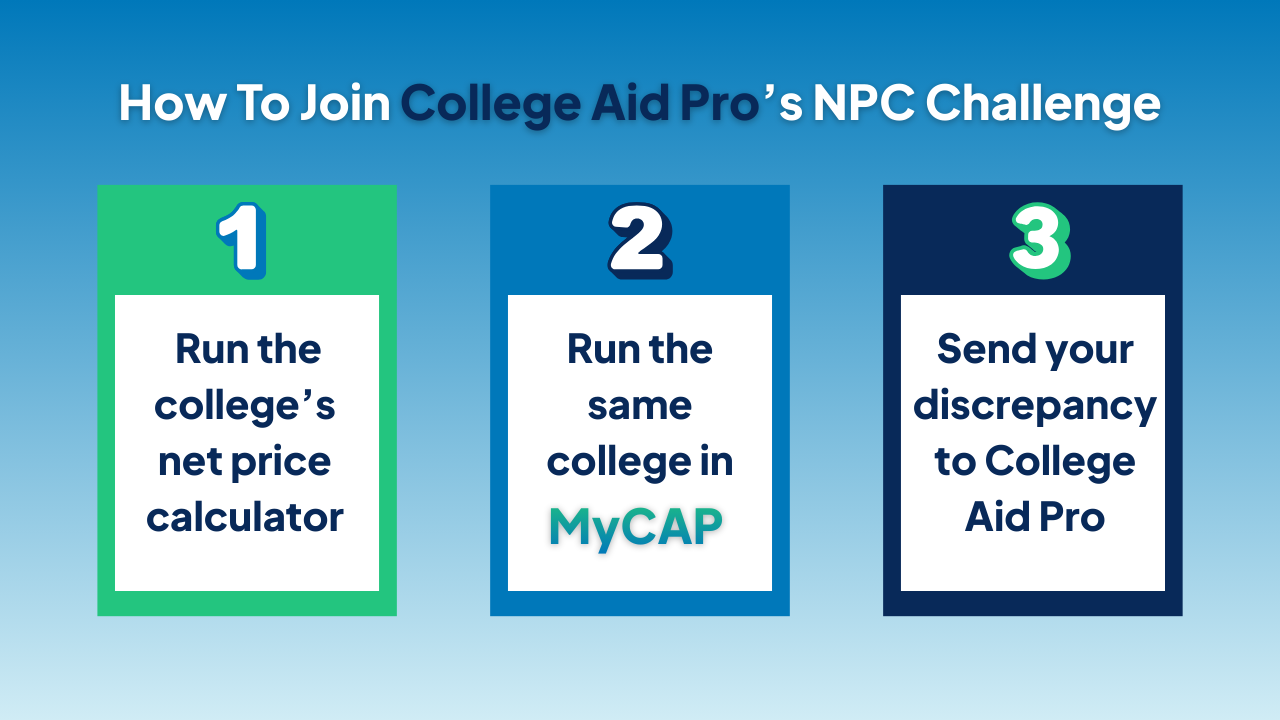

How To Join College Aid Pro’s NPC Challenge

You do not have to love spreadsheets to jump in. Here is the simple process.

Step 1: Run the college net price calculator

Pick a school that is actually on your list and find its college net price calculator on their website.

- Enter your family information as accurately as possible

- Save the result with a screenshot or PDF

- If you see an aid year or data year mentioned, note that too

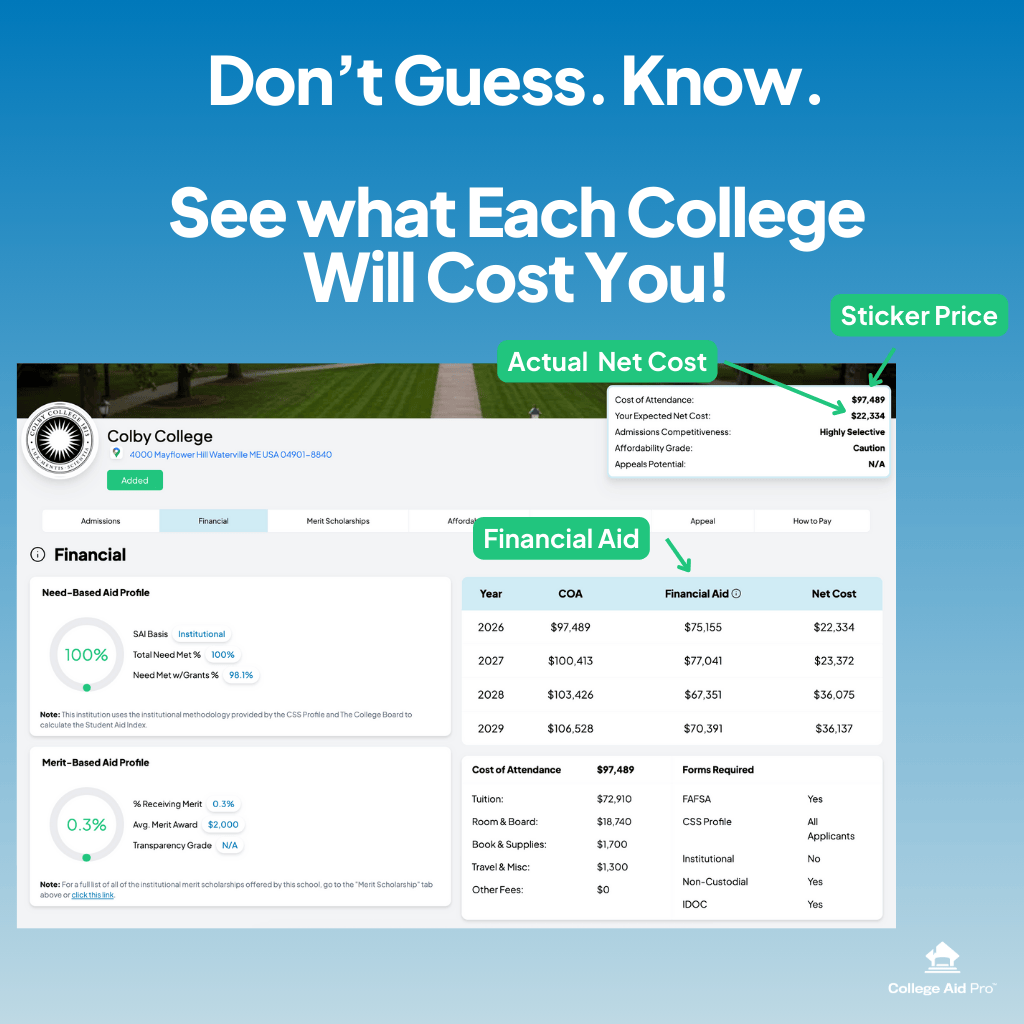

Step 2: Run the same college in MyCAP

Log in to MyCAP, or create a free account if you have not yet.

- Enter your family’s financial picture once

- Add that same school to your MyCAP list

- Open the projection for that college

MyCAP shows estimated need based and merit aid where applicable, your net cost for year one, and a view of all four years so you are not surprised down the road. Save that view as well.

Step 3: Send your discrepancy to College Aid Pro here

If the college net price calculator and MyCAP are far apart, send us an email at npc@collegeaidpro.com:

- The college name

- The college calculator result

- Your MyCAP projection for the same school

- A bit of context, like class year and whether you are looking at ED, EA, or Regular Decision

College Aid Pro will review the case, explain what is going on, and tell you which number we would plan around if it were our own family.

When A College Net Price Calculator Is Most Likely To Mislead You

Some situations are especially risky if you rely only on a college net price calculator.

- Early Decision: You are basically committing before you see the final offer. If the college says “just use our calculator to check affordability,” that is a good reason to double check with MyCAP.

- Divorced, separated, or two household families: Most calculators were built for a single household and struggle with more complex realities. MyCAP is built to handle those.

- Multiple kids in college: Many schools that use institutional methodology do not show the sibling discount correctly in their calculator, which can make a school look more expensive than it will be in reality.

If any of these sound like your situation, you are exactly the kind of family College Aid Pro hopes will join the NPC Challenge.

Why College Aid Pro Is Willing To Bet 100 Dollars

Colleges talk a lot about transparency, but most calculators are not audited, rarely explained, and only loosely required to stay current. A confused family is often a profitable family.

College Aid Pro was built to flip that script.

With MyCAP, our goal is for families to see the true cost of college, compare schools apples to apples, and avoid unnecessary debt and last minute panic.

College Aid Pro’s NPC Challenge is one more way to push toward that goal. If a college net price calculator really is better than MyCAP in a given case, we want to know, we want to fix it, and we are happy to reward the family who helped us see it.

Your Next Step

If you are serious about getting college costs right:

- Use the college net price calculator for any school you are considering

- Run the same school in MyCAP

- Send your biggest discrepancies into College Aid Pro’s NPC Challenge at npc@collegeaidpro.com

Do not let a single unverified calculator quietly decide your student’s future and your family’s finances. Put it to the test side by side with MyCAP and see which number you actually trust.