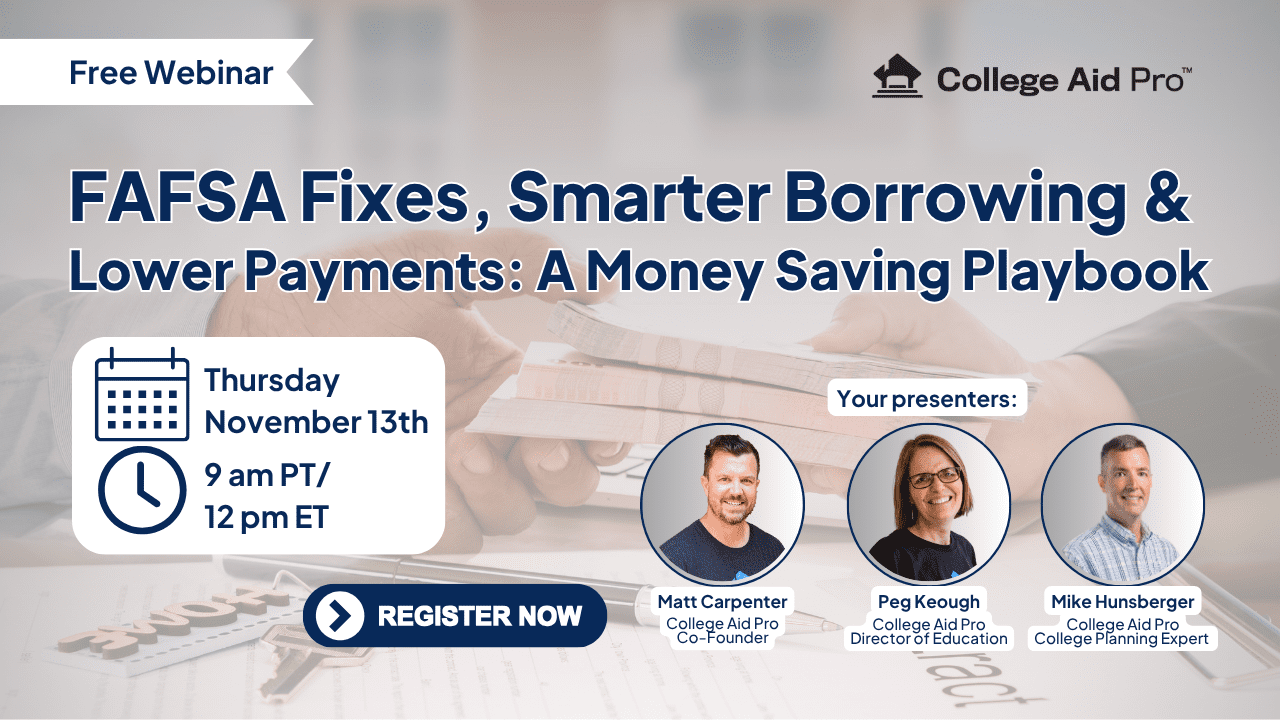

FAFSA Fixes, Smarter Borrowing & Lower Payments:

A Money-Saving Playbook for In-College, Grad-Bound & Recent Grads

Webinar Details:

FAFSA/CSS Profile mistakes can cost thousands—and colleges often under-award. In one session, Matt Carpenter, Peg Keough, and Mike Hunsberger, will show you how to boost next year’s aid, borrow smarter for grad school, and cut current loan costs.

We’ll also break down the “Big Beautiful Bill” (BBB) for grad students and current borrowers—Grad PLUS ends and federal grad loan caps begin July 1, 2026. You’ll leave with a clear plan: fix FAFSA/CSS errors, fund grad school under the new limits, and decide if refinancing makes sense.

You’ll learn how to:

- Was last year’s aid fair? How to spot under-awards, compare offers, and know when something’s off.

- FAFSA/CSS Profile, done right: Proven steps to avoid mistakes and maximize eligibility.

- Appeal like a pro: What to say, what to submit, and how to negotiate—even mid-year.

- Find the best loan rates: Where to look and how to compare offers beyond APR.

- Borrow smarter for grad school (BBB update): What Grad PLUS ending and new caps mean, plus the smart order—Fellowships/Assistantships→Direct loans→Private loans (if needed).

- Refinancing 101: What it is, how it works, and who should consider it.

- Lower payments now & later: Tactics to reduce total interest.

Bonus for registrants: Can’t make it live? Register anyway—you’ll receive the full recording after the webinar.

Take control of your college financial plan and make sure you’re getting the best deal possible. 🔗 Register today!